Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

What is the EV Subsidy in India and How Does It Work in 2025?

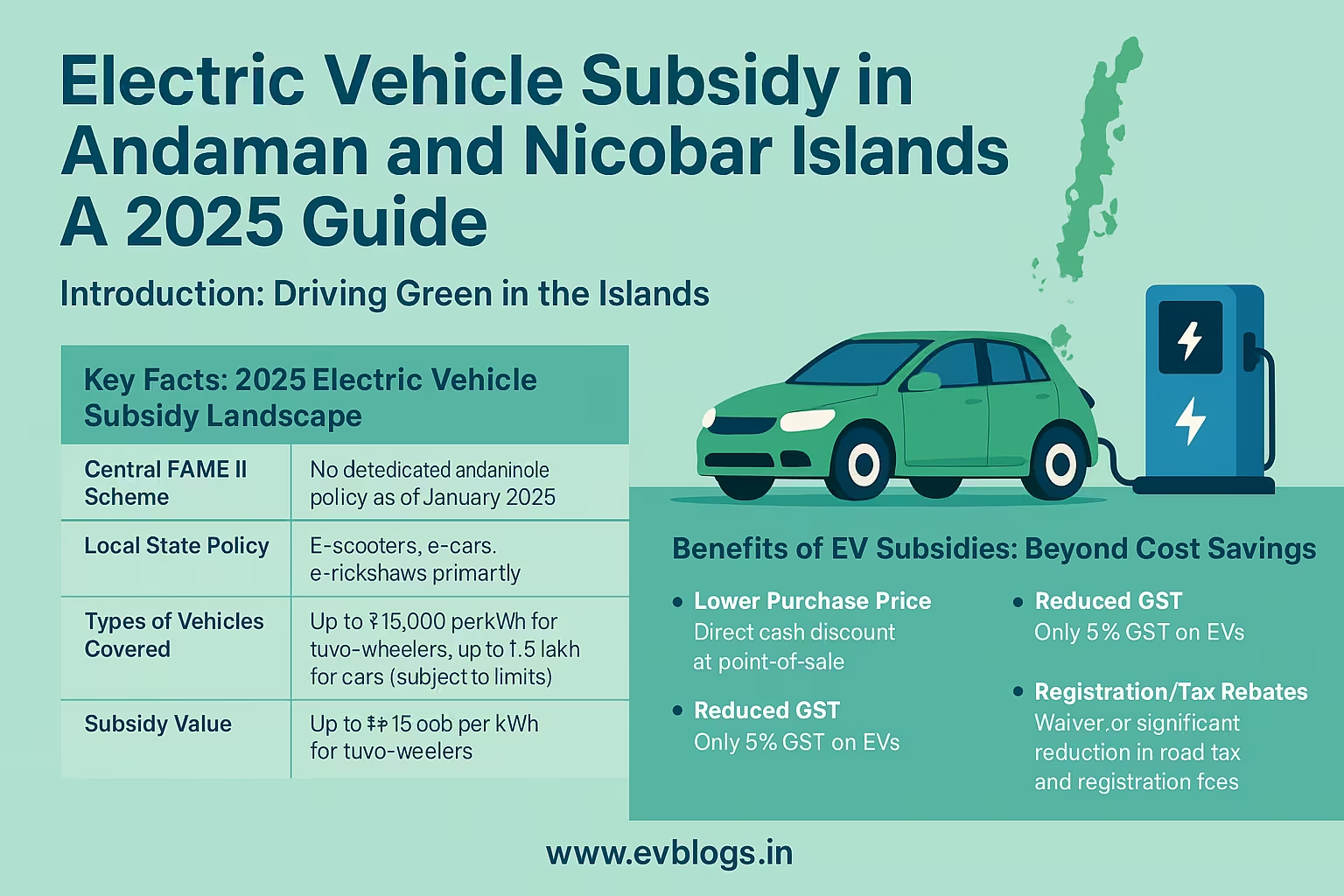

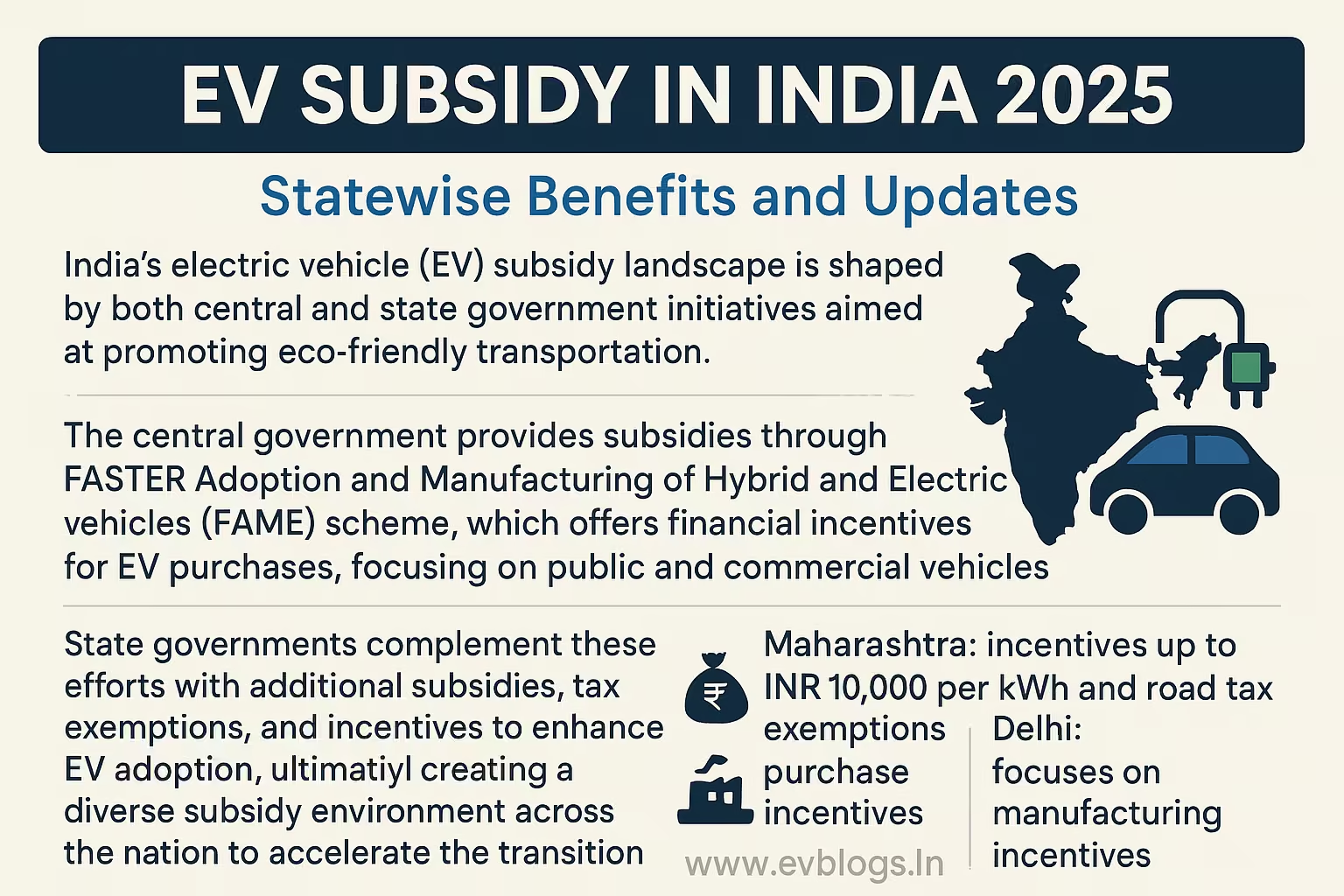

If you’ve been thinking about switching to an electric vehicle (EV) in India in 2025, one of your major considerations is probably the EV subsidy. The Indian government and various state governments are offering a range of subsidies and incentives to help you make the switch from petrol or diesel vehicles to cleaner, greener EVs. But how do these subsidies work, and what do you really get as a buyer?

Electric Vehicle (EV) subsidies in India are financial incentives provided by the central and state governments to encourage the adoption of EVs. The main aim is to reduce pollution, promote clean energy, and decrease reliance on imported fossil fuels.

Here’s how the EV subsidy system works in India:

