Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

What Is EV Finance and Insurance in India and Why Should You Care?

Getting an electric vehicle (EV) in India is now easier than ever with tailor-made finance and insurance options. With the EV market booming in 2025—more than 1 million EVs were sold in India in 2024—banks and financial institutions have launched competitive rates and policies specifically for EVs. But the world of EV finance and insurance is different from what you might be used to with petrol or diesel vehicles.

Let’s help you figure out everything important about buying, financing, and insuring your EV in India.

- EV finance includes loans, leasing, and EMI options for buying your electric vehicle.

- EV insurance protects your investment against risks like accident, theft, battery failure, and third-party liability.

- In 2025, government policies, green lending programs, and new-age fintech companies make financing and insuring your EV simpler and more affordable.

Did You Know?

In 2025, the average interest rate for EV loans in India is about 7.5%—up to 2% lower than regular car loans in many banks due to government subsidies and green programs.

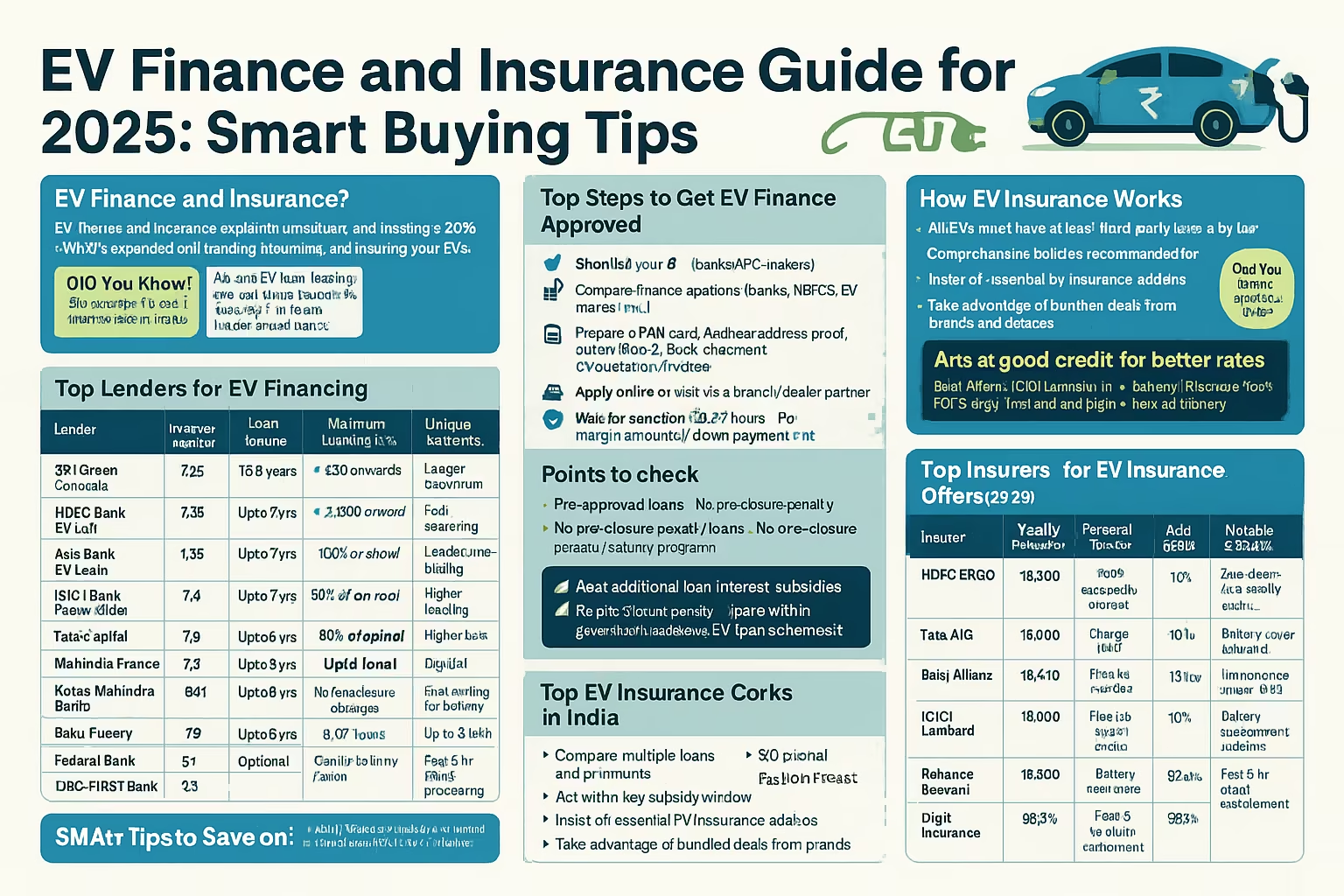

Which Indian Banks and Finance Companies Offer the Best EV Loans in 2025?

