Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

What Is the GST Rate on Electric Vehicles in India (2025)?

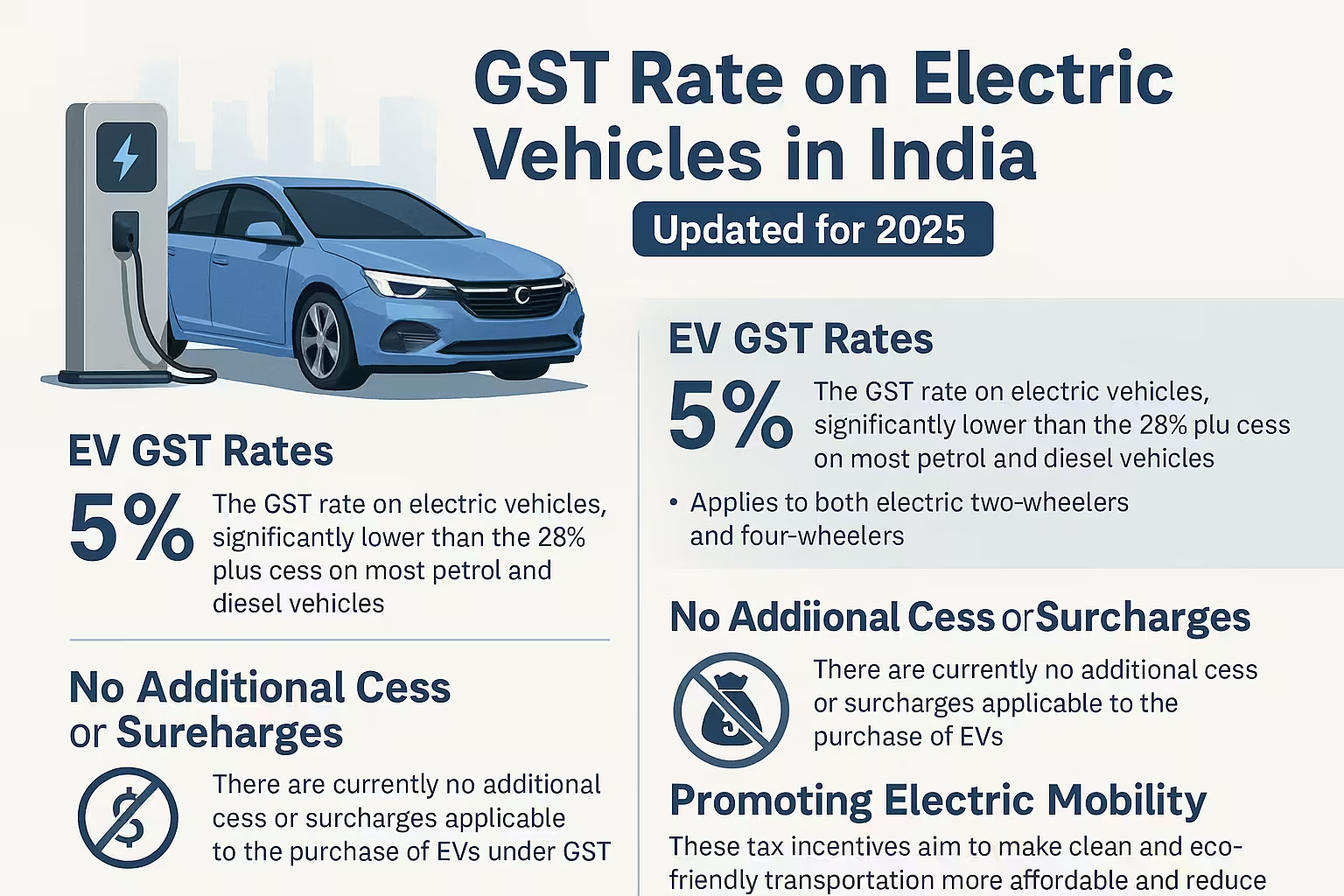

Looking to purchase an electric vehicle (EV) in India? One of the first questions that comes up is: What is the GST rate on electric vehicles in 2025? Getting clarity on tax rates is essential for your financial decisions, whether you’re considering a personal EV, a two-wheeler for zipping around town, or even planning for your business fleet.