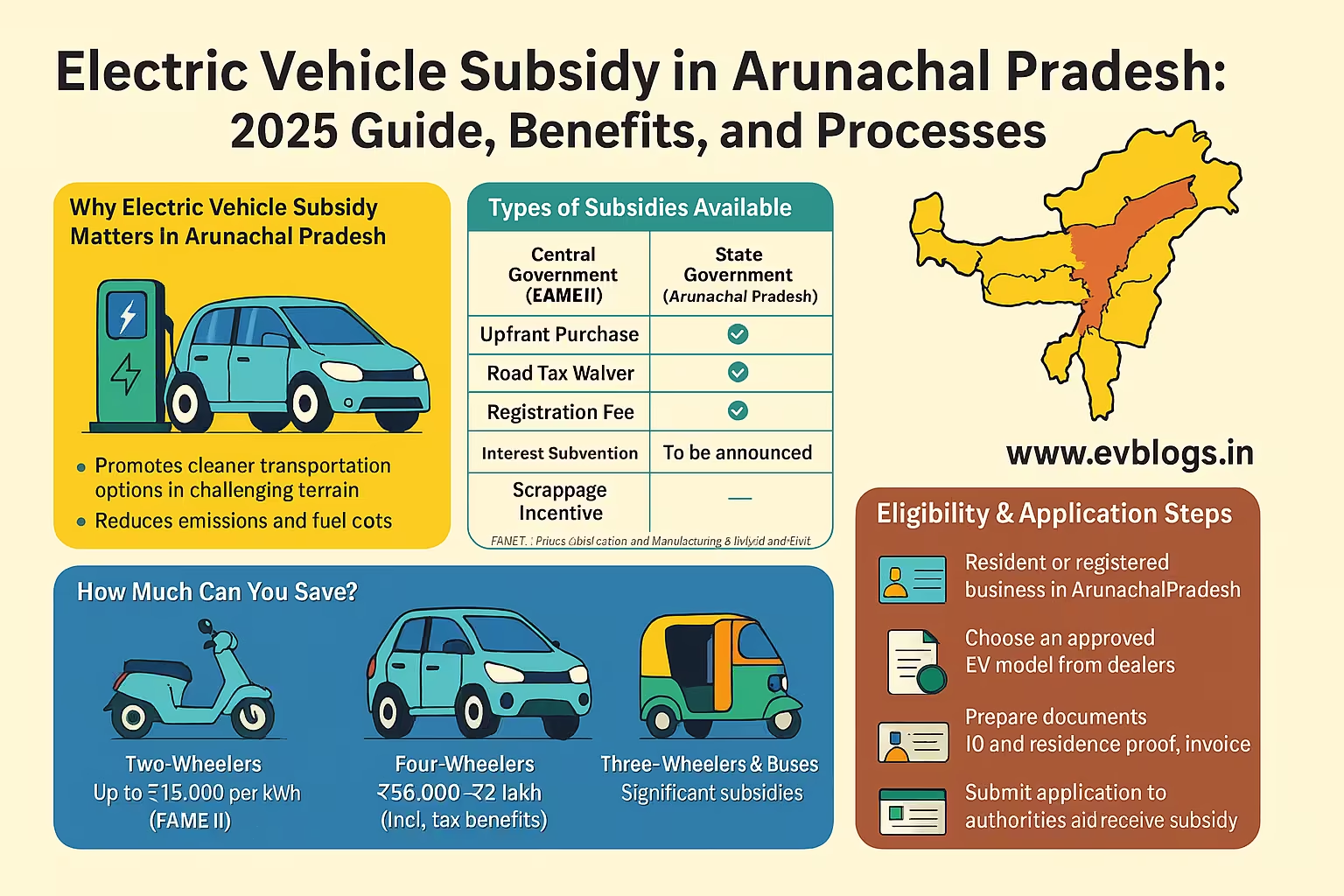

- The Central Government’s FAME-II scheme (Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India) provides direct subsidies for EV buyers, especially for two-wheelers, three-wheelers, and electric cars.

- Most Indian states offer their own additional incentives. These can be direct cash subsidies, exemption from road tax, registration fee waivers, or free charging infrastructure.

- Subsidies are usually credited directly to your bank account (Direct Benefit Transfer) or reduced from the upfront price at the dealership.

- Different categories of EVs—two-wheelers, three-wheelers, four-wheelers, buses—get different subsidy amounts.

- There are limits, such as the maximum price of the vehicle or battery capacity, to qualify for certain subsidies.

Key things you should know about EV subsidies in India (2025):

- Only vehicles certified under FAME-II are eligible for central subsidies.

- You need to be the first owner of the new EV.

- Many state subsidies are on a “first come, first served” basis due to limited budgets.

- Subsidies can change every financial year based on government policies and budget announcements.

Did You Know?

In 2025, more than 1 million EVs are projected to be sold in India, with nearly 40% benefiting from state or central subsidies.

Why Are Indian Governments Offering EV Subsidies in 2025?

You might wonder, why do central and state governments in India spend so much on EV subsidies?

The main reasons include:

- Combatting rising air pollution levels in Indian cities by replacing polluting fuel vehicles with cleaner alternatives.

- Reducing India’s heavy dependence on imported oil, which drains foreign reserves.

- Supporting “Atmanirbhar Bharat” (self-reliant India) by boosting the local EV manufacturing ecosystem.

- Meeting international climate agreements and emission reduction targets.

- Encouraging the adoption of innovative, sustainable mobility solutions.

Benefits for You:

- Lower upfront cost for buying an EV.

- Reduced total cost of ownership compared to petrol/diesel vehicles.

- Access to other perks like free parking, toll waivers, and priority permits in some states.

Benefits for the Country:

- Cleaner air and better public health.

- Energy security and economic savings.

- Job creation in the EV and battery manufacturing sectors.

Expert Insight:

The Indian EV market is expected to grow at a CAGR of over 40% till 2030, largely due to supportive government policies and increasing consumer awareness.

Which States in India Offer the Highest EV Subsidies in 2025?

Not all state subsidies are equal. As an EV buyer in 2025, you should know where you get the maximum benefit.

