Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

What Is the Difference Between EV Loan and Normal Car Loan in India?

Choosing between an EV loan and a normal car loan in India can be confusing, especially with India’s shift towards green mobility. As an Indian car buyer, you want to know which loan suits your needs, fits your budget, and takes advantage of government incentives.

Let’s explore what makes an EV loan unique compared to a traditional car loan in India, answer your biggest questions, and arm you with expert-backed advice for 2025.

Why Are EV Loans Becoming Popular in India?

If you’re seeing more electric vehicles (EVs) on Indian roads, there’s a good reason. The government is pushing for clean mobility, offering many incentives for EV buyers. Banks and NBFCs are also launching specialized loan products for electric vehicle buyers—to make switching from petrol or diesel to electric easier and more affordable.

- Major public and private banks in India now offer dedicated EV loan schemes for new electric cars.

- In 2025, nearly all leading car financiers (like SBI, HDFC, Axis, ICICI, and Tata Capital) have exclusive EV loan offers, with interest rates usually lower than standard car loans.

- Special government benefits, such as tax exemptions under Section 80EEB, further increase demand for EV loans.

You benefit from additional perks (lower EMIs, zero to minimal processing fees, exclusive discounts) alongside supporting sustainability.

Did You Know?

As of 2025, the State Bank of India offers EV loans at interest rates starting as low as 7.0% p.a., compared to 8.75%–10.25% for most conventional car loans.

What Are the Main Features of EV Loans in 2025?

An EV loan is designed exclusively for purchasing electric vehicles—cars, two-wheelers, and even commercial EVs in India. But what stands out for you in 2025?

- Lower interest rates (as much as 1.5%-2% reduced compared to normal car loans)

- Higher maximum loan amounts—often covering up to 90–100% of the on-road price

- Special repayment terms, sometimes up to 8 years, with flexible EMI options

- Processing fees are typically minimal or waived for EVs

- Faster loan approval and disbursal, especially for select EV models

Let’s break down what you actually get:

- Interest rates: 7%–9% p.a. (as of 2025)

- Loan tenure: Up to 8 years (vs. 5–7 years for normal car loans)

- Maximum funding: Up to 100% (vs. 80–90% for normal cars)

- Tax benefits: Yes, under Section 80EEB

Expert Insight

Experts predict that by 2028, more than 40% of all urban car loans in India will be for electric vehicles, driven by better loan terms and falling EV prices.

How Does a Normal Car Loan Work in India in 2025?

A normal car loan or traditional auto loan is what you’ve likely used before. Here’s what you typically experience:

- Available for all types of vehicles—petrol, diesel, CNG, and hybrid cars

- No special government incentives are offered outside of regular tax deductions

- Banks generally require a minimum down payment (10%–15% of the car’s price)

- Interest rates (8.5–11% p.a. in 2025) vary based on credit profile, bank, and type of car

- Loan tenure usually between 3 and 7 years

- Maximum loan-to-value is about 80–90%

- Processing fees and prepayment penalties can be higher

Features:

- Standard loan processing and approval period

- No special discounts for green mobility

- No dedicated tax incentives (unlike EV loans)

Did You Know?

In India, normal car loans haven’t seen any major reduction in rates in 2025, but EV loan rates are on a downward trend thanks to government support.

