Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

What is Electric Vehicle Insurance in India and Why Do You Need It in 2025?

Electric vehicle (EV) insurance in India is a specialized protection plan designed for electric cars, bikes, and scooters. As more Indian drivers choose environment-friendly EVs in 2025, understanding how insurance for these vehicles works is crucial for your peace of mind—and your wallet.

When you buy an electric vehicle, you’re investing in new technology, unique components (like the expensive battery pack), and different risks compared to petrol or diesel vehicles. Standard motor insurance doesn’t always account for the unique needs of EVs, so electric vehicle insurance fills this gap.

- EV insurance in India covers accidental damage, theft, fire, and third-party liabilities—just like traditional motor insurance.

- It usually includes extra protection for the battery, electric motor, and charging equipment.

- Comprehensive policies can help you deal with damages from floods, fire, vandalism, or even accidents by third parties.

You need EV insurance because:

- Under the Motor Vehicles Act, 1988, third-party liability insurance is mandatory for all vehicles, including EVs.

- EV parts, especially batteries, are expensive and not easily available, so insurance helps minimize repair and replacement costs.

- You get financial protection in case of natural disasters, theft, or accidental damage.

If you plan to drive your EV on Indian roads in 2025, insurance is not just a legal formality—it’s essential for your financial security.

Did You Know?

As per the Indian government’s Vahan portal, EV registrations crossed 2.1 million units by early 2025, a massive jump from just 1.3 million in 2023.

How Is Electric Vehicle Insurance Different From Regular Vehicle Insurance in India?

You might be wondering if you can just buy a regular car or bike insurance for your EV. While some basics are the same, EV insurance in India is tailored for electric vehicles’ unique needs in 2025.

Key differences include:

- Component Coverage: EV insurance specifically covers high-cost parts like the lithium-ion battery and charging cables.

- Premium Calculation: Premiums for EVs are generally lower due to fewer moving parts and lower risk of fire/explosion. However, battery replacement cost can impact this.

- Government Benefits: IRDAI (Insurance Regulatory and Development Authority of India) has mandated lower third-party insurance rates for EVs compared to ICE (Internal Combustion Engine) vehicles since 2022 and continues this in 2025.

- Special Add-ons: Coverage for battery degradation, portable charger protection, and roadside assistance for out-of-charge scenarios.

Major points:

- Traditional policies may not fully protect against unique EV risks.

- EV-specific policies offer better value for money and more relevant features.

Expert Insight

Insurance providers like Tata AIG, Bajaj Allianz, and ICICI Lombard have launched dedicated EV insurance products in 2025, each offering EV-centric add-ons and telematics-based premium discounts.

Which Are the Top Electric Vehicle Insurance Providers in India for 2025?

Choosing the right insurance provider is key to maximizing protection and value for your electric vehicle. Here’s a detailed comparison of top EV insurance companies in India for 2025:

| Insurer | Special EV Coverages | Claim Settlement Ratio 2024 | Battery Replacement Included | Premium Range (₹/Year) | Fast Claim Processing | Roadside Assistance | Unique Features |

|---|---|---|---|---|---|---|---|

| Tata AIG | Battery, charger, cable | 98.3% | Yes | 5,000 – 18,000 | Yes | Yes | ‘Go Green Discount’, battery warranty add-ons |

| ICICI Lombard | Battery & portable charger | 99.1% | Yes (up to 2 yrs) | 6,000 – 20,000 | Yes | Yes | On-site minor repairs, cashless garages |

| Bajaj Allianz | Charging station cover | 97.7% | Yes (pro-rata) | 5,500 – 17,500 | Yes | Yes | Flat battery jumpstart, in-app claims |

| HDFC ERGO | EV-specific parts | 98.0% | Yes | 6,200 – 19,800 | Yes | Yes | Own damage only plan, EV roadside cover |

| Digit Insurance | Battery & motor | 97.5% | Yes | 5,000 – 17,000 | Yes | Yes | Low depreciation rate, app-based service |

| New India Assurance | All EV parts | 95.8% | Yes | 4,800 – 15,200 | No | Yes | PSU trust, large agent network |

| SBI General | Battery/charging risks | 96.7% | Yes | 5,300 – 16,900 | Yes | Yes | Pay-as-you-drive options |

| Reliance General | Portable charger, towing | 96.2% | Yes | 5,100 – 16,000 | Yes | Yes | Quick claim approval, add-on warranty |

| IFFCO Tokio | Battery, in-cabin tech | 97.1% | Yes | 5,700 – 18,200 | Yes | Yes | Network of 4,300+ garages |

| Future Generali | Battery & damage cover | 96.0% | Yes | 5,400 – 17,800 | No | Yes | Customizable plans |

In-depth Look at Top Providers:

- Tata AIG: Offers exclusive green discounts and additional battery warranty features, perfect for eco-conscious buyers.