In 2025, almost all major Indian banks and NBFCs (Non-Banking Financial Companies) have their own EV loan products, often with exclusive features like zero processing fee or flexible repayment.

Here’s a comparison of 10 top lenders for EV financing:

| Lender | Interest Rate (% p.a.) | Loan Tenure | Processing Fee | Maximum Funding (%) | Unique Benefits |

|---|---|---|---|---|---|

| SBI Green Car Loan | 7.25 | Up to 8 yrs | Nil | 90% of on-road | No prepayment penalty, longer tenure |

| HDFC Bank EV Loan | 7.35 | Up to 7 yrs | 0.25% (min ₹2K) | 100% ex-showroom | Fast approval, exclusive for EVs |

| Axis Bank EV Loan | 7.5 | Up to 7 yrs | ₹3,500 onwards | 85% of on-road | Low documentation, quick disbursal |

| ICICI Bank Green Auto | 7.4 | Up to 7 yrs | 0.5% (min ₹3K) | 100% on ex-showroom | Pre-approved for select account holders |

| Tata Capital | 7.9 | Up to 6 yrs | 1.25% | 95% of ex-showroom | Higher funding, flexible EMIs |

| Mahindra Finance | 7.8 | Up to 5 yrs | 1% (min ₹3K) | 80% of on-road | Rural-focused, easy eligibility |

| Kotak Mahindra Bank | 7.2 | Up to 7 yrs | 0.5% | 90% of on-road | Instant sanction, digital processing |

| Bajaj Finserv | 8.1 | Up to 5 yrs | 2% | 100% on ex-showroom | Zero downpayment for salaried |

| Federal Bank | 7.6 | Up to 5 yrs | 0.5% | 80% ex-showroom | No foreclosure charges |

| IDFC FIRST Bank | 7.5 | Up to 6 yrs | ₹3,000 onwards | 90% ex-showroom | Gen Z-friendly, faster processing |

Description of lenders in details:

- SBI Green Car Loan: India’s largest lender with special rates. Offers longer repayment periods and zero prepayment charges.

- HDFC Bank EV Loan: Known for digital applications and speedy approvals, perfect if you want to drive home your EV in just days.

- Axis Bank: Strong on documentation and fast-track loan disbursal, making it suitable for self-employed buyers.

- ICICI Bank Green Auto Loan: Targets existing customers with pre-approved offers and covers entire ex-showroom price.

- Tata Capital: Flexible EMI and high funding ratio, good for those who prefer a custom loan approach.

- Mahindra Finance: Well-known in rural markets, friendly for buyers with limited banking history.

- Kotak Mahindra Bank: Processes loan applications quickly through fully digital systems.

- Bajaj Finserv: Offers unique zero down payment schemes for salaried buyers.

- Federal Bank: Highlights no pre-payment penalties—helpful if you’re planning to close early.

- IDFC FIRST Bank: Caters to younger buyers and first-time EV owners with easy loan tools.

Expert Insight

Many Indian banks in 2025 offer extra benefits like free EV charger installation or bundled insurance when you finance your EV, making the deal even more attractive.

What Are the Key Steps to Get EV Finance Approved in India?

You may wonder if getting a loan for an electric car or bike is different from a regular one. Here’s what you need to do and keep ready:

Steps to get your EV Loan:

- Shortlist the EV you want: 2-wheeler, 3-wheeler, car, or commercial.

- Compare finance options: Check banks, NBFCs, and even EV makers (like Tata or Ola) offering manufacturer tie-up schemes.

- Prepare your documents:

- PAN card

- Aadhaar or address proof

- Salary slips or bank statement (for last 6 months)

- Quotation/invoice for the EV

- CIBIL/Credit score (ideally above 700)

- Apply online or visit a branch/dealer partner.