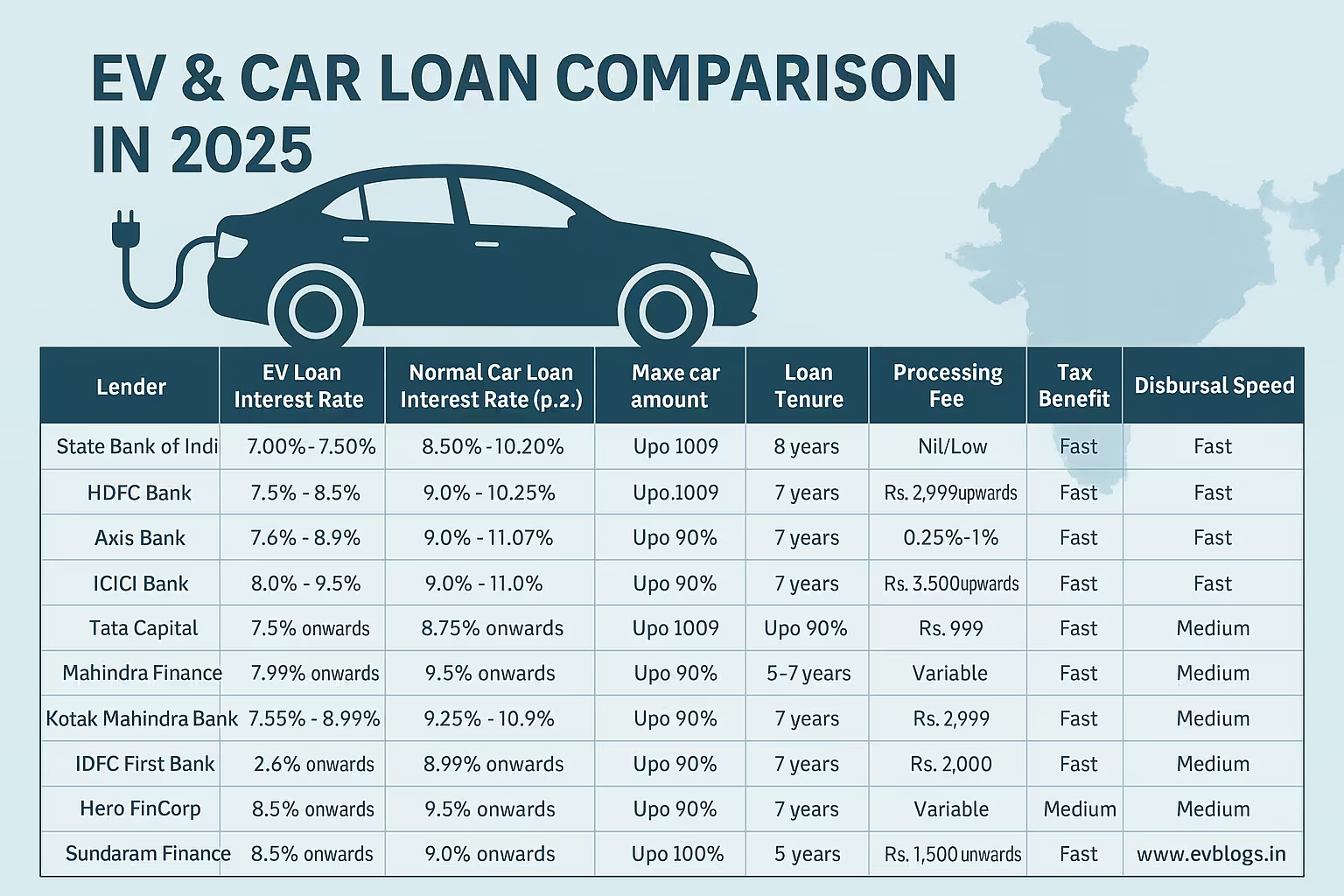

Which Banks and NBFCs Offer the Best EV & Car Loans in India (2025)?

Here’s a side-by-side loan comparison table of major Indian lenders for EV and normal car loans:

| Lender | EV Loan Interest Rate (p.a.) | Normal Car Loan Interest Rate (p.a.) | Max financer amount | Loan Tenure | Processing Fee | Tax Benefit (80EEB) | Disbursal Speed |

|---|---|---|---|---|---|---|---|

| State Bank of India | 7.00% - 7.50% | 8.50% - 10.20% | Up to 100% | 8 years | Nil/Low | Yes | Fast |

| HDFC Bank | 7.5% - 8.5% | 9.0% - 10.5% | Up to 100% | 7 years | Rs. 2,999 upwards | Yes | Fast |

| Axis Bank | 7.6% - 8.9% | 8.75% - 10.75% | Up to 100% | 7 years | 0.25%-1% | Yes | Fast |

| ICICI Bank | 8.0% - 9.5% | 9.0% - 11.0% | Up to 90% | 7 years | Rs. 3,500 upwards | Yes | Fast |

| Tata Capital | 7.5% onwards | 8.75% onwards | Up to 100% | 7 years | Rs. 999 onwards | Yes | Fast |

| Mahindra Finance | 7.99% onwards | 9.5% onwards | Up to 90% | 5–7 years | Variable | Yes | Medium |

| Kotak Mahindra Bank | 7.55% - 8.99% | 9.25% - 10.99% | Up to 90% | 7 years | Rs. 2,999 | Yes | Medium |

| IDFC First Bank | 7.6% onwards | 8.99% onwards | Up to 90% | 7 years | Rs. 2,000 | Yes | Fast |

| Hero FinCorp | 8.5% onwards | 9.5% onwards | Up to 90% | 7 years | Variable | Yes | Medium |

| Sundaram Finance | 8.5% onwards | 9.0% onwards | Up to 100% | 5 years | Rs. 1,500 onwards | Yes | Medium |

Loan and feature differences explained:

- State Bank of India (SBI): Known for lowest EV loan interest in 2025, fast processing, and high approval for salaried professionals.