- ICICI Lombard: High claim settlement ratio, portable charger protection, and quick on-site services make it ideal for busy city users.

- Bajaj Allianz: Flat battery jumpstart service included; great for EV two-wheeler owners frequently on the move.

- HDFC ERGO: Unique “Own Damage Only” plan tailored for those who want basic yet efficient cover.

- Digit Insurance: Attractive for tech-savvy users with fast app-based claim settlement and competitive premium rates.

- New India Assurance: A trusted PSU with a vast agent network, suitable for those preferring traditional insurance experience.

- SBI General: Innovative pay-as-you-drive options—pay less if you drive less, a win for EV city commuters.

- Reliance General: Fast claim approval and warranty add-ons; good for premium segment EV owners.

- IFFCO Tokio: Extensive garage network, especially helpful in Tier 2 and rural cities.

- Future Generali: Custom plans for both car and two-wheeler EVs, flexible for unique EV use cases.

Did You Know?

In 2025, over 70% of new private car registrations in major Indian metros are EVs, according to SIAM (Society of Indian Automobile Manufacturers).

What Are the Types of Electric Vehicle Insurance Available in India in 2025?

You should know the main types of insurance policies available for your EV in 2025 because the right choice can save you both money and trouble.

- Third-Party Liability:

- Mandatory by law in India.

- Covers damages or injuries to third parties but not to your own vehicle.

- Cheapest, but least coverage for your own losses.

- Comprehensive Insurance:

- Covers own damages, theft, fire, natural calamities, and third-party liabilities.

- Most recommended for new or high-value EVs.

- Standalone Own Damage (OD) Cover:

- Only covers damages to your EV (introduced recently for greater flexibility).

- Can be paired with an existing third-party policy.

- Add-On Covers (specific to EVs):

- Battery protection/depreciation cover.

- Portable charging equipment cover.

- Zero depreciation cover.

- Roadside assistance (including towing to charging stations).

- Engine (motor) protection.

Why choose comprehensive or specialized covers?

- The battery alone can account for 30-40% of your EV’s value, so specialized protection is crucial.

- EVs are more susceptible to water or short-circuit damage than petrol/diesel vehicles.

- Add-ons help cover scenarios unique to EVs, like home charging station theft or accidental damage during charging.

Which Factors Affect Electric Vehicle Insurance Premiums in 2025?

When you get a quote for your EV insurance in India, you might notice that the price varies based on a number of factors. Here’s what determines your premium in 2025:

- IDV (Insured Declared Value): Higher the current market value of your EV, higher the premium.

- Battery Cost and Type: Expensive batteries (lithium-ion) and higher kWh ratings mean costlier premiums.

- Model and Variant: Premium EVs like Tata Nexon EV Max or BYD Atto 3 are more expensive to insure than budget EVs like Tata Tiago EV.

- Location: Metropolitan cities attract higher premiums due to greater risk of theft or accidents.

- Age of Vehicle: Newer EVs have higher premiums; premiums decrease as the car ages.

- Usage Pattern: Commercial use (like fleet taxis) attracts higher premiums than personal use.

- Add-ons Chosen: More add-ons like zero depreciation, battery protection, or roadside assistance will increase your premium.

- No Claim Bonus (NCB): If you haven’t made a claim in previous years, you get a discount.

- Security Features: Anti-theft devices and advanced driver assistance systems (ADAS) can lower your premium.

Expert Insight

IRDAI continues to offer a 15% discount on third-party insurance premiums for EVs compared to ICE vehicles in 2025 to promote green mobility.

Why Is Depreciation Important for Electric Vehicle Owners Under Indian Tax Laws?