Here’s a comparison of the top 10 Indian states for EV subsidies (2025):

| State | Two-Wheeler Subsidy (₹/kWh) | Max Two-Wheeler Subsidy | Four-Wheeler Subsidy | Road Tax Exemption | Registration Fee Waiver | Extra Incentives |

|---|---|---|---|---|---|---|

| Delhi | ₹5,000 | ₹30,000 | ₹1,50,000 | 100% | 100% | Scrappage, Interest subvention |

| Maharashtra | ₹5,000 | ₹25,000 | ₹1,00,000 | 100% | 100% | Early bird incentive, scrappage bonus |

| Gujarat | ₹10,000 | ₹20,000 | ₹1,50,000 | 100% | 100% | Battery incentives |

| Tamil Nadu | ₹5,000 | ₹20,000 | ₹1,50,000 | 100% | 100% | Free permits for commercial EVs |

| Karnataka | 0 (no direct cash subsidy) | 0 | 0 | 100% | 100% | Priority registration |

| Telangana | ₹10,000 | ₹15,000 | ₹1,50,000 | 100% | 100% | Battery recycling incentive |

| Kerala | ₹10,000 | ₹30,000 | ₹1,50,000 | 100% | 100% | Free charging stations |

| Assam | ₹10,000 | ₹20,000 | ₹1,50,000 | 100% | 100% | Women entrepreneur incentive |

| Rajasthan | ₹2,500 | ₹10,000 | ₹1,00,000 | 100% | 100% | Subsidy up to 3kWh battery |

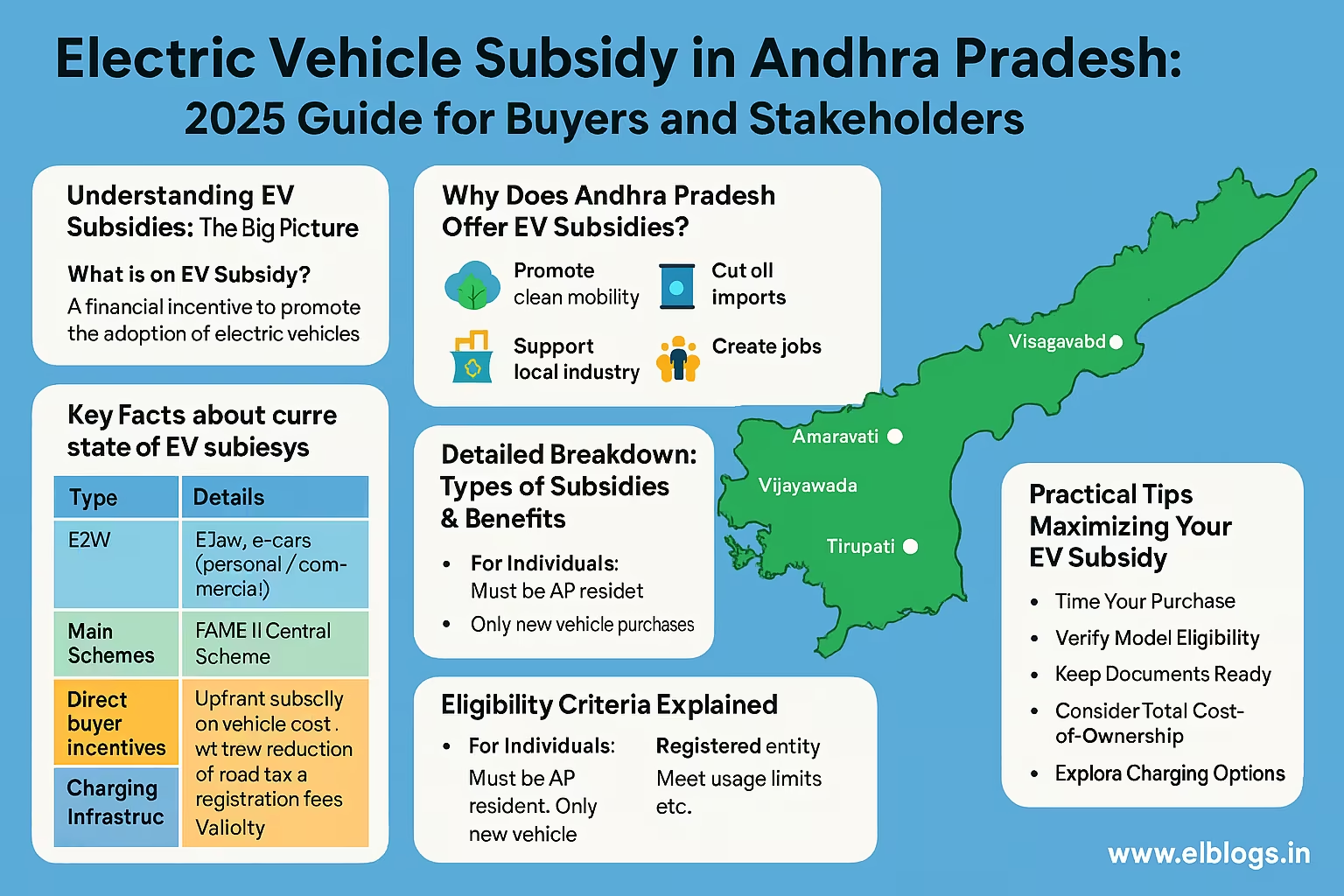

| Andhra Pradesh | 0 | 0 | 0 | 100% | 100% | Free charging stations |

Top states with unique incentives in 2025:

- Delhi: Highest overall subsidy, including extra for scrappage and interest subvention.

