Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

Electric Vehicle Subsidy in Uttar Pradesh: Comprehensive Guide for 2024

Introduction: The Promise and Potential of Electric Vehicles in UP

The transition to electric vehicles (EVs) represents a significant shift in India’s transport landscape, offering promising environmental, economic, and societal benefits. Uttar Pradesh (UP) — India’s most populous state — holds a pivotal position in this journey. As air quality concerns, fuel costs, and climate imperatives intensify, the UP government has introduced targeted subsidies and incentives to accelerate EV adoption across two-wheelers, three-wheelers, cars, commercial fleets, and public transport.

This article provides a practical, detailed, and clear guide for individuals, families, and business owners considering EVs in UP. It explains the current state of subsidies, who is eligible, the application process, key benefits, expert insights, and answers to frequently asked questions, equipping you to make informed decisions about electric mobility.

Table of Contents

- Why Electric Vehicle Adoption Matters in UP

- Overview of EV Policy and Subsidies in Uttar Pradesh

- Types of Electric Vehicles Covered

- Key Subsidy Amounts and Benefits (2024)

- Eligibility Criteria: Who Can Avail the Subsidy?

- How to Apply: Step-by-Step Process

- Comparison with Other State Subsidies

- Expert Insights and Tips for Users

- Use Cases and Practical Advice

- Frequently Asked Questions (FAQ)

- Conclusion: Moving Forward with Confidence

- Sources

Why Electric Vehicle Adoption Matters in UP

Air Quality and Health

Uttar Pradesh’s major cities—such as Lucknow, Kanpur, and Ghaziabad—regularly rank among India’s most polluted. Vehicular emissions are a leading culprit, making EVs critical for public health and cleaner air.

Economic Opportunity

EV manufacturing, charging infrastructure, battery recycling, and maintenance could create numerous green jobs in both urban and rural UP, supporting the state’s economic development.

Mobility for All

Subsidizing electric two- and three-wheelers benefits daily commuters, delivery workers, fleet operators, women, and marginalized groups by offering affordable, cleaner transport choices.