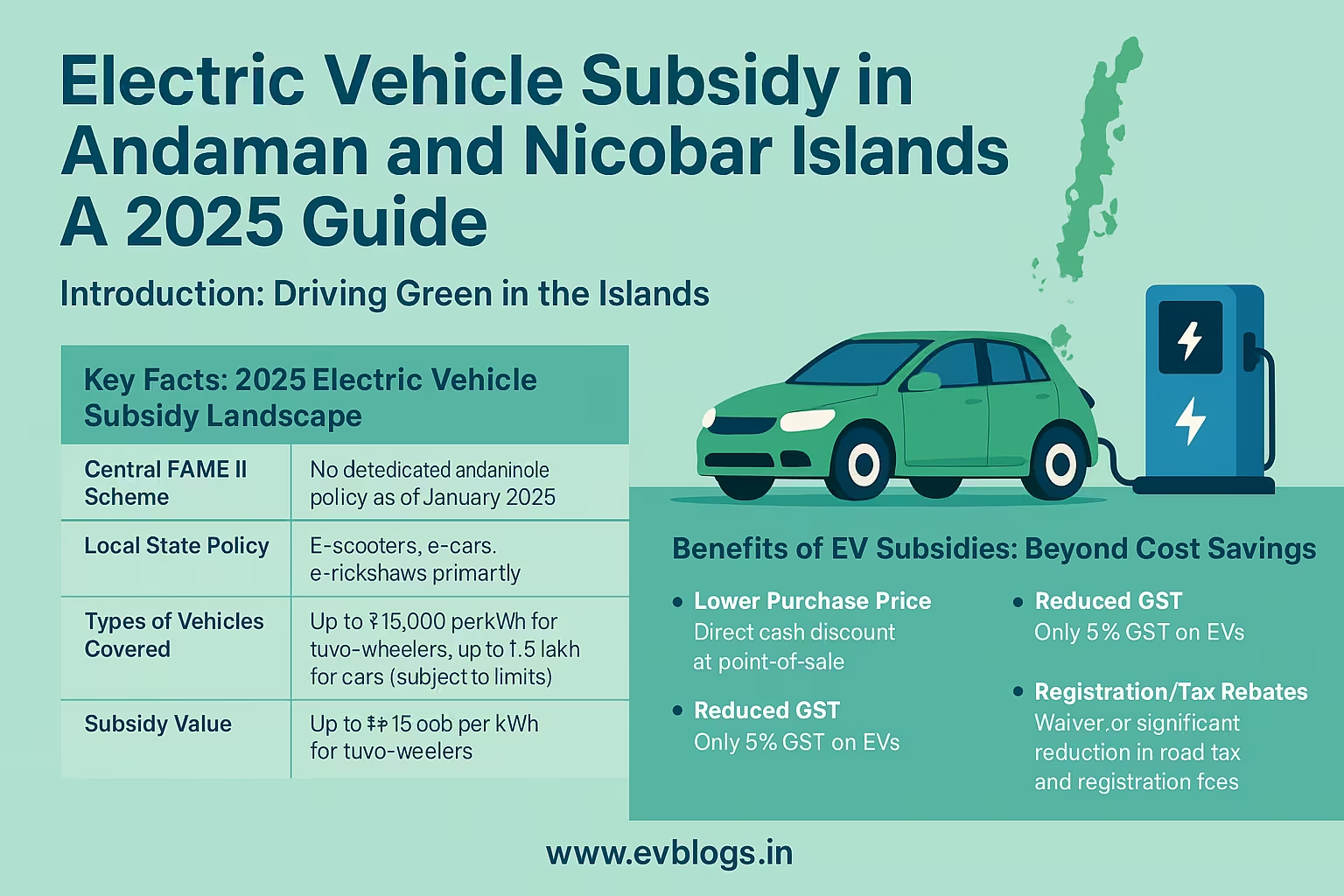

As of 2025, electric vehicles in India attract just 5% GST (Goods and Services Tax). This rate is significantly lower than the standard 28% GST that applies to most conventional petrol and diesel vehicles. The reduced GST rate on EVs is a big push by the Indian government to promote eco-friendly transport and support the transition away from fossil fuels.

- GST Rate on Electric Vehicles (2025): 5%

- GST Rate on Petrol/Diesel Vehicles: 28% + Cess (varies)

- The GST rate applies to both electric two-wheelers and four-wheelers, including cars, scooters, motorcycles, bicycles, and buses.

- The GST rate for charging stations and EV chargers: Reduced to 5% from the earlier 18%.

Did You Know?

If you buy an electric vehicle in India in 2025, you pay nearly 80% less GST compared to buyers of petrol or diesel vehicles!

Why Did the Indian Government Reduce GST on Electric Vehicles?

