Electric Vehicle Subsidy in Andaman and Nicobar Islands: A 2025 Guide

Introduction: Driving Green in the Islands

As the world pivots towards sustainable mobility, electric vehicles (EVs) have emerged as a beacon of hope for combating climate change and reducing dependency on fossil fuels. Nowhere is this transition more crucial than in ecologically sensitive zones like the Andaman and Nicobar Islands. With their fragile ecosystems, limited fuel logistics, and growing demand for personal transport, these islands are uniquely positioned to benefit from EV adoption.

The Government of India’s push for e-mobility, paired with state-level initiatives, has created new opportunities for islanders to embrace green transportation. Central to this movement is the electric vehicle subsidy—a financial incentive designed to make EVs accessible and appealing. This article offers a comprehensive look at how these subsidies work in Andaman and Nicobar Islands as of 2025, who can benefit, eligibility criteria, application processes, expert insights, and practical advice for residents.

Understanding Electric Vehicle Subsidies in Andaman and Nicobar Islands

What is an EV Subsidy?

An electric vehicle subsidy is a government-backed financial incentive that reduces the upfront cost of purchasing an EV. These subsidies can be direct (cash discounts), indirect (tax exemptions or reduced registration fees), or a combination of both. In India, EV subsidies are provided under the central government’s FAME II scheme (Faster Adoption and Manufacturing of Electric Vehicles), often supplemented by local policies.

Why Are Subsidies Important for Island Communities?

- High Fuel Costs: Transportation costs on the islands are inflated due to import logistics.

- Environmental Sensitivity: Internal combustion engines increase pollution risks in fragile habitats.

- Energy Security: Reducing reliance on imported fuels improves local energy independence.

- Tourism Impact: Clean transport supports eco-tourism—a major economic pillar.