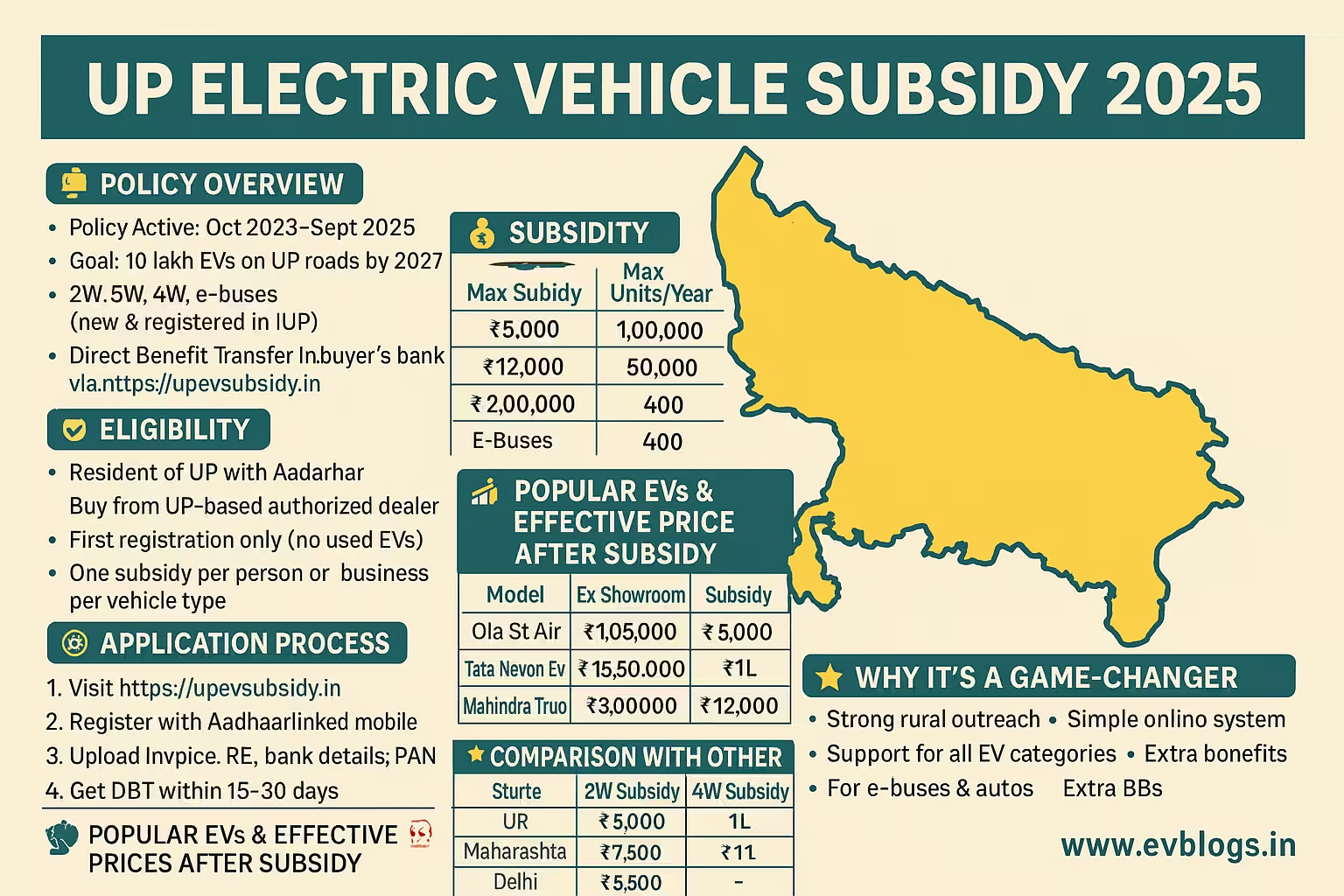

Overview of EV Policy and Subsidies in Uttar Pradesh

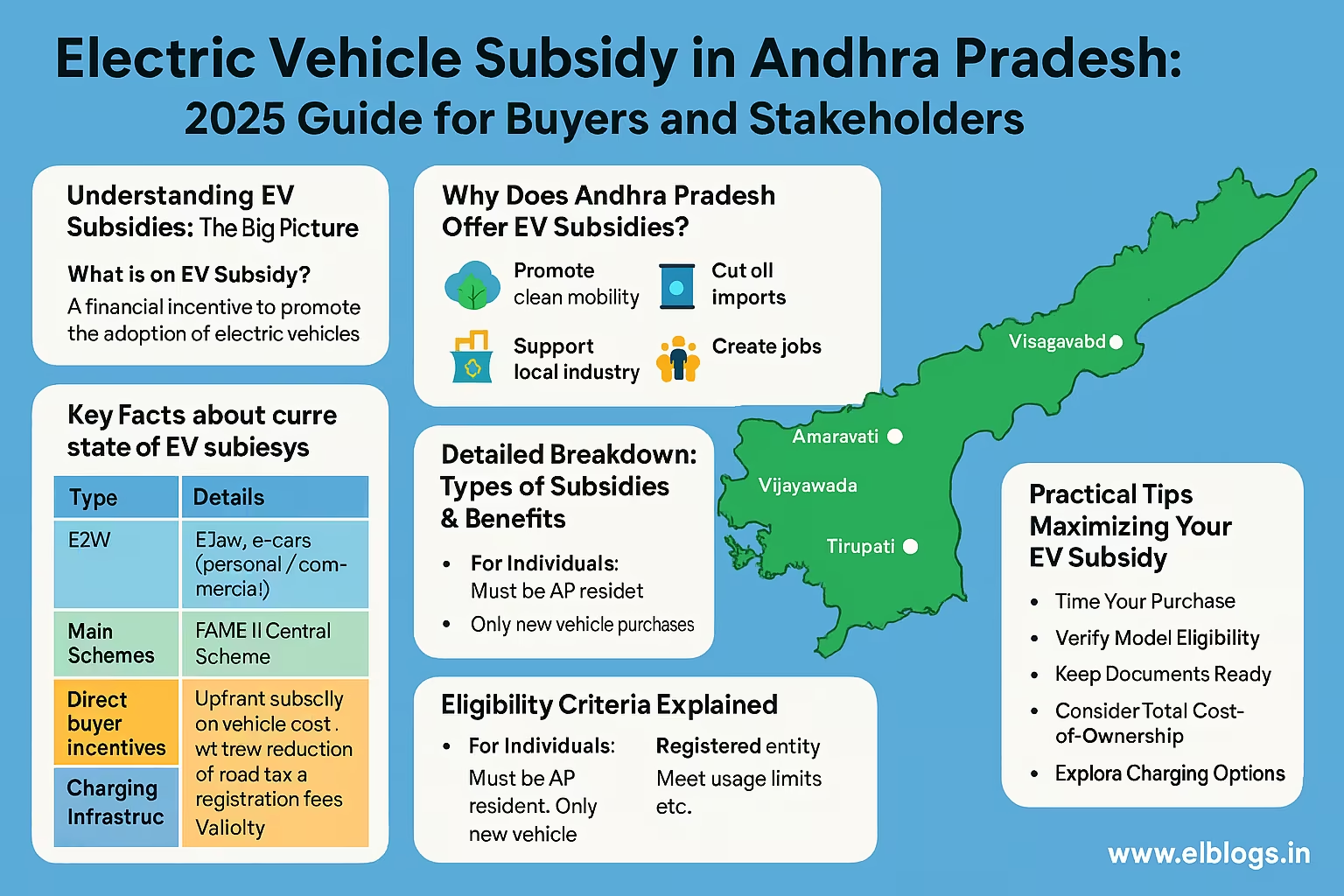

The Uttar Pradesh Electric Vehicle Manufacturing and Mobility Policy 2022 is the backbone of current subsidies and incentives. This policy, aligning with India’s national FAME-II program, aims to:

- Increase EV share to 10% of all new vehicle registrations by 2024.

- Promote domestic EV manufacturing.

- Support charging infrastructure across urban and semi-urban areas.

- Encourage public transport and last-mile connectivity transition to EVs.

Under this policy, direct purchase subsidies are offered for early adopters, particularly in the private buyers and commercial fleet segments.