- HDFC & Axis Bank: Very aggressive in metro cities, competitive for new EV cars like Tata Nexon EV, Hyundai Kona.

- ICICI & Tata Capital: Quick approvals for both self-employed and salaried, with flexible EMIs.

- Mahindra & Kotak: Good for rural and semi-urban users, slightly higher rates, but tailored customer support for first-time buyers.

- IDFC, Sundaram, Hero FinCorp: Niche products for specific car brands, generally for private buyers.

Did You Know?

Many finance companies now offer pre-approved EV loans for Tata, Mahindra, and Hyundai models, making the loan-to-drive process as short as 48 hours.

When Should You Consider an EV Loan Over a Normal Car Loan in India?

Your decision should depend on your priorities—cost efficiency, long-term savings, access to government incentives, and your day-to-day driving needs.

Choose an EV loan if:

- You’re buying a new electric vehicle, and want to minimise upfront and monthly costs.

- You want extended repayment tenures or flexible EMI options (often available with EV loans).

- You plan to claim tax benefits under Section 80EEB (deduction up to ₹1.5 lakh on interest paid).

- You value lower operating costs (fuel, maintenance) over the car’s lifetime.

Choose a normal car loan if:

- You prefer a conventional petrol/diesel car or if you have specific brand/model preferences not available as EV.

- You want to purchase a used (not new) vehicle—few EV loans support pre-owned cars in 2025.

- You have specific car features or usage patterns that favor ICE (Internal Combustion Engine) vehicles.

Expert Insight

In 2025, car manufacturers are planning more budget EV launches around ₹10 lakh, making EV loans increasingly competitive compared to normal car loans for first-time car buyers in India.

What Are the Step-by-Step Differences in Application Process?

EV Loan Application Process (2025):

- Eligibility: Over 21 years old, salaried/self-employed, stable income, CIBIL score 700+ (some flexibility for EV).

- Online/Offline Application: Apply via bank’s app/website or at EV dealerships (many offer on-the-spot financing).

- Documents: KYC docs, address proof, income proof (salary slips/ITR), car quotation/proforma invoice, bank statements.

- Approval: Often pre-approved for major EV brands; approval in as little as 24–48 hours.

- Disbursal: Directly paid to dealer; faster processing for select models/dealers with tie-ups.

Normal Car Loan Process:

- Eligibility: Stricter with credit score; sometimes more paperwork.

- Application: May involve longer in-branch process or agency visits.

- Documents: Similar, but usually stricter scrutiny of income and repayment capacity.

- Approval Time: 3–5 days on average; priority on new cars.

- Disbursal: Dealer payment or reimbursement, depending on agreement.

Key differences:

- EV loans are built for speed and flexibility, especially with new EV-friendly lenders emerging in India.

- There is greater willingness to finance 100% of EV cost, compared to ~85% for normal cars.

- Paperwork is often less cumbersome for EVs, especially if bank has a green initiative.

Did You Know?

Tata Motors dealerships in Tier-2 cities reported a 35% jump in on-spot EV loan approvals in early 2025, with nearly 85% of EV buyers availing full finance.