- Wait for sanction: Usually within 24-72 hours.

- Pay the margin amount/down payment (varies by bank).

- Loan disbursed; you drive away with your new EV!

Points to check:

- Pre-approved or pre-qualified loans for faster processing.

- No pre-closure penalty loans if you plan to pay off early.

- Check for special government-backed or state EV loan schemes.

Did You Know?

Some states like Delhi, Maharashtra, Tamil Nadu, and Gujarat currently offer additional loan interest subsidies or partnership programs with banks, further reducing your financial burden in 2025.

How Does EV Insurance Work in India? Do You Need Special Policies?

Qualifying for EV insurance is a must: it’s legally required and protects you from common and EV-specific risks.

- All Indian EVs must have at least third-party insurance by law.

- Comprehensive policies are recommended as they cover damage to your car, battery, charger equipment, and personal accident cover.

- Many insurers in 2025 now offer specific “EV insurance” policies, factoring in risks like battery failure, theft of charging cable, fire due to short circuit, etc.

Types of policies:

- Third-party Liability: Covers injury/damage to others.

- Comprehensive: Covers third-party + own-damage + battery + electricals, etc.

- Add-ons: Zero depreciation, roadside assistance (with special EV tow options), battery cover, charger equipment cover.

Expert Insight

In India, only a handful of insurers like Bajaj Allianz, ICICI Lombard, HDFC Ergo, Tata AIG, and Digit now have fully digital claims for EV breakdown, including free towing for battery-related breakdowns up to 500 km.

Which Indian Insurers Provide the Best EV Insurance in 2025?

Here’s a quick comparison among leading insurance providers, focusing on both price and coverage (based on a mid-priced electric car like Tata Nexon EV or MG Comet EV):

| Insurer | Yearly Premium (₹) | Comprehensive Coverage* | Battery Cover Included | Personal Accident (₹) | Add-ons (Notable) | Claim Settlement Ratio (2025) |

|---|---|---|---|---|---|---|

| HDFC ERGO | 16,000 | Theft, accident, natural disaster | Yes | 15 lakh | Zero dep, 24h EV assist | 99.1% |

| Tata AIG | 17,000 | All standard, plus charger theft | Yes | 15 lakh | Battery degrade, charger loss | 98.8% |

| Bajaj Allianz | 15,500 | Theft, own damage | Yes | 10 lakh | Roadside EV assist | 99.2% |

| ICICI Lombard | 18,000 | Theft, flood, fire, personal items | Yes | 15 lakh | Home charging cover, no claim bonus | 98.7% |

| Reliance General | 16,500 | Full own damage, natural disaster | Yes | 10 lakh | EV taxi/Rent car loss | 98.5% |

| Digit Insurance | 14,700 | All standard plus protein-free claim | Yes | 15 lakh | Fast 3 hr claim settlement | 99.3% |

| SBI General | 16,300 | All standard, accidental cover | Optional | 15 lakh | Accessories, key loss add-on | 97.9% |

| New India Assurance | 15,400 | Damage, theft, natural calamity | Optional | 15 lakh | Customizable add-ons | 97.8% |

| Oriental Insurance | 16,100 | Full own damage + loss of use | Optional | 10 lakh | Consumables, engine guard | 97.6% |

| Future Generali | 15,900 | All basic + green parts | Yes | 15 lakh | Battery add-on, charger | 97.4% |

*Comprehensive coverage may differ based on add-ons, city, and car brand.

Key insurer details:

- HDFC ERGO: Best for hassle-free, digital claims and fast cashless network.

- Tata AIG: Offers the most EV-specific add-ons such as battery degradation protection.

- Bajaj Allianz: Known for high settlement rates and EV roadside assistance.

- ICICI Lombard: Great for high-value EVs offering charging equipment cover.

- Reliance General: Useful for EV taxi owners, adds downtime coverage.

- Digit Insurance: Leading for instant claims and paperless processes.

- SBI General: Government-backed, trusted for all vehicle types.

- New India Assurance: Offers traditional reliability and custom options.

- Oriental Insurance: Comprehensive packages with flexible add-ons.

- Future Generali: Value-driven and keen on EV parts replacement.

Did You Know?

As per an IRDAI directive, insurers in India are required to develop battery-specific claim norms for electric vehicles by 2025—this makes claim acceptance and processing much simpler for you!