The drop to a 5% GST rate didn’t happen overnight. The government’s goal is to drive mass adoption of EVs by making them more affordable and attractive.

-

Environmental Focus: India faces serious air pollution issues in many major cities. Electric vehicles emit zero tailpipe emissions, helping improve air quality.

-

Reducing Oil Imports: As India imports more than 80% of its crude oil, shifting to EVs reduces foreign exchange outflow.

-

Global Commitments: In line with the Paris Agreement, India aims to reduce its carbon footprint and has set out ambitious electrification targets.

-

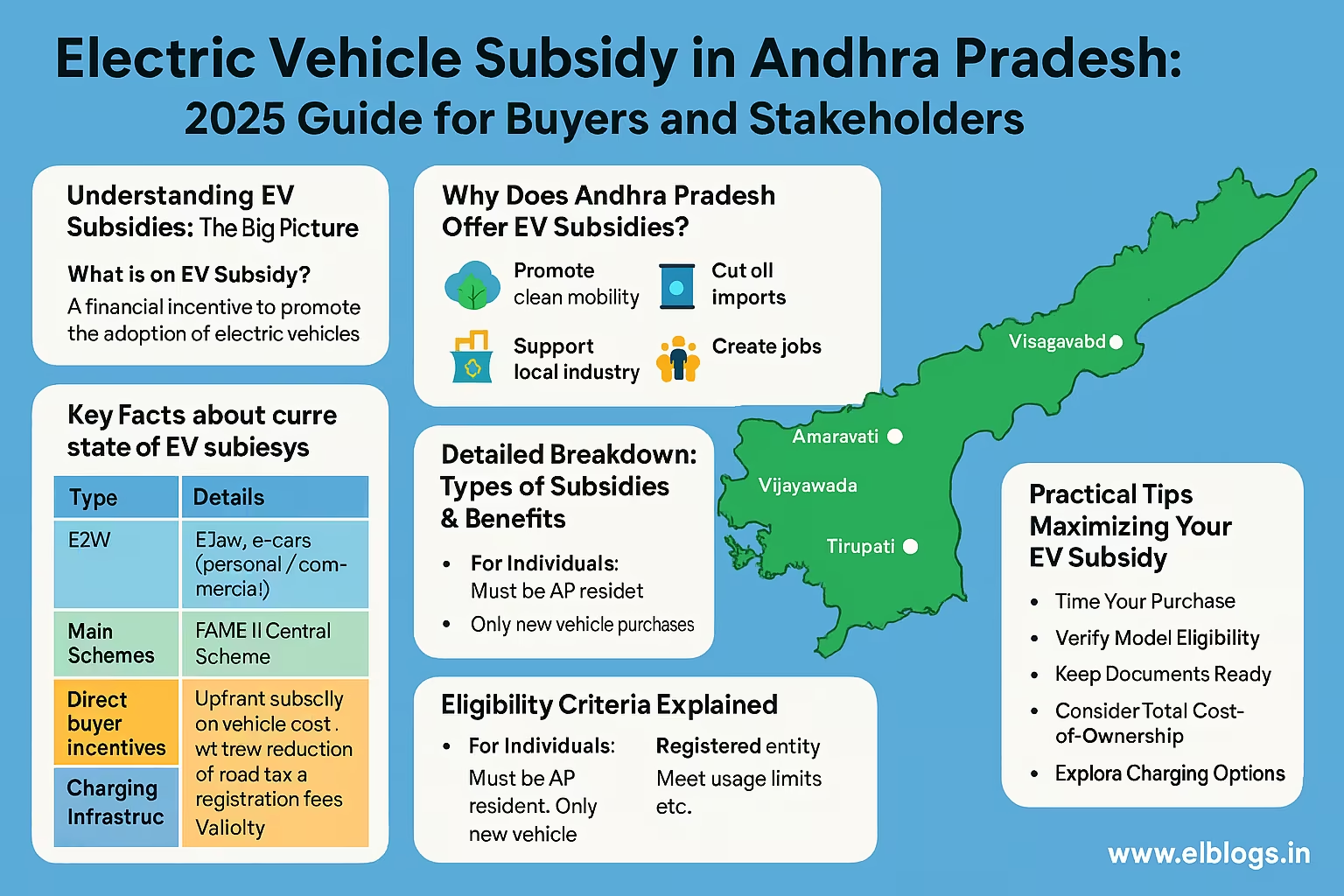

Faster Adoption and Manufacturing of Electric Vehicles (FAME): The FAME II scheme offers incentives to EV buyers and manufacturers. A lower GST acts as a further boost.