- Maharashtra: Early bird offers, scrappage bonus.

- Gujarat: Highest per kWh subsidy for two-wheelers.

- Kerala and Telangana: Focus on free charging and battery recycling.

- Assam: Special focus on women entrepreneurs.

Did You Know?

Delhi EV buyers can get up to ₹1.5 lakh subsidy for electric cars in 2025, one of the highest in India.

What Are the Main Requirements to Qualify for EV Subsidies in 2025?

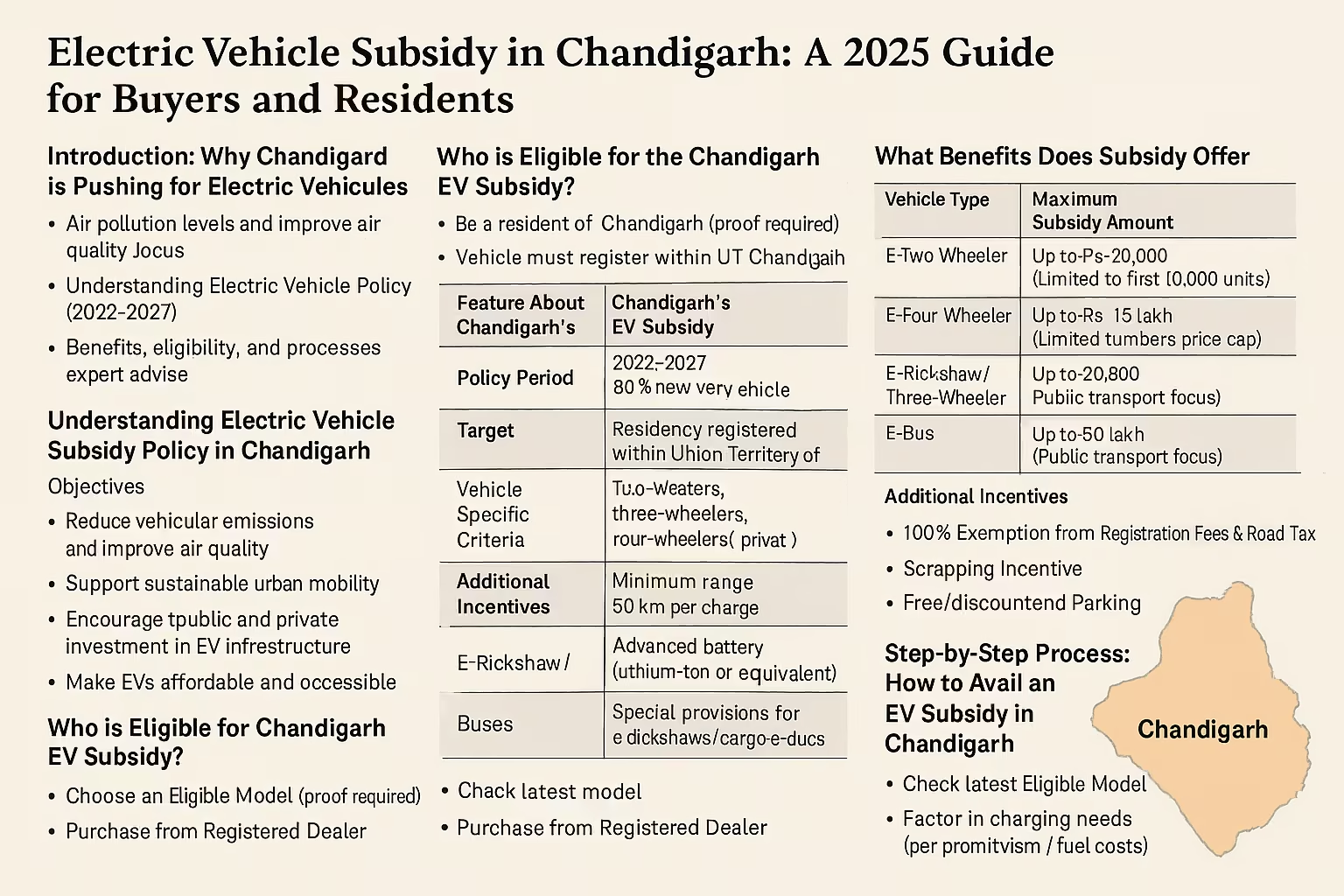

Understanding the eligibility criteria is crucial before you plan your EV purchase. Here’s what you need to look out for across most Indian states and the central FAME-II scheme.

General Requirements:

- Vehicle Category: Only vehicles approved under FAME-II and respective state policies are eligible.