Depreciation is how the value of your EV reduces over time due to wear and tear or obsolescence. For Indian EV owners, depreciation is especially important because:

- It determines your resale value and affects your insurance’s Insured Declared Value (IDV).

- Under Indian tax laws, depreciation can be used to reduce your taxable profits if you use your EV for business.

- It helps you calculate the correct claim amount in case of total loss or theft.

How depreciation applies under Indian tax laws in 2025:

- EVs used for business can claim depreciation under Section 32 of the Income Tax Act, 1961.

- The current depreciation rate for EVs is 15% per annum on the written down value (WDV) basis.

- If you purchased and registered a new EV between 1 April 2019 and 31 March 2025, you were eligible for an increased depreciation rate of 30%.

Key facts:

- Higher depreciation means lower IDV (and thus, lower insurance premium) in subsequent years.

- Losses due to depreciation cannot be claimed for personal-use vehicles unless converted to business use.

Did You Know?

The 30% accelerated depreciation rate for EVs was introduced by the government in FY2020 to promote faster adoption, and has been extended till 31 March 2025.

How Does Depreciation Affect Electric Vehicle Insurance Claims in India?

When you file an insurance claim for your electric vehicle, insurers calculate the payout after adjusting for depreciation—which means you don’t get the full cost of repairs or replacement, especially for certain parts.

Here’s how depreciation affects your EV insurance claims:

- Insurers apply a depreciation rate to parts like plastic, rubber, glass, tyres, and especially batteries.

- The older your EV, the higher the depreciation and the lower your claim payout.

- For batteries, typical depreciation applied can be up to 40% after 2 years.

- If you have a ‘Zero Depreciation’ add-on cover, you get the full claim amount without any deduction for depreciation (except for some parts).

| Component | Depreciation Rate (Year 1) | Depreciation Rate (Year 2) | Depreciation Rate (Year 3+) |

|---|---|---|---|

| Battery | 20% | 40% | 50%+ |

| Plastic/Rubber Parts | 30% | 35% | 40% |

| Metal Body | 5% | 10% | 15% |

| Glass | 0% | 0% | 0% |

- If your EV is declared a total loss (like in a major accident), the insurer pays the IDV after subtracting depreciation.

- Without zero-dep cover, you might end up paying a large chunk for out-of-pocket repairs.

Did You Know?

In 2025, over 60% of Indian EV owners opt for zero depreciation add-on due to the high cost of battery replacement.

When and How Can You Claim Depreciation for Electric Vehicles Under Indian Tax Laws?

If you use your EV for business—say as a cab operator, delivery vehicle, or company car—you can claim depreciation as an expense to reduce your taxable income.

- When?

- At the end of each financial year, while filing your income tax returns.

- Only if your EV is part of your business assets (not for personal use).

- How?

- Maintain records of purchase, registration date, and proof of business use.

- Apply the depreciation rate (usually 15% WDV, or 30% if bought before 31 March 2025).

- Show the reduced asset value and claim it as a deduction from your business profits.

- Depreciation is allowed even if you have financed the EV, as long as you are the registered owner.

Important things to remember:

- If you shift the EV from personal to business use, get it updated in your accounts and vehicle RC.

- You cannot claim depreciation if the vehicle is not registered in the business’s name.

- Depreciation on EVs is not allowed for salaried individuals unless used in a business or profession.

What are the Common Add-Ons or Riders for Electric Vehicle Insurance in India?

To get the best out of your EV insurance, consider adding these popular add-ons (riders) available in 2025:

- Zero Depreciation Cover: Ensures full payout on claims without deducting depreciation on parts.

- Battery Protection Cover: Covers the high cost of battery replacement or repairs, especially if damaged by water or fire.

- Charging Equipment Cover: Protects home chargers and portable charging cables against accidental damage or theft.

- Roadside Assistance: Emergency services for breakdowns, flat tyres, battery discharge, or towing to the nearest charging station.

- Engine (Motor) Protection: Covers damage to the electric motor due to water ingress or short circuit.

- Return to Invoice Cover: In case of total loss, pays the original invoice value of your EV (not just the depreciated IDV).

- Consumables Cover: Covers small but essential parts like coolant, nuts, bolts, etc.

- Key Replacement Cover: Covers the cost of replacing lost or stolen EV key fobs.