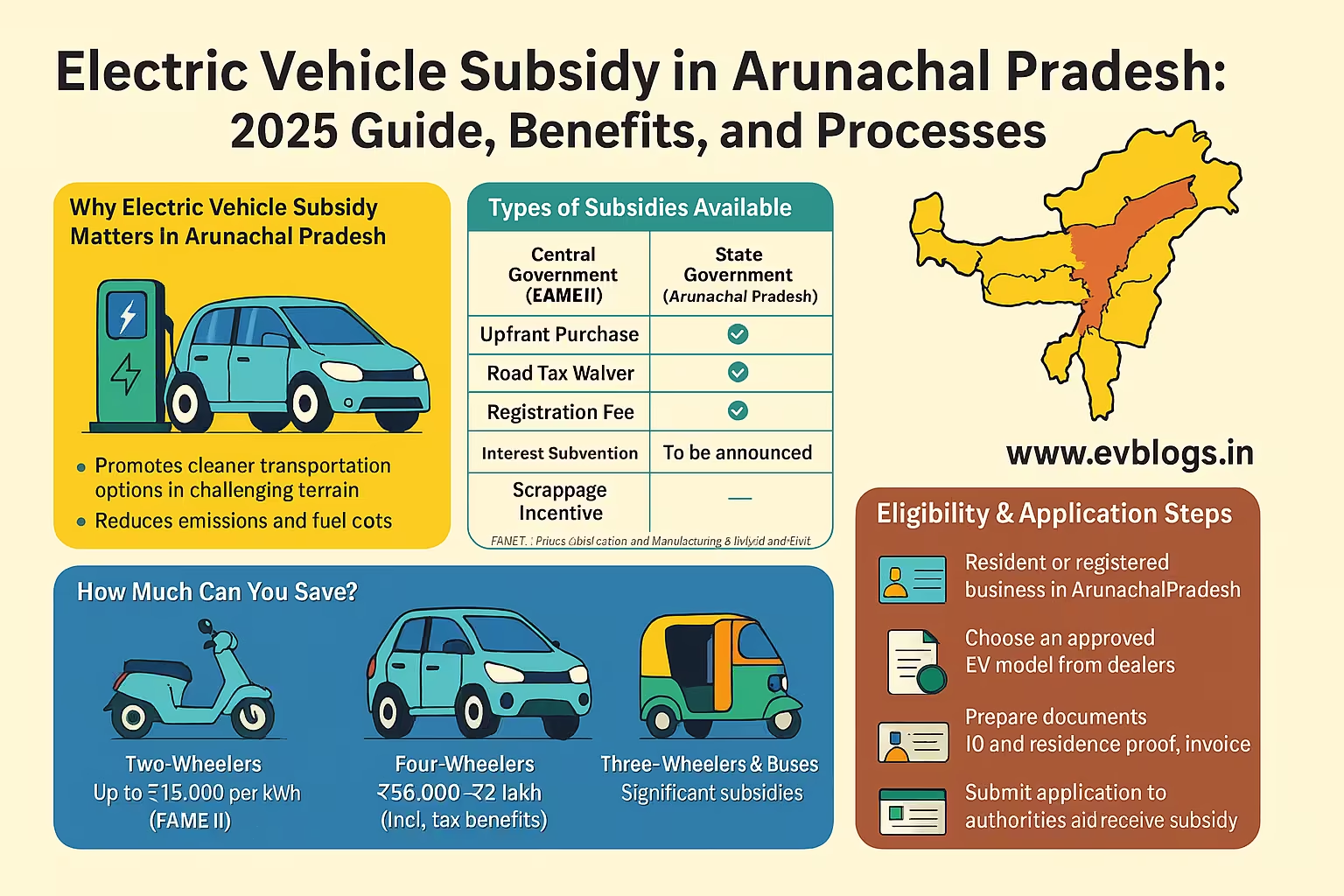

Types of Electric Vehicles Covered

Subsidies and incentives in UP cover a wide spectrum of vehicle types, tailored to the state’s transport mix:

- Electric Two-Wheelers: Scooters, motorcycles (personal and commercial use)

- Electric Three-Wheelers: E-rickshaws, e-carts, loaders

- Electric Four-Wheelers: Private cars, taxis, fleet vehicles

- Electric Buses: In select government-led public transport schemes

- Commercial Light and Heavy Vehicles: Depending on segment and usage

It is essential to check specific model eligibility, as only vehicles approved under the Department of Heavy Industries (DHI) FAME-II list, or those registered within the defined state period, qualify for certain subsidies.

Key Subsidy Amounts and Benefits (2024)

The subsidies in Uttar Pradesh are structured primarily as direct financial benefits on the ex-showroom price, with add-on perks for early adopters and commercial uses. Here is a breakdown of the main subsidy amounts, effective as of 2024:

| Vehicle Type | Maximum Subsidy (Per Vehicle) | Conditions & Notes |

|---|---|---|

| Two-wheelers | Up to ₹5,000 (per vehicle)* | Limited to first 2 lakh buyers; 15% of ex-showroom price; Only those registered between Oct 2022 - Mar 2025 |

| Three-wheelers | Up to ₹12,000 (per vehicle) | Same registration window; Up to 5,000 vehicles |

| Four-wheelers | Up to ₹1 lakh (per vehicle) | For the first 1,000 buyers; 15% of ex-showroom price |

| E-buses | Subsidies via special procurement | Targeted at fleet operators/public agencies |

| Commercial EVs | Extra capital interest subvention | 10% up to ₹5 lakh; subject to criteria |

*In addition, all electric vehicles enjoy 100% waiver on registration fees and road tax until March 2025.