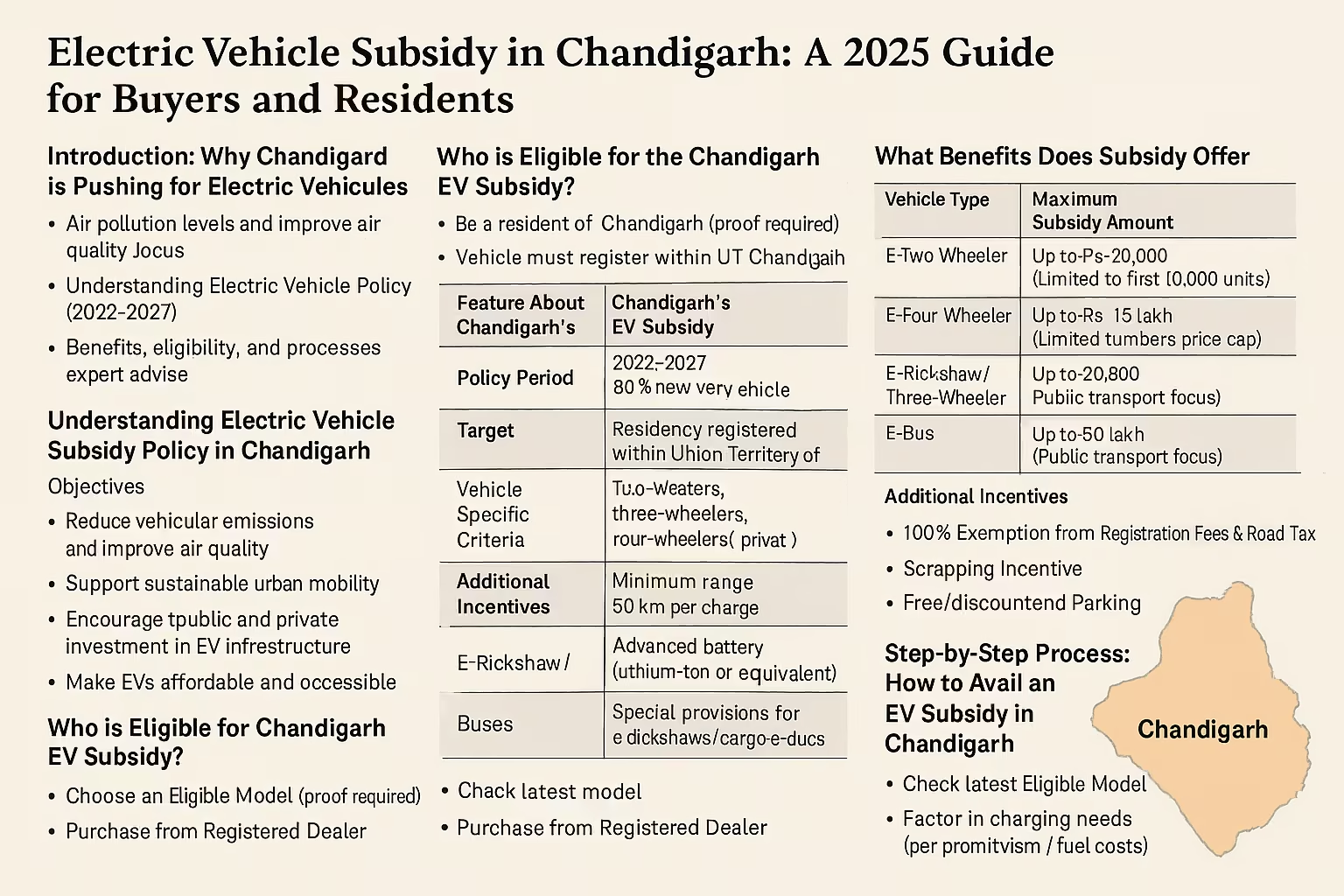

Why Do Indian Government Policies Matter for Your Loan Choice?