-

GST reduction was first announced in August 2019, and this key policy remains unchanged as of 2025.

Expert Insight:

The GST Council has ensured that tax policy stays in sync with India’s EV vision. Uptake of electric vehicles rose by over 270% between 2021 and 2024 in India!

Which Vehicles Qualify for the 5% GST Rate?

Worried if your EV purchase will get this tax benefit? The 5% GST on electric vehicles in 2025 is broad and covers:

- Electric two-wheelers (scooters, motorcycles)

- Electric three-wheelers (e-autos, passenger/cargo rickshaws)

- Electric four-wheelers (cars, taxis, commercial vehicles)

- Electric buses (state transport, private operators)

- Electric bicycles

No restriction on battery size or range for qualifying for the lower GST rate.

- Hybrid cars, plug-in hybrids, and mild hybrids do NOT get this 5% GST rate—they fall under higher GST slabs.

- Retrofitted EV kits may have a different rate—always check at the time of purchase.

Did You Know?

Over 17 lakh EVs were sold in India in FY 2024—and every one of them benefitted from the 5% GST rate.

How Do GST Rates on Electric Vehicles Compare to Other Vehicles in 2025?

Making a choice? Here’s a numbers-based comparison of GST rates on popular vehicle types sold in India as of 2025.

| Vehicle Type | GST Rate in 2025 | Cess (%) | Total Indirect Taxes (%) | Typical On-Road Price Impact |

|---|---|---|---|---|

| Electric Car | 5% | 0% | 5% | Lowest among car options |

| Electric Scooter/Bike | 5% | 0% | 5% | Much cheaper, less tax |

| Petrol Car (<1200cc) | 28% | 1% | 29% | Highest GST+cess slab |

| Diesel Car (<1500cc) | 28% | 3% | 31% | Higher than petrol |

| SUV (>1500cc, >4m) | 28% | 22% | 50% | Most heavily taxed segment |

| Hybrid Car | 28% | 15% | 43% | Not eligible for 5% GST |

| LPG/CNG Car | 28% | 1%-3% | 29-31% | No special GST concession |

| Electric Bus | 5% | 0% | 5% | Big savings for operators |

| Petrol Scooter/Bike | 28% | 0% | 28% | Over five times EV GST |

| Commercial Diesel Vehicle | 28% | 15% | 43% | No green tax benefit |

What’s the Main Takeaway?

- Shifting to an electric vehicle could save you up to 45% in GST and cess compared to SUVs and over 23% compared to small petrol cars in 2025.

Expert Insight:

The savings from lower GST can range from ₹20,000 (for a scooter) to over ₹2.5 lakh (for premium electric cars) compared to buying new fossil fuel vehicles.

What About GST on EV Chargers and Charging Stations?

If you’re wondering about the tax implications when you install an EV charger at your home or set up public charging stations, here’s what you need to know for 2025:

-

EV Chargers & Charging Stations: GST has been reduced to 5% (from 18% pre-2019)

-

Applies to: Fast chargers, home wallboxes, charging equipment for commercial use.

-

Businesses installing private EV charging infrastructure also pay just 5% GST.

-

Solar-powered charging stations are included.

-

Spare parts, repair services, and accessories may still have different GST rates (usually 12-18%), so always check your invoice.

Did You Know?

The GST Council clarified in 2024 that any standalone EV charger, whether you buy for home or commercial use, is taxed at just 5%.

When Did the Lower GST Rate on EVs Take Effect?

- The 5% GST rate on electric vehicles officially came into force on 1 August 2019.

- Maintained unchanged till 2025 due to strong EV adoption and green policy focus.

- Charging equipment’s GST rate was reduced at the same time.

- Announcements made by GST Council (chaired by the Union Finance Minister) and notified by the Ministry of Finance, Government of India.

- GST for hybrid vehicles remains unchanged.

Timeline summary:

- Pre-Aug 2019: GST on EVs was 12%

- Aug 2019 onwards: GST slashed to 5%

- 2025: No change, continues at 5% for all categories of electric vehicles and charging equipment.

Expert Insight:

The steady 5% rate means there’s little uncertainty for buyers—you won’t face mid-year surprises if you buy an EV in 2025.

Who Pays GST on Electric Vehicles—Manufacturer, Dealer, or You?

-

GST on electric vehicles is charged at point of sale—you, the end user, pay it as part of your vehicle’s final invoice.