Why Do EV Loans and Insurance Have Special Features Compared to Regular Vehicles?

There are unique aspects of EVs—like their battery cost, limited charging infra, and technology—that make their financial and insurance products different.

- EV batteries alone can cost up to 40% of your vehicle’s price!

- Replacement or repair costs are higher due to advanced technology.

- EV wear-and-tear is different from petrol/diesel vehicles.

- Support infra (like roadside charging) is still growing.

Because of these points:

- Loans might have longer tenures since batteries have longer warranties (8 years in most cars).

- Insurance policies have add-ons focused on battery, charger, and accidental emergencies.

- Many finance companies partner with automakers to bundle chargers, free insurance for 1st year, or free maintenance schemes.

Expert Insight

With EV adoption increasing, the RBI directed all Indian banks to treat EV loans as “priority sector lending” from 2025, giving you better rates than petrol vehicle loans.

When Is the Best Time to Buy an Electric Vehicle in India for the Best Finance and Insurance Deals?

Timing your purchase can mean big savings and better deals in 2025.

- Check for state government incentive periods—for example, Delhi’s EV Policy offers up to ₹1.5 lakh subsidy on new cars until March 2025.

- Look for “green loan” festival offers (like Diwali) from major banks with reduced rates and processing fee waivers.

- Auto expos (like the India EV Show) often have spot financing approvals and bundled insurance/maintenance for zero extra cost.

- Car dealers may offer free insurance or extended battery warranties during off-peak months or on last-year variants.

Best times in 2025:

- January-March: End of financial year and subsidy cycles.

- August-November: Festive season with launch discounts.

- During new EV launches: Manufacturers provide exclusive packages, sometimes including 2-3 years’ insurance or service.

Always:

- Compare multiple offers (online tools, direct dealer negotiation).

- Check latest state government and central FAME-II/FAME-III subsidy deadlines.

Did You Know?

Maharashtra’s state EV policy provides double subsidies—one for individual buyers and another for fleet purchasers—if you buy before June 2025!