Why should you consider these?

- The high value of EV components (battery pack can be ₹2–6 lakhs) makes these add-ons cost-effective.

- EV-specific risks (like charger theft) are not covered by standard policies.

- Add-ons can be customized, so you only pay for what suits your usage.

Expert Insight

Some insurers in 2025 are offering “Smart Coverage”—where your premium is adjusted based on actual driving data from your EV’s telematics system.

How Much Does Electric Vehicle Insurance Cost in India in 2025? (With Real Examples)

The insurance premium for your EV depends on the model, location, and coverage you choose. Here’s a look at indicative annual premiums for popular electric vehicles in 2025:

| EV Model | Variant | City | Manufacturer’s IDV (₹) | Base Premium (Comprehensive) | Typical Add-ons (₹) | Total Annual Premium (₹) |

|---|---|---|---|---|---|---|

| Tata Tiago EV | XT MR | Pune | 8,00,000 | 7,200 | 2,000 | 9,200 |

| Tata Nexon EV | Fearless+ LR | Delhi | 17,50,000 | 12,100 | 3,000 | 15,100 |

| MG Comet EV | Exclusive | Mumbai | 9,50,000 | 8,000 | 2,200 | 10,200 |

| BYD Atto 3 | Extended Range | Bengaluru | 35,00,000 | 20,300 | 4,500 | 24,800 |

| Mahindra XUV400 | EL Pro | Hyderabad | 18,75,000 | 13,000 | 3,200 | 16,200 |

| Hyundai Kona EV | Premium | Chennai | 23,50,000 | 16,800 | 3,500 | 20,300 |

| Ola S1 Pro | Gen 2 | Jaipur | 1,35,000 | 2,200 | 900 | 3,100 |

| Ather 450X | 3.7 kWh | Ahmedabad | 1,60,000 | 2,400 | 1,000 | 3,400 |

| MG ZS EV | Essence | Kolkata | 25,00,000 | 17,200 | 3,800 | 21,000 |

| Tata Punch EV | Empowered+ LR | Lucknow | 10,50,000 | 8,900 | 2,400 | 11,300 |

What to learn from these examples:

- EVs have slightly lower premiums than equivalent petrol/diesel cars due to IRDAI discounts.

- Major metro cities cost more due to higher risk.

- Add-ons for battery and charger protection are important; they increase the premium by 15–25%, but offer significant peace of mind.

- Two-wheeler EVs have much lower premiums—often between ₹2,000–₹4,000/year.

- Premium EVs (like BYD Atto 3) attract higher premiums due to their expensive batteries and parts.

Which Tax Benefits Can You Avail for Electric Vehicles in India in 2025?

Indian government policies actively support electric vehicle adoption, and you can enjoy several tax benefits:

- Section 80EEB (Income Tax Act):

- You can claim tax deduction up to ₹1.5 lakh on the interest paid on a loan taken to buy an EV (applies to both two and four-wheelers).

- Available only for loans sanctioned between 1 April 2019 and 31 March 2025.

- Accelerated Depreciation for Businesses:

- Businesses buying EVs can claim up to 30% depreciation (till March 2025), which reduces taxable profits.

- GST Benefits:

- GST on EVs is 5% (compared to 28% on petrol/diesel cars).

- GST on EV chargers is also 5%.