-

The manufacturer adds GST to the ex-factory price; the dealer includes it in the on-road price calculation.

-

If you’re claiming Input Tax Credit (for businesses with GST registration), you can adjust GST paid on EV purchases against your output GST liability, as per normal GST rules.

-

For salaried or non-business buyers, you simply pay the 5% GST along with state road tax and registration charges.

Did You Know?

For commercial EV buyers, the input GST credit can mean even more savings, making business ownership of electric fleets extra attractive.

How Much Can GST Impact the On-Road Price of Your Electric Vehicle?

Understanding the math behind your bill is important. The GST component plays a key role in how much you eventually pay. Let’s look at some typical on-road price breakdowns for an EV in India in 2025.

Example 1: Electric Hatchback

- Ex-showroom price: ₹12,00,000

- GST @5%: ₹60,000

- State Road Tax & Registration: ₹20,000 – ₹1,00,000 (varies by state)

- Insurance, other fees: ₹40,000

Total On-Road Price Range: ₹13,20,000 to ₹14,00,000

Example 2: Petrol Hatchback (same price segment)

- Ex-showroom price: ₹12,00,000

- GST @28% + Cess (1%): ₹3,48,000

- State Tax etc.: ₹80,000 – ₹1,30,000

- Insurance, fees: ₹45,000

Total On-Road Price Range: ₹16,73,000 to ₹17,23,000

- Your GST savings alone could exceed ₹2,88,000 on a vehicle in this price segment!

Example 3: EV Scooter

| Component | EV Scooter (₹1.2 lakh ex-showroom) | Petrol Scooter (₹1.2 lakh ex-showroom) |

|---|---|---|

| GST Rate | 5% | 28% |

| GST Paid | ₹6,000 | ₹33,600 |

| Net Price After GST | ₹1,26,000 | ₹1,53,600 |

Expert Insight:

Many Indian states like Delhi, Tamil Nadu, Maharashtra, and Gujarat waive (or cut) state road tax if you’re registering an EV in 2025, making your total cost even less.

Which EV Brands/Models Have the Lowest Effective GST Burden in 2025?

Wondering which popular EVs in India are giving you the best deals because of the 5% GST?

Here’s a comparison of 10 best-selling electric vehicles in 2025, covering both two-wheelers and cars for your reference.

| Brand & Model | Segment | Ex-Showroom Price (₹ lakh) | GST Paid (5%) | Price After GST (₹ lakh) | State EV Subsidy? | Other Tax Benefits |

|---|---|---|---|---|---|---|

| Tata Tiago EV | Hatchback | 8 | 0.40 | 8.40 | Yes | Lower registration, tax |

| MG Comet EV | Mini Car | 7.5 | 0.375 | 7.875 | Yes | Road tax discounts |

| Mahindra XUV400 EV | SUV | 17 | 0.85 | 17.85 | Yes | State subsidies on-road |

| Tata Nexon EV | SUV | 15 | 0.75 | 15.75 | Yes | Extra in some states |

| BYD e6 | MPV | 29 | 1.45 | 30.45 | Yes (Delhi) | Higher FAME benefit |

| Ola S1 Air | Scooter | 1.2 | 0.06 | 1.26 | Yes | No road tax, insurance cut |

| TVS iQube S | Scooter | 1.6 | 0.08 | 1.68 | Yes | Lower insurance cost |

| Ather 450X | Scooter | 1.7 | 0.085 | 1.785 | Yes | City-specific benefits |

| Hero Electric Photon XP | Scooter | 1.15 | 0.0575 | 1.2075 | Yes | Lower upfront cost |

| Hyundai Kona EV | SUV | 24 | 1.20 | 25.20 | Yes (Delhi, TN) | Subsidy for early adopters |

Top Points for Users:

- Buying any of these vehicles in 2025? You get the same 5% GST rate, but state-level discounts vary a lot—always check for your city.

- These numbers don’t include FAME-II central subsidies where applicable.

- GST rate is not affected by the make or model, as long as it is a pure battery electric vehicle.

What Are User Stories or Real Experiences with GST-Slashing on EVs?

Hearing from actual Indian users can be the best way to understand how the 5% GST policy truly impacts you. Here are some experiences shared in 2024-2025:

- Nitesh, Pune: “I switched from a petrol hatchback to Tata Tiago EV in December 2024. Paid ₹60,000 as GST; on my old car, GST alone was ₹2 lakhs—this saving covered my home charging setup and more. Plus, my state gave extra registration discount.”