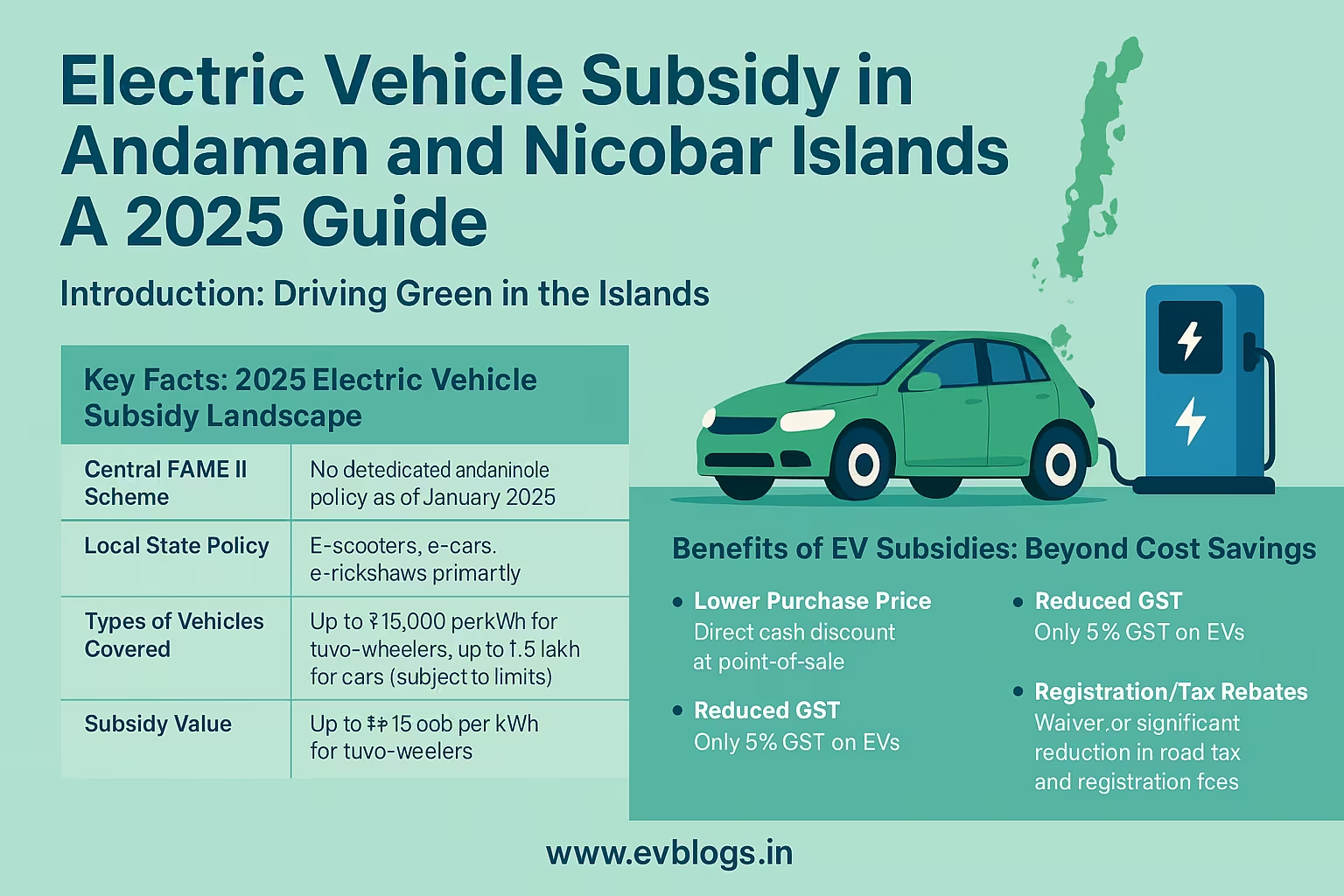

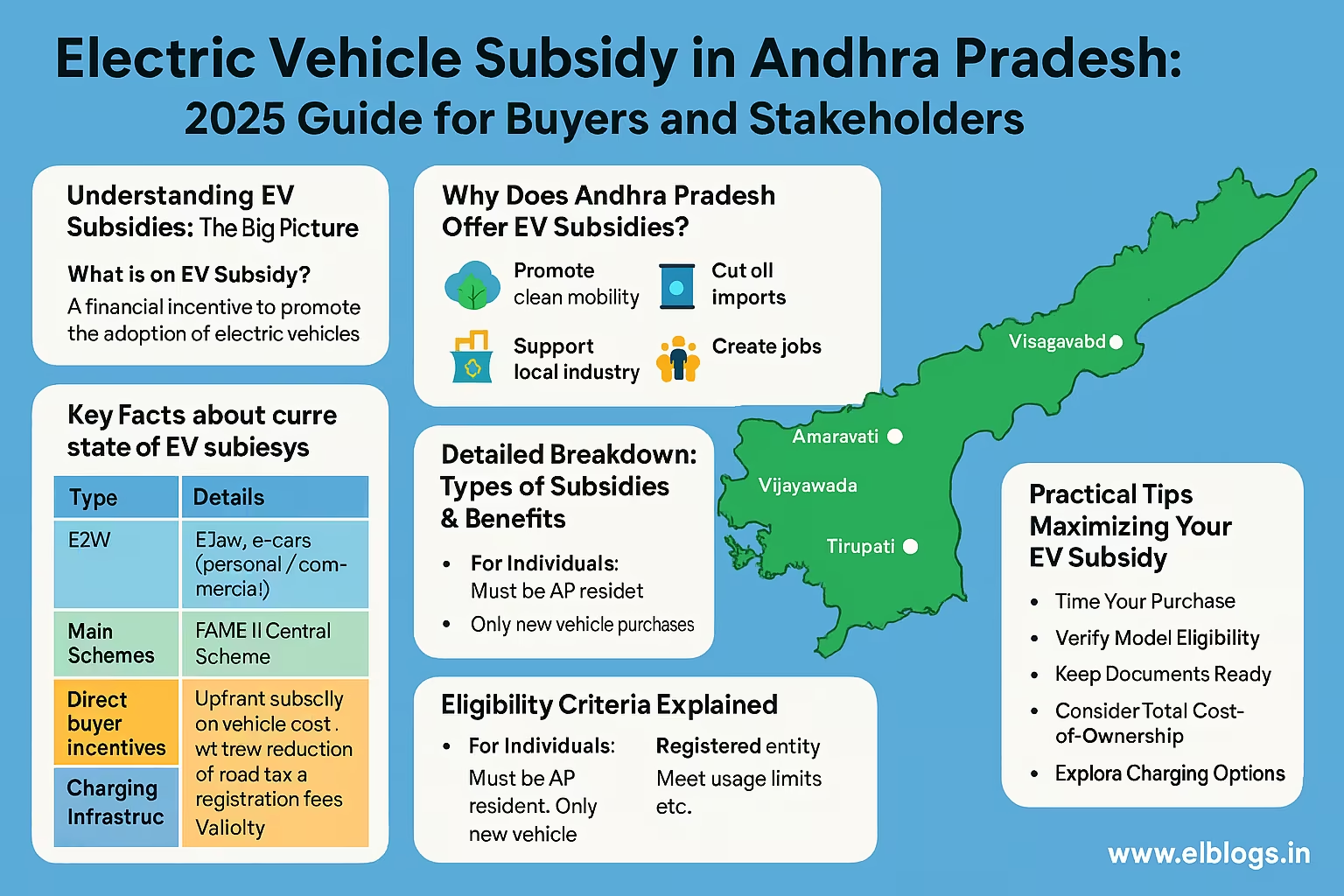

How Do Subsidies and Government Policies Affect Your EV Finance and Insurance?

Government incentives in 2025 make your EV much more affordable, both up front and over time.

Central Subsidies:

- FAME-II Scheme: Gives direct upfront subsidy on electric cars, scooters, autos, and buses.

- Up to ₹10,000 per kWh for cars (max ₹1.5 lakh per car)

- Up to ₹20,000 for electric two-wheelers

- GST on EVs: Only 5% GST (against 28% on regular vehicles)

State Subsidies (examples for 2025):

- Delhi: Up to ₹1.5 lakh on cars, ₹30,000 on bikes, extra on scrapping old car.

- Maharashtra: ₹1 lakh for cars, ₹15,000 for bikes, double for first buyers/fleet up to June 2025.

- Tamil Nadu, Gujarat, Telangana: Varying from ₹10,000–₹1.5 lakh.

Impact on Loans and Insurance:

- Banks process loans faster and at lower rates due to “green” priority status.

- Insurers offer lower premiums for EVs, especially in top policy states.

- Many state governments waive registration, road tax, or even auto insurance for the first year (check local RTO).

Checklist:

- Ask your dealer OR check official state EV portals for latest 2025 policy before finalizing your deal.

- Confirm that your bank/insurer applies these subsidies/waivers (not all do automatically).

Expert Insight

If your state waives road tax and registration for EVs in 2025, your on-road price reduces by 10–12%. This also means a lower loan amount and, eventually, lower EMI and insurance premium.