Note:

- These incentives are over and above the central FAME-II subsidies, where applicable.

- The number of vehicles per segment is capped. Subsidies are on first-come, first-served basis within the policy window.

Additional Incentives

- Charging Stations: Capital subsidy up to 25% (max ₹10 lakhs) for setting up public charging stations.

- Manufacturing & R&D Units: Land rebate, stamp duty exemption, SGST reimbursement, and power tariff incentives for select industrial units.

- Battery Recycling: Incentives for companies engaging in recycling and re-use of EV batteries.

Eligibility Criteria: Who Can Avail the Subsidy?

Individuals, businesses, and institutions can apply for the UP EV subsidy if they meet the following requirements:

General Conditions

- Buyer must be a resident of Uttar Pradesh and register the vehicle within UP.

- The vehicle must be purchased and registered within the scheme’s window (Oct 2022–Mar 2025, or until the segment cap is exhausted).

- Only new battery-operated EVs (not retrofitted/conversions) are eligible.

- Vehicle must appear on the government’s approved EV list (e.g., DHI FAME-II or state-authorized).

- One-time subsidy per vehicle, non-transferable.

- For commercial and fleet uses, organizational PAN and GST details may be required.

Not Eligible

- Second-hand EVs, or vehicles previously registered elsewhere

- Vehicles purchased outside the UP policy window

- Retrofitted/conversion vehicles

- Vehicles used for purposes that do not align with approved categories

Physical and digital documentation is mandatory, including ID proof, address proof, invoice, proof of payment, and vehicle registration certificate.

How to Apply: Step-by-Step Process

Here’s a practical roadmap for availing the EV subsidy in Uttar Pradesh in 2024:

Step 1: Check Vehicle Eligibility

- Refer to the [UP EV Policy portal] or the DHI FAME-II recognized list to see if your chosen model qualifies.

Step 2: Purchase at Authorized Dealership

- Confirm the dealership is approved and aware of the state subsidy process.

- Ensure you are among the first eligible applicants per segment.

Step 3: Register Your Vehicle

- Register the EV at your respective Regional Transport Office (RTO) in UP.

- Collect registration certificate and road tax waiver documentation.

Step 4: Prepare Required Documents

Have the following ready:

- Proof of UP residency (Aadhar, Voter ID, passport, etc.)

- Bill of sale/invoice and payment proof

- Vehicle registration certificate

- Bank account details/cancelled cheque (for direct subsidy transfer)

- PAN card (for business/fleet purchase)

Step 5: Apply Online or Through Dealership

- Some subsidies are processed automatically at the point of sale (POS) by the dealership, reducing buyer paperwork. Confirm this at your dealership.

- In other cases, submit an online application through the UP Transport portal or via an offline form at your RTO, attaching digital scans of supporting documents.

Step 6: Track and Receive Subsidy

- After processing, the subsidy is directly credited to your linked bank account or deducted from the ex-showroom price (based on claim method).

- Retain all receipts for reference and in case of audit.

Tip: Due to high demand and vehicle caps, act promptly after the policy announcement or at the start of the fiscal year.