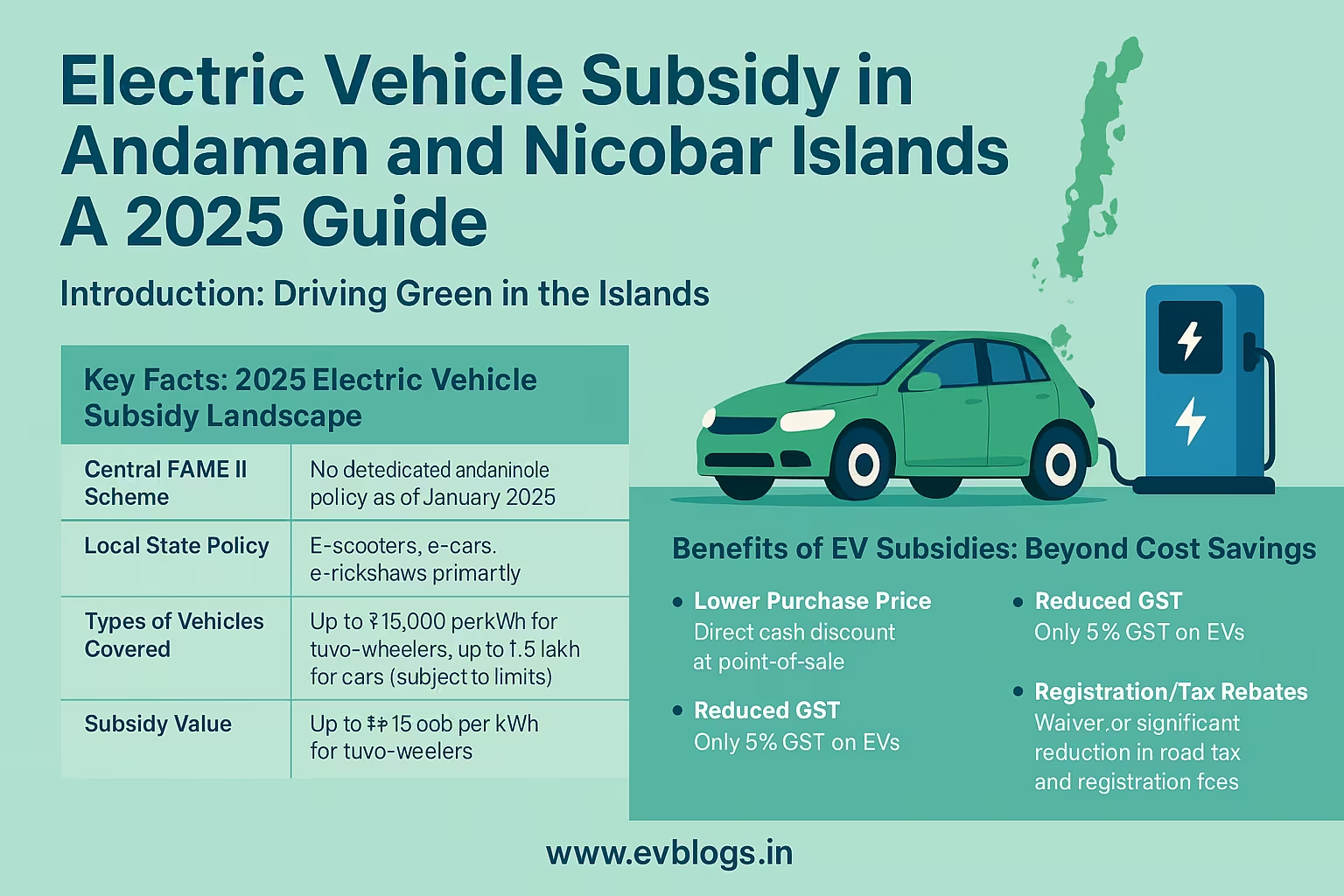

Key Facts: 2025 Electric Vehicle Subsidy Landscape

| Aspect | Details (As of 2025) |

|---|---|

| Central FAME II Scheme | Extended until March 2027; covers two-, three-, four-wheelers |

| Local State Policy | No dedicated standalone policy as of January 2025; central benefits applicable |

| Types of Vehicles Covered | E-scooters, e-cars, e-rickshaws primarily |

| Subsidy Value | Up to ₹15,000 per kWh for two-wheelers; up to ₹1.5 lakh for cars (subject to limits) |

| Other Incentives | GST at 5%, income tax benefits under Sec 80EEB |

| Charging Infrastructure | Expansion underway; public charging points in Port Blair and major towns |

Eligibility Criteria: Who Can Avail EV Subsidy?

General Eligibility

- Resident Status: Any Indian citizen residing in Andaman & Nicobar Islands can avail central subsidies.

- Vehicle Type: Only vehicles approved under FAME II and registered locally qualify.

- Manufacturer/Dealer Participation: The vehicle must be purchased from an approved OEM/dealer under FAME II.

Specific Requirements

- First-time Registration: Only new vehicles are eligible.

- Non-commercial Use: Certain incentives may be restricted to private buyers.

- Maximum Limit: One vehicle per individual under subsidy norms.

Documentation Needed

- Proof of identity (Aadhaar card/passport/voter ID)

- Proof of residence (local address proof)

- Purchase invoice

- Bank account details

- Dealer/OEM certification

Benefits of EV Subsidies: Beyond Cost Savings

Financial Advantages

- Lower Purchase Price

- Direct cash discount at point-of-sale.

- Reduced GST

- Only 5% GST on EVs versus higher rates on petrol/diesel vehicles.

- Registration/Tax Rebates

- Waiver or significant reduction in road tax and registration fees.

Environmental & Social Benefits

- Reduced air and noise pollution—critical in biodiversity hotspots.

- Lower carbon footprint across tourism and local commuting sectors.

- Encourages clean-energy jobs and skills development.

Long-Term Ownership Perks

- Lower running costs due to cheaper electricity versus petrol/diesel.

- Less frequent maintenance needs—EVs have fewer moving parts.

- Income tax deduction up to ₹1.5 lakh on loan interest under Section 80EEB.

Step-by-Step Process: How to Avail the EV Subsidy

Here’s how a resident can benefit from the available subsidies:

Step 1: Choose an Eligible Vehicle

- Select an EV model approved under FAME II from an authorized dealer.

Step 2: Confirm Dealer Participation

- Ensure your chosen dealership handles FAME II paperwork; most do.

Step 3: Prepare Required Documents

- Gather proof of identity, residence, bank details, purchase invoice.

Step 4: Complete Purchase Formalities

- The dealer applies the subsidy directly as a discount at sale time.

- You pay the net amount after subsidy deduction.

Step 5: Registration & Tax Exemption

- Register your vehicle with local RTO; road tax waivers may apply automatically based on prevailing rules.

Step 6: Access Additional Benefits

- Claim income tax deductions if purchasing via loan (file during ITR season).