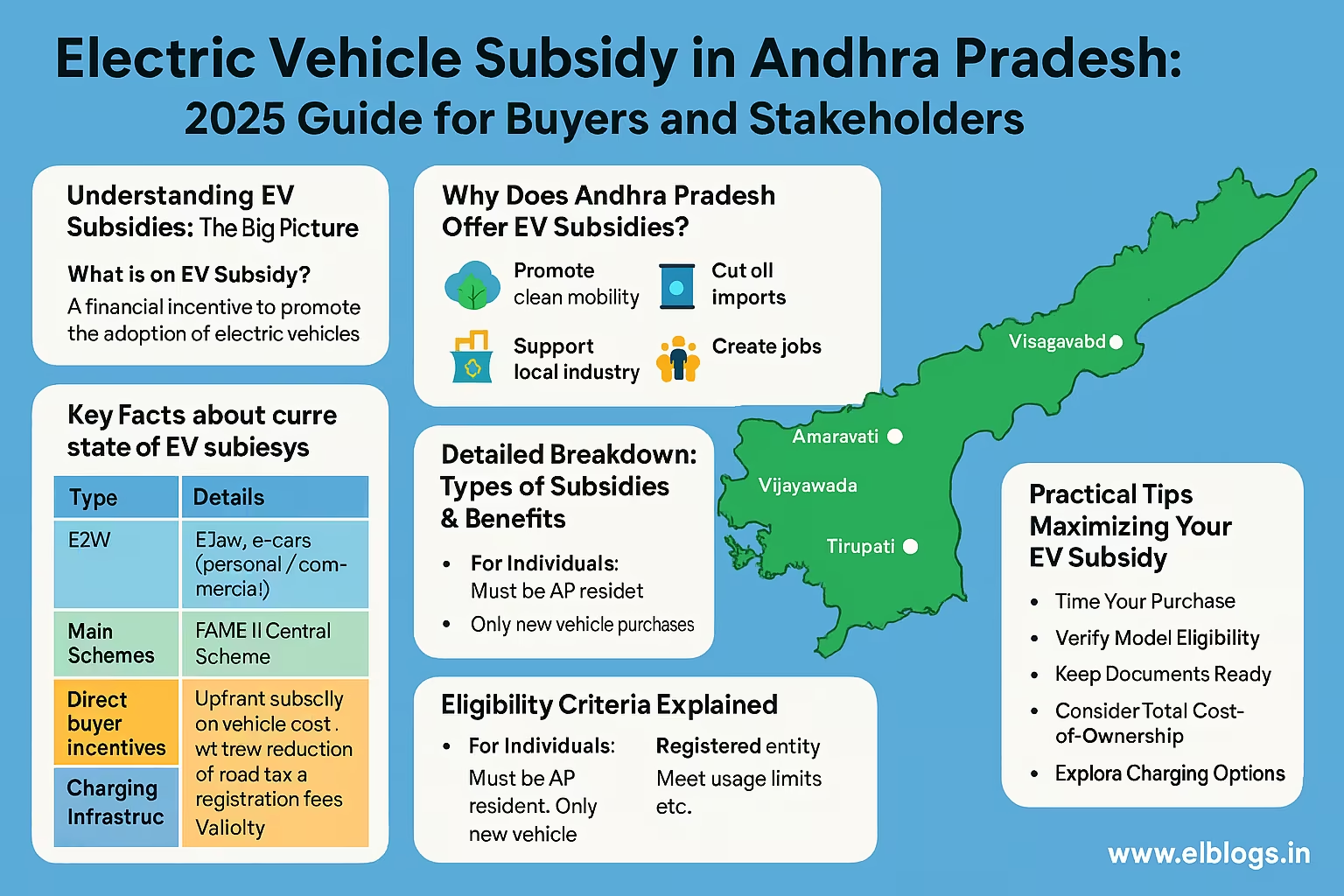

Indian federal and state governments strongly support EV adoption to cut air pollution and fuel imports.

Relevant government schemes and benefits in 2025:

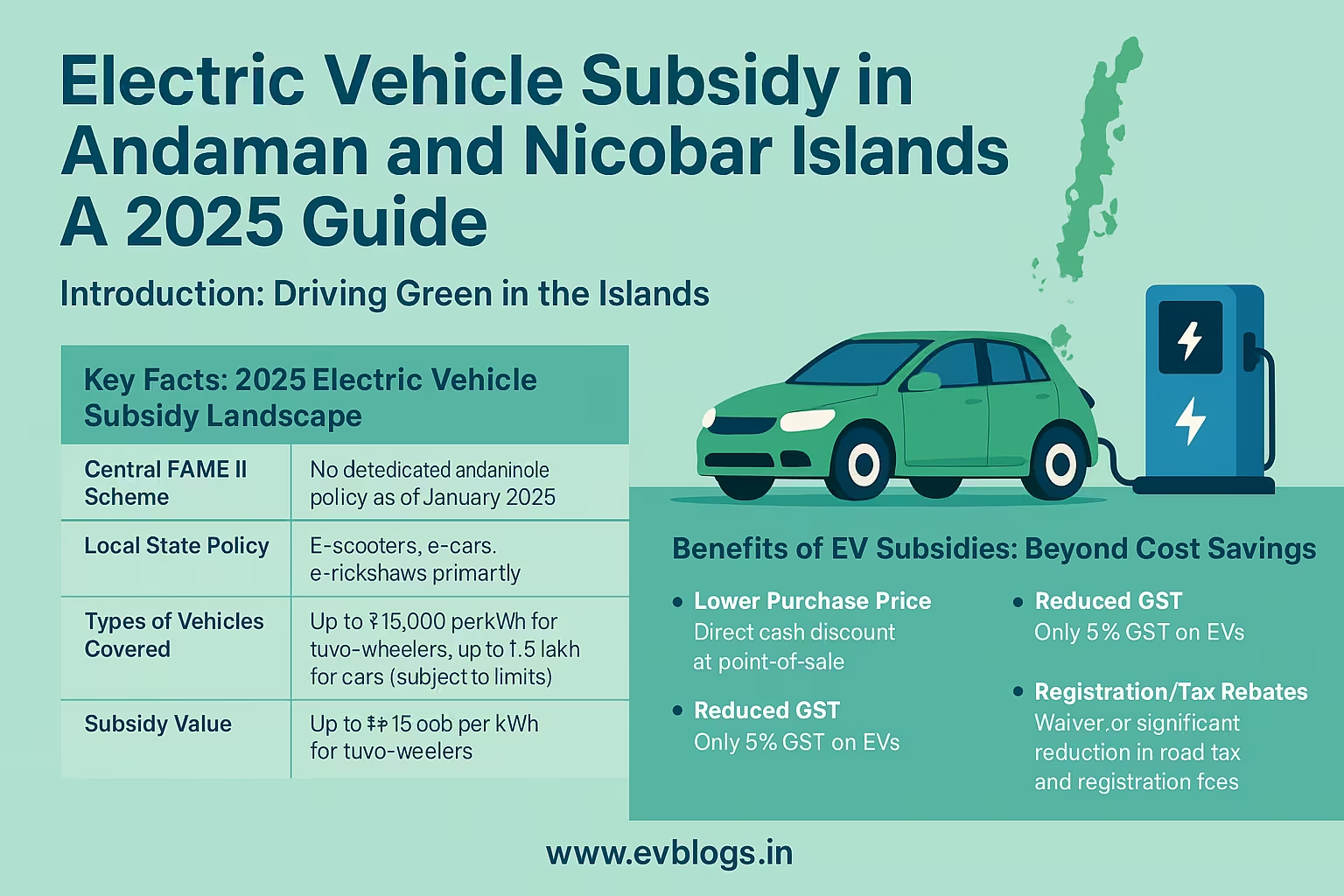

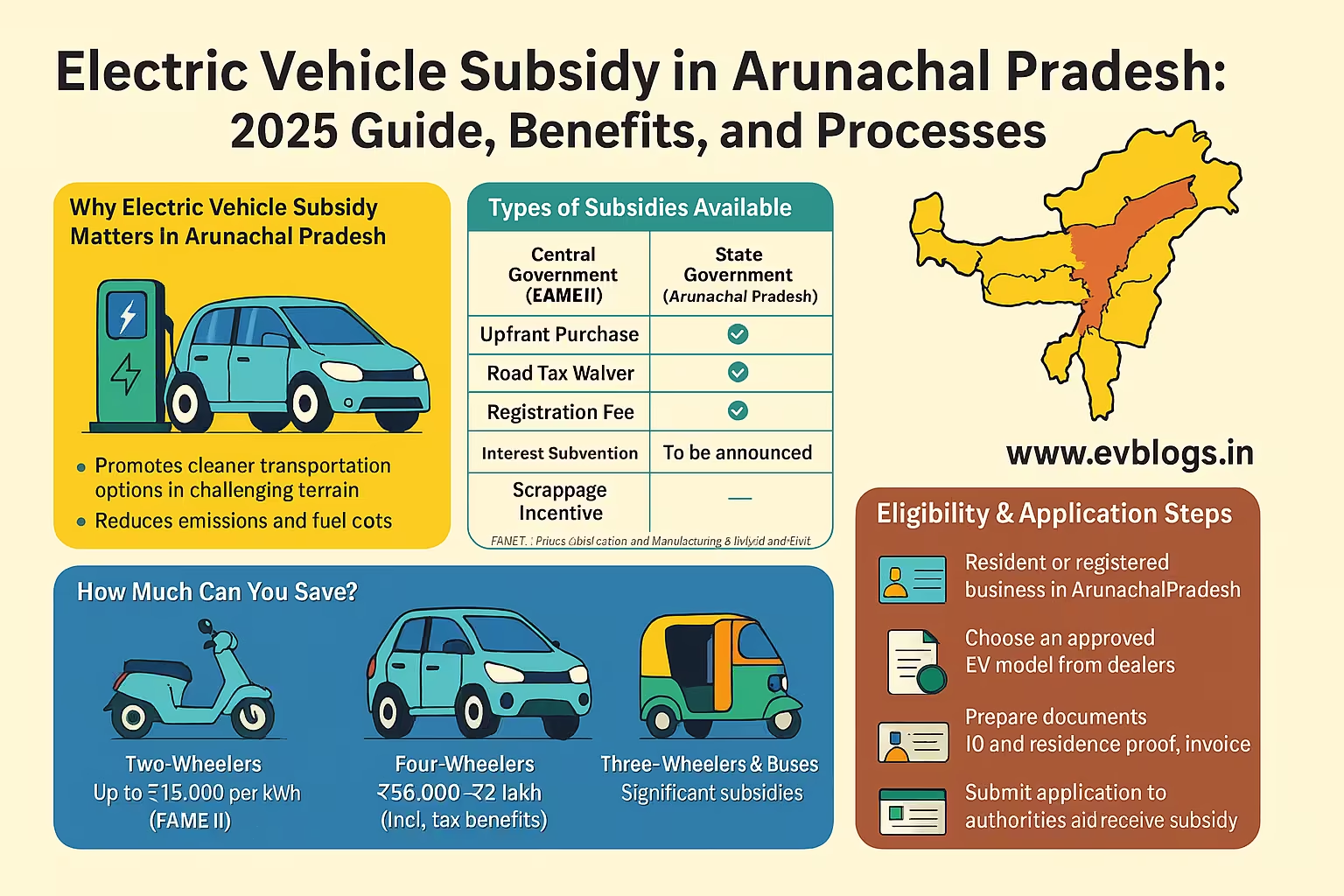

- FAME II Scheme (Faster Adoption and Manufacturing of Electric Vehicles): Offers direct subsidies for EVs, lowering their cost and required loan amounts.