- First Owner: You must be buying the EV as a new, first owner.

- Location: Your address proof must match the state in which you are availing the subsidy.

- Vehicle Price Cap: Four-wheeler subsidies are usually only for vehicles under ₹15 lakh ex-showroom.

- Battery Capacity: Many states provide subsidies based on battery size (e.g., ₹10,000 per kWh up to 2-3 kWh).

- Dealer Registration: Buy only from authorized dealers to ensure seamless subsidy claims.

- Documents Required: Aadhaar card, address proof, vehicle invoice, bank details, etc.

Central FAME-II Requirements (2025):

- Two-wheeler: 50% localization content, battery capacity of at least 2 kWh.

- Four-wheeler: Only for commercial (fleet/taxi) segment.

- Only selected manufacturers and models are eligible.

State-Specific Conditions:

- Many states process subsidies on a first-come, first-served basis.

- Some states have yearly quotas; once exhausted, you may not get the subsidy that year.

- In states like Delhi or Maharashtra, scrapping an old IC vehicle gets you extra savings.

Expert Insight:

As of 2025, over 80% of EV buyers in Delhi, Maharashtra, and Gujarat have successfully claimed their subsidies within 30 days of purchase.

How Do You Apply for an EV Subsidy in India in 2025?

If you’re ready to buy an EV, here’s how you can actually claim your subsidy:

Step-by-Step Process (General Overview):

- Step 1: Choose an eligible EV model approved under FAME-II and your state policy.

- Step 2: Visit an authorized dealer and provide your KYC documents (Aadhaar, PAN, address proof).

- Step 3: Complete the purchase process. The dealership will apply the central and state subsidy benefits to your invoice or process reimbursement.

- Step 4: Register your EV at the local RTO, which will process any road tax and registration fee waivers.

- Step 5: If your state processes subsidies as a reimbursement, fill out the state government’s subsidy claim form online or at the dealership.

- Step 6: Provide your bank details. Subsidy amount is credited directly (usually within 30-90 days).

State-Specific Application Notes:

- Delhi: Fully online process through the Delhi EV portal.

- Maharashtra: Dealer assists with online application; extra benefits for scrappage processed separately.

- Gujarat: Instant subsidy on purchase invoice.

- Other States: Most follow a dealer-assisted, partly online process.

Important Tips:

- Verify if your chosen model is eligible for both central and state subsidies.

- Keep all invoices, registration copies, and bank details handy.

- Track your application status through government portals or dealership assistance.

Did You Know?

In 2025, all major Indian states have integrated EV subsidy applications with their VAHAN vehicle registration portals for smoother processing.

Which EVs Are Eligible for Maximum Subsidies in 2025?

Not every EV in the market qualifies for maximum subsidy. If you’re looking to maximize your benefit, here’s what you should focus on:

Top Eligibility Factors:

- Central FAME-II Eligibility: Only certain models and brands are listed for subsidy.

- Battery Capacity: Models with larger batteries get bigger state subsidies (up to the cap).

- Price Cap: Only models below the state’s price cap get four-wheeler subsidies.

- Localization: Vehicles with higher local content (parts made in India) get preference under FAME-II.

Top Eligible Models & Typical Subsidy Amounts (2025):

| EV Model | Category | Central FAME-II Subsidy | Top State Subsidy* | Total Potential Subsidy |

|---|---|---|---|---|

| Ola S1 Pro | Two-wheeler | ₹22,500 | ₹30,000 (Delhi) | ₹52,500 |

| Ather 450X Gen 3 | Two-wheeler | ₹22,500 | ₹25,000 (Maharashtra) | ₹47,500 |

| TVS iQube S | Two-wheeler | ₹22,500 | ₹20,000 (Gujarat) | ₹42,500 |

| Tata Nexon EV Prime | Four-wheeler | 0 (private use) | ₹1,50,000 (Delhi) | ₹1,50,000 |

| Tata Tiago EV | Four-wheeler | 0 | ₹1,00,000 (Maharashtra) | ₹1,00,000 |

| MG Comet EV | Four-wheeler | 0 | ₹1,00,000 (Kerala) | ₹1,00,000 |

| Mahindra XUV400 | Four-wheeler | 0 | ₹1,50,000 (Delhi) | ₹1,50,000 |

| Hyundai IONIQ 5 | Four-wheeler | 0 | 0 | 0 |

| BYD e6 (Fleet) | Four-wheeler (taxi) | ₹1,50,000 | ₹1,50,000 (Delhi) | ₹3,00,000 |

| Piaggio Ape E-Xtra FX | Three-wheeler | ₹50,000 | ₹60,000 (Telangana) | ₹1,10,000 |

*State subsidy varies by location and may be capped by price, battery, or model.

Key Points:

- Private four-wheeler buyers get state subsidies only, not central FAME-II (2025).

- Commercial/fleet buyers may get both central and state subsidies.

- High-range, premium EVs (price above ₹15 lakh) usually do not qualify.