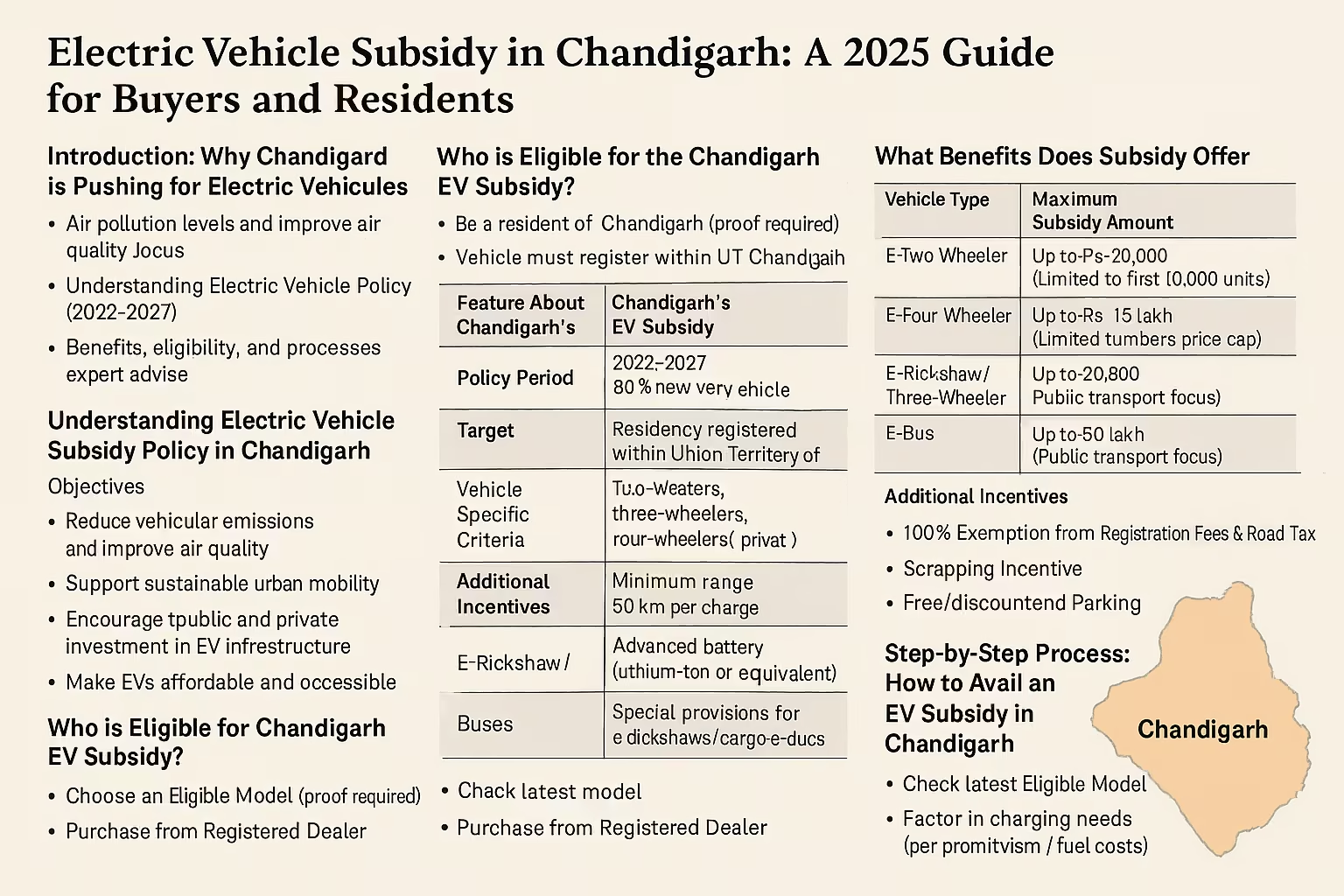

Comparison with Other State Subsidies

Here’s how Uttar Pradesh’s EV subsidy compares to a few progressive states:

| State | Two-Wheeler Subsidy | Four-Wheeler Subsidy | Tax Waiver | Notable Differences |

|---|---|---|---|---|

| UP | Up to ₹5,000 | Up to ₹1 lakh | 100% till Mar 2025 | First-come, first-served model |

| Delhi | Up to ₹30,000 | Up to ₹1.5 lakh | 100% | Higher two-wheeler incentive |

| Maharashtra | Up to ₹10,000 | Up to ₹2.5 lakh | 100% up to 2025 | Additional city-specific perks |

| Gujarat | Up to ₹20,000 | Up to ₹1.5 lakh | Subsidy + Registration | Capped at certain units |

| Tamil Nadu | Policy pending | Up to ₹1.5 lakh | 100% proposal | More focus on manufacturing |

Uttar Pradesh’s direct subsidy is moderate but significant in context of the large market size and includes generous tax waivers. Combined with FAME-II, the effective prices of EVs in UP are among the most competitive in North India.