- GST Reduction: EVs attract only 5% GST (vs. 28% for petrol/diesel cars), making them more affordable.

- Section 80EEB Benefit: Claim additional ₹1.5 lakh deduction on EV loan interest—applies only to EV buyers.

- State-Level Incentives: Maharashtra, Delhi, Gujarat, Tamil Nadu, and Karnataka offer road tax exemptions, registration fee waivers, etc.

How it impacts your choice:

- Your effective EMI on an EV loan can be lower not just due to rates, but also thanks to lower principal after incentives.

- Tax-free and subsidized zones could make your total cost of ownership 10–30% less over 5–8 years compared to a petrol/diesel car.

Disclaimer: Incentives and rules may vary by state and may change without prior notice. Always verify the latest benefits with your local RTO or government portal.

Expert Insight

With the latest Union Budget (2025), the central government increased the allocation for FAME III, hinting at future subsidies and potential zero-interest EV loan schemes.

How Do Interest Rates, EMI, and Tenure Actually Affect Your Payments?

This is where your monthly budgeting really counts. Let’s see what it means for your pocket in 2025.

Suppose you buy a ₹12 lakh car with maximum finance and standard tenure.

-

EV Loan Example (7.5% p.a., 8 years, ₹0 processing fee):

- Down Payment: ₹0

- EMI: Approx ₹16,700/month

- Total Interest Paid (8 years): ~₹3.0 lakh

- Tax Benefit (80EEB): up to ₹1.5 lakh deduction

-

Normal Car Loan (9.5% p.a., 7 years, 10% down, ₹12,000 fee):

- Down Payment: ₹1.2 lakh

- EMI: Approx ₹17,900/month

- Total Interest Paid (7 years): ~₹3.7 lakh

- No extra tax benefits

Direct savings for you with EV loan:

- Lower EMI

- Lower or no down payment

- More years to repay with reduced burden

- Additional tax savings

Banks favor EV buyers with better risk scores and future value projections, seeing EVs as lower-risk due to their rising demand and resale market stability.

Did You Know?

Switching to an EV in India can reduce your total monthly outgo (EMI + operating cost) by 30–40% compared to a similar petrol car in 2025.

Which Cars Can You Buy With EV Loans vs. Normal Car Loans?

EV Loans:

- Only for new electric cars (passenger and some commercial)

- Popular eligible models (2025):

- Tata Nexon EV, Tata Tiago EV, MG ZS EV, Mahindra XUV400 EV, Hyundai Kona Electric, BYD e6, Tork Kratos, Ola S1 (two-wheeler EVs)

- Some lenders also cover e-auto rickshaws and electric two-wheelers

- Most do not finance second-hand/used EVs yet in 2025

Normal Car Loans:

- Petrol, diesel, hybrid, CNG cars (new or second-hand)

- Huge model range—Maruti Suzuki, Hyundai, Honda, Kia, Tata, Mahindra (all fuel types)

- Available for used, certified, and even imported vehicles

Key Considerations:

- If you want a wide selection across brands and fuel types, normal car loans have an edge.

- If you’re sure about buying new and want to be emission-free, EV loans are best.

Expert Insight

By 2025, Tata Motors sold over 1.2 lakh EVs in India, making them the top beneficiary of EV loan programs among Indian carmakers.

What Are Real-World User Experiences and Case Studies for Indian Buyers?

Let’s hear directly from users who’ve taken these loans in 2024–2025:

Case Study 1: Priya, Bangalore (Software Engineer, Age 28)

- Chose Tata Nexon EV in June 2024

- Got pre-approved EV loan from Axis Bank at 7.5% with zero processing fee, 100% financing, ₹0 down payment

- Accessed ₹1.5 lakh tax deduction for loan interest under Section 80EEB

- Experienced instant loan disbursal and took delivery in 3 days

Case Study 2: Sanjay, Pune (Small Business Owner, Age 36)

- Bought Maruti Dzire (petrol) via a standard car loan at 10.1%

- Required ₹1.3 lakh down payment, got 7-year repayment

- No special tax or subsidy; overall EMI slightly higher than for a similar-priced EV

Case Study 3: Amrita, Delhi (Government Employee, Age 32)

- Wanted Hyundai Kona Electric, but bank only offered 90% financing, so had to pay ₹2 lakh upfront

- Still saved 2% on interest compared to conventional car loans

- Claimed Delhi state EV incentives that waived road tax and registration charges

Case Study 4: Ravi, Chennai (Retired, Age 62)

- Opted for loan on Honda Amaze (diesel)

- Found interest rate higher (11%), with 15% down payment and ₹5,000 processing fee

- Process took five days longer than his friend’s EV loan process

Did You Know?