What Special Add-ons Should You Consider When Insuring Your Electric Vehicle?

Comprehensive insurance policies let you pick extra options, often for just a small added premium. For EVs in India, here are must-have add-ons:

- Battery Protection Add-on: Covers battery failure, repair/replacement, and even gradual degradation (normally excluded).

- Charger & Charging Cable Cover: Protects you from theft/damage to home/public chargers and portable charging cables.

- Zero Depreciation (Bumper-to-Bumper): Get the full claim value, without depreciation for battery/components.

- On-site Charging Assistance: Fast roadside help if your EV runs out of charge or gets stranded.

- Key Loss / Accessory Cover: Many EVs have expensive smart keys and digital accessories.

- Personal Accident Upgrades: Higher pa cover and hospital cash benefits.

Others to consider:

- Consumables Cover (for expensive coolants/fluids unique to EVs)

- Tyre and Rim Damage (important due to higher EV torque)

- Roadside Assistance for long intercity journeys

Tip: Always read terms for what is covered or excluded—especially for battery damage due to unauthorized charging or natural disasters.

Did You Know?

More than 67% of claims on electric cars in India in 2024-25 are related to battery, home charger, and key loss, much higher than for petrol cars.

Which Are the Top EV Manufacturers in India and What Finance/Insurance Offers Do They Give?

EV makers often tie up with banks, NBFCs, and insurers to offer bundled schemes, reducing your effort and sometimes overall cost.