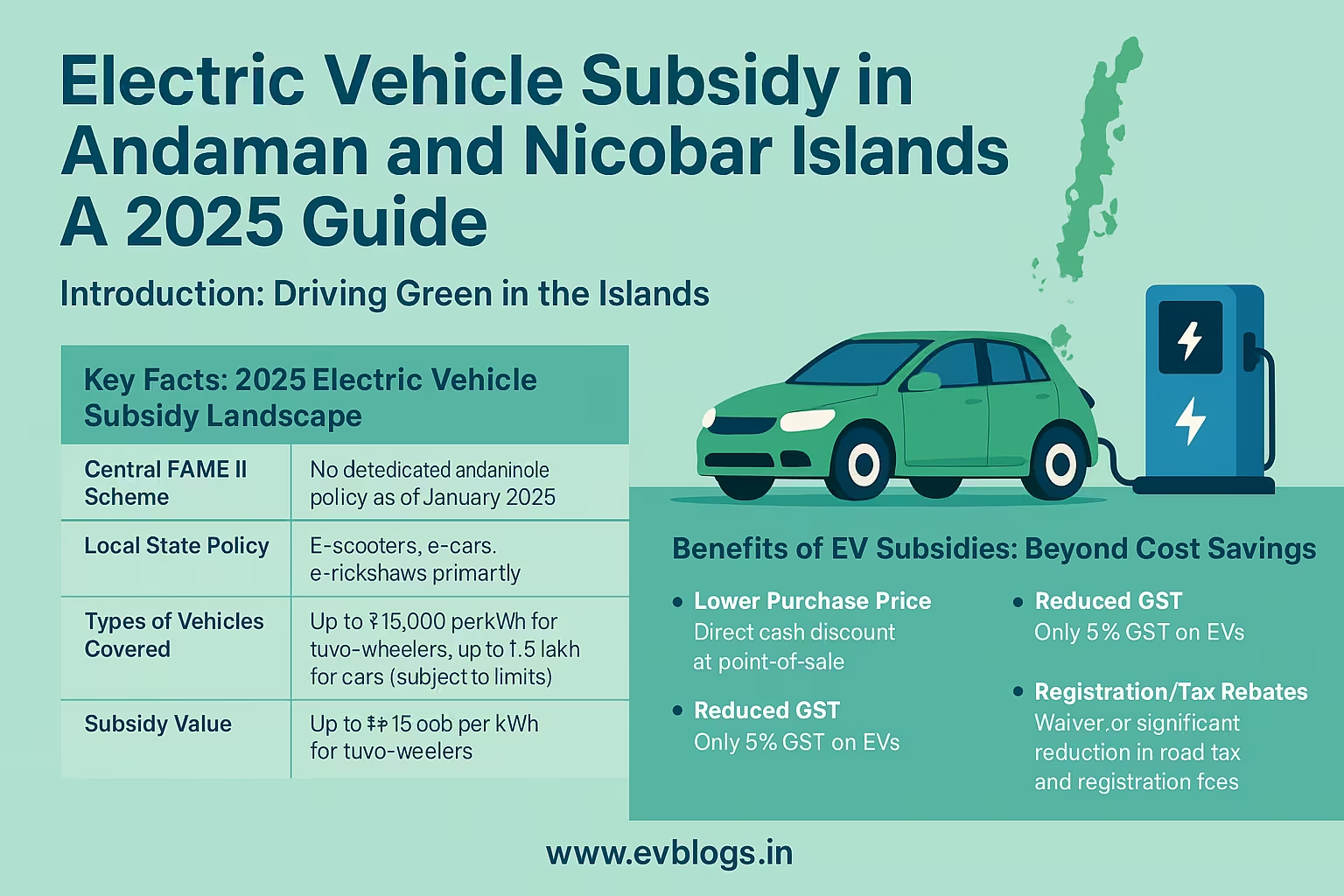

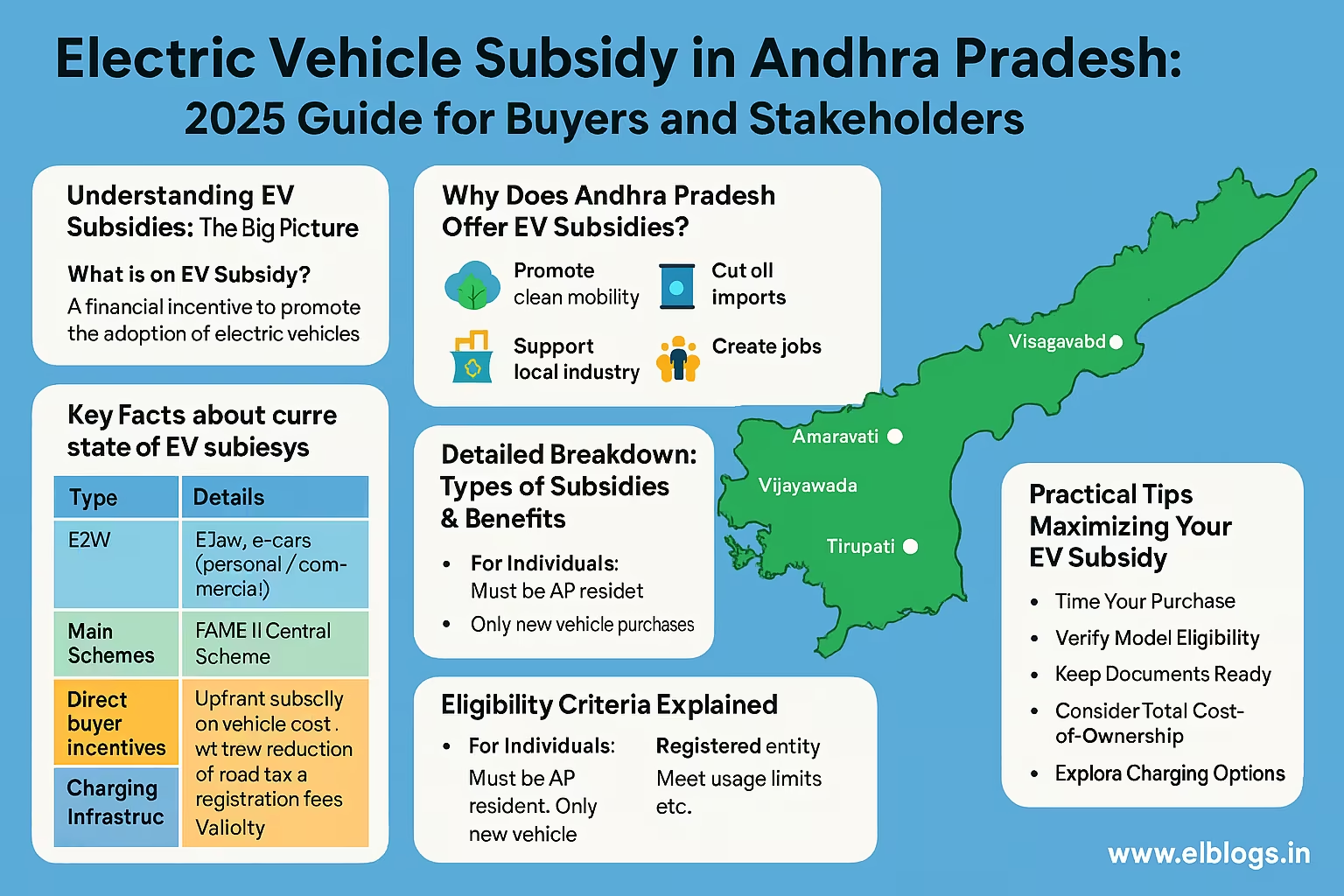

- State Incentives:

- Several states (Delhi, Maharashtra, Gujarat, Tamil Nadu, Kerala) offer road tax exemption, registration fee waivers, and subsidies up to ₹2.5 lakh.

- Check local RTO and state government websites for the latest 2025 policies.

Who gets these benefits?

- Individual buyers (Section 80EEB, GST).

- Business owners (depreciation).

- Fleet owners and commercial operators (all of the above).

Did You Know?

Tamil Nadu and Maharashtra remain the top two states for state EV subsidies in 2025, offering up to ₹2.5 lakh for four-wheelers and ₹25,000 for two-wheelers.

How to Choose the Best Electric Vehicle Insurance in India for 2025?

With so many options and new policies, choosing the right insurance for your EV in 2025 can be confusing. Here’s how you can decide:

- Assess Usage:

- City vs. highway driving? Daily commute or occasional trips? Higher use needs higher protection.

- Check Battery Coverage:

- Ensure the policy fully covers battery replacement and accidental damage.

- Add-Ons:

- Opt for zero depreciation, battery protection, and roadside assistance as minimum add-ons.

- Premium vs. Coverage:

- Don’t just look at the cheapest policy; check claim settlement ratios and after-sales service.

- Network Garages:

- Choose insurers with large cashless garage networks, especially for EVs.

- Claim Process:

- Look for digital-first insurers with quick claim turnaround time.

- Discounts:

- Use IRDAI’s EV premium discounts and check for extra discounts for installing anti-theft devices or eco-friendly driving.

Tips:

- Review the list of exclusions—damage during illegal racing or battery wear and tear may not be covered.

- Carefully read add-on terms, especially “battery cover”—some only cover accidental damage, not natural wear.