Expert Insight:

In 2025, the Tata Nexon EV continues to be India’s best-selling electric car, with maximum subsidies claimed in Delhi and Maharashtra.

When Is the Best Time to Buy an EV to Maximize Subsidy in India (2025)?

EV subsidy policies are often revised every financial year. Here’s how timing your purchase can help you get the best deal:

Why Timing Matters:

- State subsidy budgets can run out (first-come, first-served).

- New financial year announcements (April) may bring policy changes.

- Early-bird special incentives in some states (e.g., Maharashtra’s first 100,000 buyers).

Best Timing Tips for 2025:

- Buy early in the financial year (April-June) to avoid missing out if budgets exhaust.

- Check for special schemes during festivals (many states announce additional discounts during Diwali or Independence Day).

- Watch for updates on central FAME-II extension or discontinuation (currently expected to run at least till March 2025).

- Scrappage incentives may be increased periodically; track local RTO notifications.

User Experiences:

- Many early buyers in Maharashtra (2023-24) received both standard and early-bird incentives, getting up to ₹1.2 lakh off on EVs.

- In Delhi, buyers who scrapped old vehicles alongside purchase got maximum combined savings in 2025.

Did You Know?

As of June 2025, Gujarat’s EV subsidy fund had already reached 60% utilization, making early purchase crucial for maximum benefit.

How Much Money Can You Really Save with EV Subsidies in 2025?

It’s important to know the actual savings—upfront and over the vehicle’s lifetime—when factoring in all subsidies and incentives.

Upfront Savings:

- Two-wheelers: You can save ₹20,000–₹52,500 (central + state).

- Four-wheelers: Savings range from ₹1 lakh to ₹3 lakh, depending on model and state.

- Three-wheelers and commercial EVs: Highest total incentives, especially in fleet segments.

Ongoing Savings:

- Road tax and registration fee exemptions (5-12% of ex-showroom price).

- Lower running cost—electricity is cheaper than petrol/diesel by up to 80%.

- Reduced maintenance costs due to fewer moving parts.

- Priority parking, toll waivers, and free charging in select states.

Real User Story:

- “I bought my Tata Nexon EV in Delhi in early 2025. With the state subsidy, zero road tax, registration waiver, and scrappage bonus, my on-road price dropped by nearly ₹2.1 lakh. My monthly running cost is less than ₹1 per km, compared to ₹7 per km for my old petrol car.” — Raghav, Delhi

Example Savings Breakdown (2025):

| Cost Item | Petrol Car | Tata Nexon EV (with Subsidy) |

|---|---|---|

| Ex-showroom Price | ₹14,00,000 | ₹14,50,000 |

| Subsidy | ₹0 | -₹1,50,000 |

| Road Tax + Reg. | ₹1,00,000 | ₹0 |

| Effective Price | ₹15,00,000 | ₹13,00,000 |

| Fuel (per km) | ₹7 | ₹1 |

| Maintenance (5yr) | ₹70,000 | ₹20,000 |

Expert Insight:

Over a 5-year period, EV owners in India typically save ₹3-4 lakh more than petrol car owners due to lower running and maintenance costs, even after higher upfront price.

What Are the Challenges or Limitations of EV Subsidies in India?

While EV subsidies are a boon for buyers, there are certain challenges and caveats you should be aware of.

Common Challenges:

- Limited Budgets: Many states run out of subsidy funds mid-year.

- Eligibility Restrictions: Not all models qualify, especially premium/luxury EVs.

- Changing Policies: Subsidy amounts and eligibility can change with each budget.

- Dealer Awareness: Some dealerships are not fully trained in subsidy procedures.

- Delayed Disbursement: Although improving, some users have reported delays in receiving subsidy payments (especially in states with manual processes).

Limitations:

- State subsidies are only available if you register the vehicle in that state.

- Subsidies are not transferable if you move states or sell the vehicle early.

- Fleet/commercial buyers have more options, but must meet stricter criteria.

User Feedback:

- In Kerala and Karnataka, users have reported smooth online application processes.

- In Rajasthan, some buyers faced delays due to frequent policy updates and fund exhaustion.

Did You Know?

The FAME-II scheme is expected to undergo a major revision in 2025, possibly increasing focus on commercial EVs over private ones.

Which Documents Do You Need for Claiming EV Subsidies in 2025?

To ensure your EV subsidy application is successful, keep these documents ready:

Required Documents:

- Aadhaar Card: For identity and address verification.

- PAN Card: For income tax compliance.

- Local Address Proof: Electricity bill, rent agreement, etc.

- Vehicle Invoice: From the authorized dealer.

- Bank Details: For direct transfer of subsidy.

- RC (Registration Certificate): Issued by the RTO.

- Scrappage Certificate: If claiming scrappage incentive.

Application Checklist:

- Confirm your vehicle’s eligibility on the FAME-II and state EV portal.

- Fill out all forms accurately, and double-check bank account details.