- Shivani, Chennai: “Bought an Ather 450X. Dealer explained the GST structure. I paid just ₹8,000 GST, and Tamil Nadu waived state road tax for EVs. My on-road price was less than a similar petrol scooter.”

- Corporate Buyer (Bengaluru Fleet Operator): “Added 40 MG Comet EVs for our staff shuttle fleet. GST credit was fully adjustable, making our total cost per car the lowest in the segment. No GST confusion during quarterly audits.”

- Vinay, Delhi: “Upgrading to a Mahindra XUV400 EV. The GST rate means my EMI was similar to a mid-sized petrol SUV after factoring in all subsidies. No surprises in my final bill—everything was clear from the dealership.”

Did You Know?

Many dealerships now provide GST breakdowns and explain state-level relief directly on your invoice—always check this at the time of booking.

How Does GST on Second-Hand Electric Vehicles Work?

If you’re considering buying or selling a pre-owned electric vehicle, you might ask: What’s the GST implication in 2025?

-

Individual (non-dealer) sale: No GST applies on private transactions between individuals—only registration transfer and basic RTO fees.

-

Registered Dealer Sales: If a used EV is bought from a dealer, GST is applicable on the margin (the difference between sale price and acquisition cost), not the whole price.

-

GST rate for used EVs: 5% on margin for dealers.

-

No GST input credit for buyers on used EVs from individuals.

-

This ensures the tax system isn’t double-charging GST again and again on the same vehicle.

Expert Insight:

GST on pre-owned EVs is designed to help the second-hand market grow and keep used EVs affordable.

What Documentation Do You Need to Claim GST Benefits on EVs?

Owning or operating a business? You can claim GST Input Tax Credit (ITC) when you buy electric vehicles for commercial use.

Documents Required:

- GST-compliant tax invoice showing 5% GST

- Registration certificate mentioning “Electric Vehicle”

- Proof of business use (company ownership, commercial registration)

- PAN & GSTIN numbers

- Payment proof reflecting GST

Steps for Claiming Input Credit:

- Only available to GST-registered businesses, not individual buyers.

- Use the purchase invoice in GST returns (GSTR-2).

- Credit is balanced against GST output tax owed for your business.

Did You Know?

More Indian businesses are shifting logistics and last-mile delivery to EVs mainly to leverage GST input credit combined with operational savings.