Expert Insights: What Industry Leaders Say

Dr. Nikhil Kumar (Mobility Researcher)

“Islands like Andaman face unique logistical challenges for fuel supply. By making EVs more affordable through subsidies, not only do we reduce environmental impact but also enhance energy security.”

Rina Das (Local Dealership Manager)

“Interest in e-scooters has surged since central subsidies became more visible. The process is straightforward now—buyers see immediate savings at purchase.”

Government Perspective

“We are focusing on expanding charging infrastructure alongside promoting EV adoption. Port Blair will see several new fast-charging stations by end of this year.”

— Transport Department official (Andaman & Nicobar Administration)

Practical Advice & Tips for Residents

Before You Buy:

- Research Model Options: Not all EVs qualify; check FAME II website or ask your dealer.

- Test Drive Locally: Terrain varies across islands—ensure suitability for your daily routes.

- Check Charging Options: Look for home charging compatibility or proximity to public chargers.

After Purchase:

- Leverage Service Packages: Many dealers offer free/discounted servicing for early adopters.

- Stay Updated: Policy tweaks or new local incentives might emerge—subscribe to government notifications.

Use-Cases Specific to Island Life:

- Daily Commuting: E-scooters ideal for Port Blair office-goers—low running cost over short distances.

- Tourism Operators: E-rickshaws preferred by eco-conscious tourists; attract premium customers.

- Home-to-School Runs: Parents using small e-cars enjoy peace-of-mind with lower maintenance needs.

Comparing With Mainland Policies

While Andaman & Nicobar Islands currently rely mostly on central government benefits (unlike states such as Delhi or Maharashtra with additional state-level perks), residents still enjoy substantial savings compared to buying petrol/diesel vehicles:

| Feature | Mainland States with Extra Policy | Andaman & Nicobar Islands |

|---|---|---|

| Central FAME II Subsidy | Yes | Yes |

| State-Level Cash Incentive | Varies by state | Not yet |

| Road Tax Waiver | In many states | As per union territory notification |

| Charging Infra Density | Higher | Growing |

If state-specific incentives are announced in future budgets, islanders could receive even greater support.

Common Challenges & Solutions

Challenge: Limited charging stations outside Port Blair

Solution: Plan routes carefully or install home chargers if possible.

Challenge: Higher initial cost than equivalent petrol bikes/cars

Solution: Factor total ownership cost—including fuel savings—over several years; most users break even within three years thanks to low running costs and maintenance savings.

Challenge: Lack of awareness

Solution: Attend local workshops or ask dealers about demo rides/subsidy guidance sessions regularly hosted by transport authorities.

FAQ: Real-world Answers About EV Subsidies in Andaman & Nicobar Islands

Q1: Is there a special state-level subsidy scheme for electric vehicles?

No dedicated standalone policy exists yet as of early 2025; buyers benefit from central FAME II incentives only.

Q2: Can tourists buy subsidized EVs?

No; only Indian residents with valid local address proof are eligible under current rules.

Q3: How long does it take to get the subsidy?

The central subsidy is applied instantly at point-of-sale by participating dealers—no separate reimbursement required.

Q4: Are commercial operators eligible?

Yes—for certain categories such as e-rickshaws or fleet vehicles registered locally through approved channels.

Q5: What about scrappage benefits?

No specific scrappage-linked incentives exist currently in the islands’ context; keep track of national updates which may extend here later.

Q6: Is there support for installing home chargers?

While no direct grant exists yet locally, some utility companies offer concessional tariffs for residential charging setups; check with your electricity provider or dealer partner.

Conclusion: A Greener Tomorrow Starts Today

For residents and businesses across Andaman & Nicobar Islands, adopting an electric vehicle has never been more accessible—or more important. With upfront price reductions via FAME II subsidies, ongoing tax breaks, lower running costs, and expanding infrastructure support, there’s compelling value both financially and environmentally. As policy momentum continues into 2025 and beyond—and as awareness grows—the shift towards clean mobility will help safeguard these beautiful islands while enhancing quality of life for all who call them home.

If you’re considering an electric vehicle purchase this year:

- Start by researching eligible models,

- Consult participating dealers,

- Make use of all available financial benefits, and become part of a cleaner future today.

Sources

- Ministry of Heavy Industries – FAME India Scheme Phase II

- Andaman & Nicobar Transport Department Notifications – Andaman Govt Transport

- Central Board of Direct Taxes – Income Tax Deductions Section 80EEB

- Press Information Bureau – EV Policy Updates

- Society of Manufacturers of Electric Vehicles – SMEV Reports