Expert Insight

Always compare at least 3–5 insurers for your specific model and city in 2025 to find the best balance between premium and real-world coverage.

What Are Real Indian User Experiences and Case Studies for EV Insurance & Depreciation?

Hearing from real Indian EV owners can help you make sense of insurance and depreciation in practice.

Case Study 1:

Amit, Mumbai – Tata Nexon EV Owner

- Purchased comprehensive insurance from Tata AIG with zero-dep and battery cover.

- In 2024, heavy rains flooded his parking lot, damaging his battery pack.

- Claim amount: ₹3.2 lakh.

- Insurer processed full claim within 8 days, with no depreciation deduction due to zero-dep add-on.

- Amit says: “Battery cover and zero depreciation made all the difference. I would have paid ₹1.2 lakh out of pocket otherwise.”

Case Study 2:

Sonal, Delhi – Business Owner with 4 Ola S1 Pro scooters

- Claimed 30% depreciation under Section 32 for EVs bought in FY2024-25.

- Reduced her business’s taxable income by ₹1.5 lakh.

- Also availed GST input credit on charging stations and insurance.

- Sonal says: “Tax benefits and depreciation made it much more affordable to run my fleet. The EV insurance premium is also less than petrol scooters.”

Case Study 3:

Rakesh, Chennai – MG ZS EV owner

- Chose only basic third-party insurance to save money.

- Car was stolen in early 2025.

- Received only the third-party claim—no protection for his own loss.

- Lesson: “Next time, I’ll take comprehensive cover. The savings on premium weren’t worth the risk.”

Case Study 4:

Priya, Bengaluru – Hyundai Kona EV user

- Opted for comprehensive insurance with battery and roadside assistance add-ons.

- Battery failed due to short-circuit in the second year (out of manufacturer warranty).

- Insurer applied 40% depreciation on battery as she didn’t choose zero-deprecation cover. Received only ₹1.2 lakh out of ₹2 lakh repair bill.

- Priya says: “If you can, always buy zero depreciation add-on, especially after manufacturer warranty ends.”

Final Verdict: What Should Indian EV Owners Do About Electric Vehicle Insurance & Depreciation in 2025?

As an Indian EV owner or buyer in 2025, you should:

- Always buy comprehensive electric vehicle insurance, not just third-party, to protect against costly battery and component repairs.

- Opt for essential add-ons like zero depreciation, battery protection, and roadside assistance.

- If using your EV for business, claim depreciation under tax laws and maximize your Section 80EEB and GST benefits before deadlines (March 2025).

- Carefully review policy exclusions and choose insurers with strong claim settlement ratios and EV-specific experience.

- Compare policies and premiums for your exact model, and don’t compromise coverage for small savings in premium.

The bottom line:

With EV adoption growing rapidly and parts (especially batteries) being expensive, a well-chosen insurance policy and correct use of depreciation benefits are key to minimizing your risk and maximizing your savings. Take the time to understand your options, and you’ll drive your EV worry-free in 2025 and beyond.

Additional FAQs on Electric Vehicle Insurance & Depreciation in India (Structured Data Friendly)

Q1. Can I switch my existing car insurance to electric vehicle insurance if I convert my car to EV?

Yes, but you must inform your insurer and get the RC updated. The insurer will reassess the premium and coverage based on the new EV specifications.

Q2. Is battery wear and tear covered under EV insurance in India?

Standard policies do not cover battery wear and tear, but some add-ons cover accidental damage. Always read the fine print.

Q3. What happens if my EV is used for commercial purposes but insured as a private vehicle?

Claims can be rejected if the usage declared does not match actual usage. Always insure as per the correct usage (private or commercial).

Q4. Do I need a special license or permit to insure an EV taxi or auto in India?

You need a commercial insurance policy and relevant transport permits to cover commercial EVs like taxis or autos.

Q5. Does EV insurance premium decrease every year as the vehicle ages?

Yes, as the IDV decreases due to depreciation, the premium reduces, but major component replacements (like battery) may result in higher premiums if claimed.

Disclaimer:

This article is for information purposes only and not a substitute for professional insurance, tax, or legal advice. Policy features and tax benefits may change based on insurer, vehicle model, and government regulations. Please consult with your insurer or tax advisor for personalized recommendations in 2025.