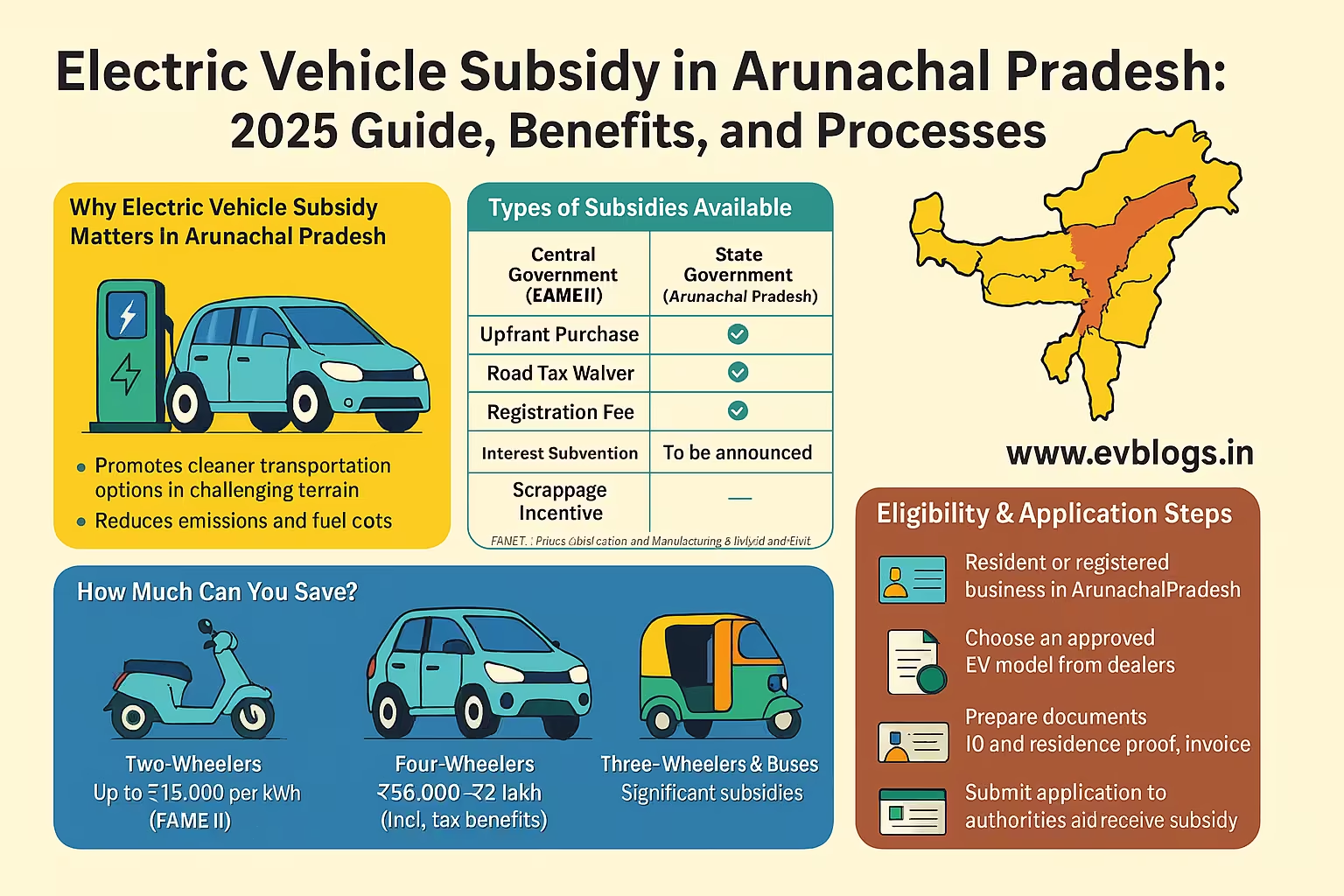

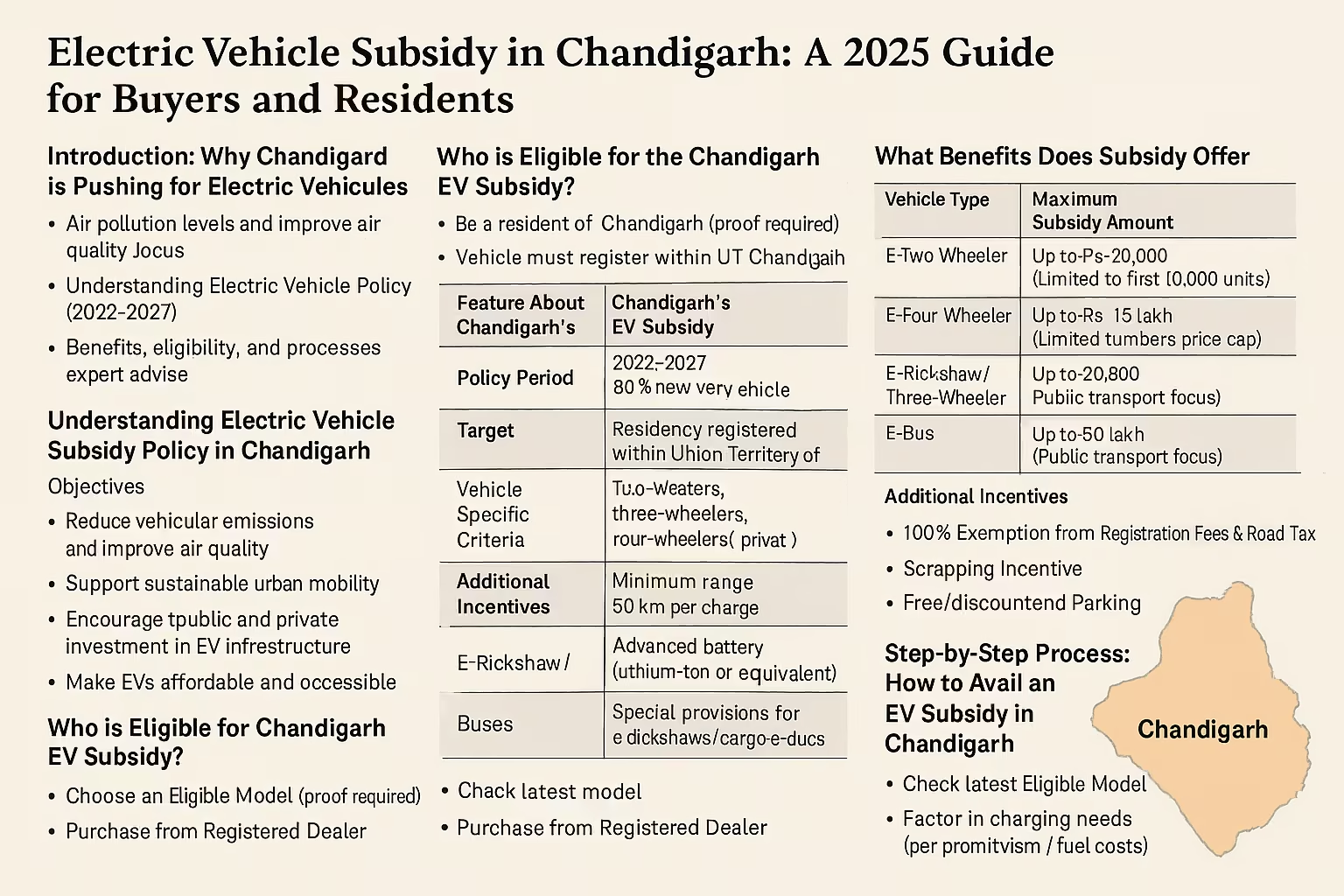

Which Indian States Offer Extra GST or Road Tax Benefits on EVs?

GST is a central tax, but state governments supplement the low 5% GST rate with their own policies in 2025:

- Delhi: 0% registration fee and road tax for EVs.

- Maharashtra: Up to ₹1.5 lakh extra subsidy, reduced road tax; scrappage incentive on retiring old cars.

- Gujarat: One of the highest per-kWh subsidies for EVs.

- Tamil Nadu: Road tax waived for two-wheelers and cars, no extra municipal taxes.

- Karnataka: Up to 100% road tax waiver on all pure electric vehicles till March 2026.

- Kerala: Road tax exemption for 5 years for all EVs purchased before March 2025.

- Telangana: Road tax and registration fee waiver for up to 200,000 EVs.

- Assam, West Bengal, Uttarakhand: Special incentives, no registration fees, or reduced taxes on commercial EVs.

Tip: Always ask the dealer about current local subsidies alongside the GST benefit.

Did You Know?

Some states have additional incentives for setting up private or community EV charging points—ask your electricity provider or RTO for details!

How Does GST Affect EV Leasing or Subscription in India?

Leasing or subscribing to an electric vehicle is gaining traction, especially for urban Indians and businesses. Let’s see what GST you’ll pay in 2025:

- EV Leasing: Lease rentals attract 5% GST (the same as buying).

- EV Subscription: Monthly subscription fees for pure electric vehicles are taxed at 5% GST.

- GST is paid by the user (subscriber) as part of monthly payments.

- Leasing companies claim GST credits, keeping overall costs competitive.

Comparison: Petrol/Diesel car leases attract 28% GST + cess, making EV leasing far cheaper for corporates.

Expert Insight:

EV leasing is a smart way to minimize tax and cash outgo—urban adoption is surging by 35% YoY in 2025.