Here’s a look at India’s top EV brands and their major finance + insurance deals in 2025:

| Brand | Top EV Model | In-House/Partner Finance | Warranty (Battery/Car) | Insurance Deals (2025) | Unique Add-ons / Bundles |

|---|---|---|---|---|---|

| Tata Motors | Nexon EV, Tigor EV | Yes (Tata Finance) | 8 yr/160,000 km | 1 Year Free, 0 dep, charger cover | 5yr free roadside assist, charger |

| MG Motor | Comet EV, ZS EV | Yes (ICICI, Axis tie-up) | 8 yr/120,000 km | 3/5yr warranty+, zero dep | Charger+insurance bundle |

| Mahindra | XUV400, eVerito | Yes (Mahindra Finance) | 8 yr/150,000 km | Free 1st year, 24x7 assist | Battery replacement scheme |

| Hyundai | Ioniq 5, Kona EV | Yes (HDFC, ICICI) | 8 yr/160,000 km | Free insurance Diwali 2025 | Up to ₹5 lakh free accessories |

| Ola Electric | S1, S1 Pro | Yes (Bajaj, Axis) | 8 yr/unlimited | Free theft, EV servicing | Flexible EMI, full digital journey |

| Ather Energy | 450X, 450S | Yes (IDFC, Bajaj) | 5 yr/60,000 km | Full digital, battery focus | Insurance included in EMI |

| BYD | e6, Atto 3 | Yes (ICICI, HDFC) | 8 yr/unlimited | Comprehensive + 2yr free serv. | Cutom premium plans |

| TVS | iQube Electric | Yes (TVS Credit, HDFC) | 5 yr/50,000 km | Free 1st year, charger cover | 36/48m EMI, on-road insurance |

| Hero Electric | Photon, Optima | Yes (Hero FinCorp) | 3 yr/30,000 km | Free insurance/buyback | Battery lease included |

| Bajaj | Chetak EV | Yes (Bajaj Finserv) | 7 yr/70,000 km | Free third-party, quick claim | 100% funding available |

Descriptions of their offers:

- Tata Motors: Market leader with exclusive in-house finance and 5-8 years extended charger/battery warranties.

- MG Motor: Often bundles multi-year insurance and charger coverage, making it value-packed for first-time buyers.

- Mahindra: Suited for both personal and fleet buyers, offers battery-specific replacement schemes.

- Hyundai: Strong on limited period “festival insurance” and premium accessory packages.

- Ola Electric: Fully digital EMI/insurance process and extra add-ons for city users.

- Ather: EMI includes insurance built-in—no surprise premium hike in 1st year.

- BYD: Extended battery warranty and tailored insurance for premium segment.

- TVS & Hero Electric: 100% vehicle on-road funding and affordable small EV loans.

- Bajaj: Quick loan with bundled third-party insurance.

Expert Insight

In 2025, bundled insurance + finance deals from leading EV makers often save you ₹25,000–₹50,000 or more, especially for first-time city car buyers.

How Can You Get the Lowest EMIs and Premiums on Your Electric Vehicle in India?

Great news: EV ownership is now more affordable due to stiff competition between lenders and insurers in India. Here’s how you can get the best deals and pay less every month.

Ways to lower your EMI:

- Opt for longer tenure (7–8 years) for lower monthly payout (but check total interest paid).

- Pay higher down payment—fund less, pay less interest overall.

- Choose state-subsidized loans where available.

- Check manufacturer/dealer tie-ups for zero/low processing fee deals.

- Maintain a high credit score (700+) for the lowest offered rates.

- Negotiate interest rates and see if dealer can “buy down” rates using their network.

Ways to reduce insurance premium:

- Install anti-theft or tracking devices (fetches 5–10% discount).

- Opt for voluntary higher deductibles (lower premium, but more self-risk).

- Bundle insurance with other policies (health, home) for “multi-policy” discounts.

- No Claim Bonus (NCB) transfers if you’re upgrading from a petrol/diesel vehicle.

- Buy online/direct for lower commission costs—compare on aggregator sites.

Special tip: If you belong to select groups (government employees, defense personnel, women drivers), you may be eligible for special offers in 2025.

Did You Know?

Some Indian employers now offer up to ₹50,000 per year EV purchase assistance, which can be used for either down payment, EMI rebate, or insurance subsidies.

What Are Some Real Indian User Experiences with EV Finance and Insurance?