According to India’s Ministry of Road Transport, 93% of electric car buyers in metro cities in 2025 used special EV loan products—often with instant digital sanction and minimal paperwork.

Which Tax Benefits and Purchase Incentives Do You Get With Each Loan?

EV Loan Tax Perks (2025):

-

Section 80EEB: Up to ₹1.5 lakh tax deduction per year on interest paid for EV loans (April 2025 FY update—still active)

- Only applies to individual buyers

- Cannot be claimed on normal car or second-hand EV loans

-

State incentives: Free/discounted registration and road tax for EV buyers with proof of finance

-

GST at 5% on EVs (vs. 28% for petrol/diesel)

Normal Car Loan:

- No exclusive income tax benefit

- Regular interest and principal repayments not tax-deductible (except for cars used in business)

Expert Insight

If you’re a salaried or self-employed professional, Section 80EEB can boost your annual savings—making EV loans extra attractive in 2025, especially when combined with state-level perks.

How Do You Decide: EV Loan or Normal Car Loan – Which is Best for You in 2025?

It ultimately comes down to your budget, environment goals, car usage, and access to charging infrastructure.

Choose an EV loan if:

- You want future-ready mobility and significant operational savings.

- Your driving is predominantly city-based or within 200–300 km/day, matching EV range.

- You want to access all government incentives and tax-deductible interest.

- You want faster, digital loan processing and lower EMIs.

Choose a normal car loan if:

-

You frequently travel long distances with poor EV charging access.

-

You are looking for a used or specific petrol/diesel model.

-

You don’t mind higher EMIs and forgoing new tax breaks.

-

For the latest 2025 offers, always compare across at least 3 banks/NBFCs.

-

Read the fine print—pay attention to foreclosure penalties and processing fees.

-

Check for tie-ups between car dealerships and lenders for special schemes.

Did You Know?

The combined benefit from 2025 central and state incentives can lower your EV’s on-road cost by ₹1–2 lakh vs. normal cars—directly lowering your required finance amount.

Conclusion: The Final Verdict – EV Loan or Normal Car Loan in India?

In 2025, you have more reasons than ever to seriously consider an EV loan, given India’s strong government push, better bank deals, and growing EV infrastructure. For most urban and even many rural buyers with regular city use, EV loans offer:

- Lower interest rates and EMIs

- Minimal or zero paperwork/processing charges

- Tax-deductible loan interest up to ₹1.5 lakh each year under Section 80EEB

- Access to central/state purchase incentives

- Full financing with faster approval and lower total cost of ownership

Yet, if your usage truly needs a conventional car, or you’re shopping for a used vehicle or a model not yet available as EV, a normal car loan may still fit your purpose.

Your smartest move in 2025: Shortlist your car (EV or regular), check updated loan offers, use an online EMI calculator, compare incentives and tax benefits, and go for the option that makes best financial, environmental, and practical sense for your needs.

Empower yourself with facts, compare real numbers, and enjoy the drive—whichever route you choose!

FAQs on Difference Between EV Loan and Normal Car Loan

1. Can I buy a used electric car with an EV loan in India?

Most banks and NBFCs in India currently offer EV loans only for new electric vehicles as of 2025. For used EVs, you may need to opt for a normal used car loan with adjusted rates.

2. What happens if I prepay my EV loan?

Many banks in 2025 are waiving or reducing prepayment penalties for EV loans, but always check your lender’s specific terms and conditions.

3. Is the processing fee really zero for EV loans?

Several banks like SBI, HDFC, and Tata Capital offer zero or minimal processing fees during promotional periods, especially if you buy select EV models. Always confirm before applying.

4. Will Section 80EEB be continued beyond 2025?

As of April 2025, Section 80EEB benefit is available. Future continuation depends on government notifications, so keep an eye on the latest finance bills.

5. Are EV loans available in rural or semi-urban areas?

Yes, major lenders are expanding EV finance options to Tier 2 and Tier 3 cities in 2025, especially in states offering strong local EV incentives and infrastructure.

Disclaimer: Interest rates, government policies, and incentive schemes may change after publication. It’s always best to check with your bank and official government portals for the latest updates. This article is for informational purposes and does not constitute financial advice.