- Save copies of all submitted documents for future reference.

State-Specific Notes:

- Delhi and Maharashtra: Allow online uploading of all documents.

- Karnataka: May require physical submission at the RTO in some districts.

Expert Insight:

In 2025, most Indian states aim to process EV subsidy applications digitally, reducing average processing time to under 30 days.

How Do Central and State EV Subsidies Work Together in India?

Many buyers ask: Can you “double-dip” and get both central and state subsidies? Here’s how the system works in 2025:

How They Combine:

- Central FAME-II Subsidy: For eligible two-wheelers, three-wheelers, and only commercial/fleet four-wheelers.

- State Subsidy: For both private and commercial buyers, with wide variations in amount and criteria.

Key Rules:

- Most states allow you to claim both central and state subsidies, but only if your vehicle model is approved under both policies.

- Subsidy amounts are not duplicated; each covers a specific portion (central applies first, then state).

- If the central scheme ends or runs out of funds, only state subsidy applies.

Combination Examples:

-

Two-Wheeler in Delhi: Ola S1 Pro

- Central FAME-II: ₹22,500

- State: ₹30,000

- Total: ₹52,500 (plus road tax and registration waiver)

-

Four-Wheeler Private in Gujarat: Tata Tiago EV

- Central FAME-II: Not applicable

- State: ₹1,00,000

- Total: ₹1,00,000 (plus road tax and registration waiver)

-

Fleet Four-Wheeler in Delhi: BYD e6

- Central FAME-II: ₹1,50,000

- State: ₹1,50,000

- Total: ₹3,00,000

Did You Know?

In 2025, at least 60% of all new electric two-wheelers sold in India benefited from both central and state subsidies.

What’s the Future of EV Subsidies in India After 2025?

You may wonder what happens after 2025—will subsidies continue, increase, or phase out?

Current Trends:

- The central FAME-II scheme is scheduled to run till March 2025; a new version may be announced, possibly with updates to focus more on public and commercial transport.

- Many states, such as Delhi and Maharashtra, have announced their own EV policies up to 2026 or 2027 but may revise benefits each year based on adoption rates and budget allocations.

- As the EV market matures, subsidies are expected to gradually reduce for private buyers and shift towards infrastructure and commercial vehicles.

Expected Changes:

- Increased focus on battery recycling and second-life incentives.

- Special incentives for rural and tier-2/3 cities.

- Extension of benefits for e-buses, cargo vehicles, and charging stations.

Advice for Buyers:

- If you want to maximize subsidy, 2025 is a good time—future schemes may offer lower incentives as EVs become mainstream.

- Keep an eye on state EV policy updates every year.

User Perspective:

- Many 2023 buyers in Delhi locked in the highest ever subsidies, as the state capped incentives for later years.

- Fleet operators in 2025 are expecting larger commercial EV incentives under the next FAME phase.

Expert Insight:

Industry analysts predict that after 2025, EV subsidies in India may pivot from direct discounts to more investment in charging infrastructure and battery management.

Conclusion: How Should You Decide on EV Subsidy Benefits in 2025?

EV subsidies in India in 2025 are among the most generous ever, especially for early adopters in top states like Delhi, Maharashtra, Gujarat, Kerala, and Telangana. As a buyer, you can potentially reduce your upfront cost by over ₹1.5 lakh for cars and ₹50,000 for two-wheelers, plus enjoy ongoing savings through tax waivers and lower running costs.

Key Takeaways:

- Check eligibility for both central and state subsidies before buying.

- Buy early in the financial year or during special government drives to ensure you get full benefits.

- Keep all your documents ready and apply through authorized dealers or official state portals.

- Be prepared for potential policy changes, especially after March 2025.

- Even after subsidies phase out, EVs offer lower running and maintenance costs compared to petrol or diesel vehicles.

If you’re looking to make the switch to electric, 2025 is possibly the best time in India’s history to maximize government support. Use this guide to compare state offers and take an informed decision.

FAQs about EV Subsidy in India – Statewise Breakdown (2025)

Q1: Can I claim EV subsidy if I move to another state after buying my vehicle?

No, subsidies are only for vehicles registered in the state of purchase, and are not transferable if you move states later.

Q2: Do all EV models qualify for both central and state subsidies?

No, only models certified under FAME-II and listed by your state are eligible. Always check approved lists before buying.

Q3: What documents are required for EV subsidy application?

You will generally need Aadhaar, PAN, local address proof, vehicle invoice, RC, bank details, and sometimes a scrappage certificate.

Q4: Are subsidies available for used or second-hand EVs?

No, subsidies are only for new, first-owner EV purchases.

Q5: Will EV subsidies continue after 2025?

Current schemes are valid till March 2025. Future policies may change, so it’s best to buy soon if you want to maximize savings. Always check official updates.

Disclaimer: Information is current as of June 2025. Subsidy eligibility, amounts, and processes may change as per government notifications and should be checked with official portals before making your purchase.