It helps to know real-world stories. Here are a few real examples from 2025 buyers across India:

-

Amit (Delhi) bought a Tata Nexon EV:

- Chose SBI Green Car Loan at 7.25% for 7 years.

- Immediate state subsidy of ₹1.5 lakh reduced loan requirement.

- Opted for Tata AIG insurance with battery add-on, making claims easy during a charger short-circuit in his gated society.

-

Priya (Bengaluru) picked an Ather 450X:

- Avail digital loan from Bajaj Finserv—zero down payment due to her employer partnership.

- Insurance included in EMI; claim settled in 1 day after panel battery replacement.

- Enjoys free roadside assistance every time she rides out of city.

-

Rajan (Pune) bought BYD Atto 3 for family:

- Used HDFC green auto loan, got interest waiver for 3 months.

- Digit Insurance gave a quick, paperless claim when his son damaged the home charger—no claim bonus applied in next renewal.

-

Shabnam (Chennai), Ola S1 owner:

- Took state EV loan at 0.5% less than petrol scooter loans.

- With Digit Insurance, got replacement cover for her charging cable stolen at a mall.

Did You Know?

Over 79% of EV buyers in India in 2025 select comprehensive insurance (vs. 55% for petrol cars)—mostly due to battery and electronic risks.

How Do You Decide the Best Finance and Insurance Choices for Your EV Needs?

Here’s your action checklist before you sign any papers:

- Know your EV: Usage, price, battery warranty, and eligible government benefits.

- Compare finance options: Don’t just check rates—look at tenure, flexibility, and partner deals from banks/NBFCs/dealers.

- Check government subsidies: Central + state policies can dramatically reduce upfront and running costs.

- Carefully review insurance coverage: Must include own-damage, battery, and charger add-ons for EVs.

- Ask for bundled offers: Banks, insurers, and carmakers often give better deals together than separately.

- Read all terms: Delays, exclusions, or fine print in insurance/loans can cost you later.

- Use online comparison tools, but confirm with your dealer for latest city-specific deals.

If in doubt, take quotes from 3–5 finance and insurance companies, use your eligibility and credit profile to negotiate the best deal.

Expert Insight

Many EV buyers save ₹60,000–₹100,000 over the entire ownership period by comparing and bargaining—not just grabbing the first loan or insurance offer.

Conclusion: Make Your Smart EV Choice with Confidence in 2025

Switching to an EV in India today lets you benefit from innovative finance and insurance products, government incentives, and a rapidly expanding ecosystem. There are more choices, better rates, and smarter bundles than ever before.

- Compare multiple loans and premiums

- Act within key subsidy windows

- Insist on essential EV insurance add-ons

- Take advantage of bundled deals from brands and dealers

- Use your good credit for better rates

Diving into the details might feel overwhelming, but an informed approach saves you money, gives you peace of mind, and helps you ride into India’s electric future worry-free.

Ready to move? Start with a shortlisted EV, use our handy tables above, and talk to 2–3 lenders and insurers in your city. Your EV journey starts with the right financial decision. Happy driving!

Frequently Asked Questions (FAQs) on EV Finance and Insurance (2025)

-

Can I transfer my old car’s no-claim bonus (NCB) to a new EV insurance policy?

Yes, you can transfer your NCB from your existing petrol or diesel car to your new EV insurance, reducing your new premium. -

Are EV loans available for used/second-hand electric vehicles in India?

Yes, in 2025, a few banks and NBFCs now offer specific loans for certified pre-owned EVs, often at slightly higher interest rates than new ones. -

Which documents do I need for EV loan and insurance approval?

You’ll need your PAN card, address proof, income proof, CIBIL score, and the quotation for your chosen electric vehicle. -

How do EV insurance claims differ from those for regular vehicles?

EV insurance claims often focus more on battery, charger, and electronic parts, and some insurers offer specialized digital claim processes just for EVs. -

Does an EV battery warranty impact insurance claims and finance eligibility?

Yes, longer battery warranties (like 8 years) can lower your insurance premium and qualify you for better loan terms, as the risk of costly repairs is lower for both lender and insurer.

Disclaimer:

All rates, premiums, and offers mentioned above are based on the most updated market data for 2025, but individual terms may vary city to city and based on your credit profile. Please cross-check with your dealer, bank, or insurer for latest eligibility and policies before making your final decision.