Expert Insights and Tips for Users

What Industry Experts Say

-

“UP’s subsidy cap ensures benefits go to early adopters. Act soon if you wish to buy in the next year.”

— Ritu Gupta, EV Policy Researcher -

“Charging networks are expanding, but plan your home charging first, especially in Tier-II/III towns.”

— Prakash Singh, Mobility Startup Founder

Practical Tips for Buyers

- Budgeting: Factor in both the state and central subsidy for the total cost. Ask dealerships to clarify the discount structure at the time of purchase.

- Early Registration: The cap on eligible vehicles means the sooner you buy, the better your subsidy claim prospects.

- Battery Warranty: Prioritize models with battery warranties of 3 years or more.

- Resale Value: EV resale markets are still nascent in UP; discuss buyback policies with the dealer.

- Charging Access: If you live in an apartment, get written confirmation from your housing society about home charger installation.

Use Cases and Practical Advice

Case 1: Daily Commuter in Lucknow

Rohan, a software engineer, regularly travels 30 km a day. By purchasing an eligible electric scooter, he saves on daily petrol costs and receives a direct state subsidy with no road tax, making the total price almost 20% lower than before.

Case 2: Fleet Operator in Kanpur

A logistics company switched its intra-city delivery fleet from diesel vans to electric three-wheelers. The upfront subsidy, combined with road tax waiver and much lower running costs, provided a break-even period of under 2 years.

Case 3: Women Entrepreneurs

Under additional UP state schemes, registered women self-help groups running e-rickshaw fleets can benefit from higher priority during subsidy allocation and access to financing support.

Frequently Asked Questions (FAQ)

Q1. What documents do I need for the EV subsidy in UP?

You need address proof, photo ID, vehicle sale invoice, registration certificate, bank account information, and proof of UP residency.

Q2. Can I get a subsidy for an EV I bought before the policy came into effect?

No. Only EVs purchased and registered during the notified window (Oct 2022–Mar 2025) are eligible.

Q3. Is the subsidy available for hybrid vehicles or converted EVs?

No, only factory-manufactured, 100% battery electric vehicles approved by DHI or the state’s list are eligible.

Q4. How is the subsidy paid — directly to the buyer or as a discount?

In most cases, the subsidy is credited directly to your bank account after document verification. Some dealers may offer a point-of-sale price reduction and process the paperwork for you.

Q5. Is there a cap on the number of subsidies per person?

Generally, one subsidy per vehicle/person. For fleet or business purchases, check with the state transport department for organizational limits.

Q6. Can I combine the state subsidy with the national FAME-II subsidy?

Yes, both can be availed if the vehicle qualifies under FAME-II and the UP policy.

Q7. Is there any support for installing home charging points?

The state policy gives higher priority to public charging infra, but many utilities offer separate schemes or technical guidelines for home installation. Check with your local electricity board.

Conclusion: Moving Forward with Confidence

Uttar Pradesh’s electric vehicle subsidy scheme in 2024 offers a substantial, timely incentive for residents contemplating a switch to electric mobility. With clear eligibility criteria, a transparent process, and meaningful financial benefits — particularly for early adopters — this policy supports sustainable transport, cleaner air, and lower commuting costs. Given the vehicle cap and finite policy window, prompt action is advised. Evaluate your commuting needs, budget, and charging options; consult an authorized dealer; and leverage the combined power of state and national incentives to move towards a smarter, greener future in UP.

Sources

- Uttar Pradesh Electric Vehicle Manufacturing and Mobility Policy 2022, Government of Uttar Pradesh.

- Central FAME-II Portal, Ministry of Heavy Industries, Government of India.

- [UP Transport Department notifications and press releases, 2022–2024]

- CEEW Centre for Energy Finance, “State EV Subsidy Tracker,” 2024.

- News coverage from The Hindu, Hindustan Times, and Economic Times, 2023–2024.

- Policy briefs and research from CEEW India, EVreporter.com, and Shakti Sustainable Energy Foundation.

For the latest notification and updates, visit the official UP EV Policy section on the UP Transport Department website.