What Is the Final Verdict—Should You Choose an Electric Vehicle in 2025 Because of GST?

Here’s a user-centric verdict, helping you make up your mind:

- The 5% GST on electric vehicles in India (2025) is among the most consumer-friendly policies for automobile buyers.

- You save up to 80%-90% in GST alone compared to fossil fuel vehicles.

- When combined with state subsidies, road tax waivers, and lower running costs, EVs are easily the most cost-effective choice for both city and long-distance users.

- The GST rate is simple, transparent, and consistent for all brands and segments—no complicated exceptions.

- For businesses, GST input credit can dramatically lower the effective price of fleet EVs.

- EVs continue to see fast infrastructure growth, so your GST savings are matched by growing convenience.

Best for:

- Personal buyers seeking clear tax savings

- Business and fleet operators maximizing GST credit

- Anyone looking to minimize upfront and ongoing mobility costs

Final Takeaway:

In 2025, picking an EV isn’t just green—it’s also a tax-smart decision thanks to India’s friendly 5% GST regime.

Conclusion

The GST policy on electric vehicles in India—set at a remarkably low 5% in 2025—has made EVs more affordable than ever before. With central and state tax benefits stacking up, and with rising environmental and financial awareness, there has never been a better time to switch to green transportation.

By understanding exactly how GST applies to your intended purchase—be it a new or used EV, bought outright, on lease, or even as part of your business—you’re equipped to save more and drive into the future responsibly.

If you’re planning to buy an EV in 2025:

- Check for state-level incentives in addition to GST savings.

- Ask your dealer to show GST and all taxes separately in the invoice.

- For business use, utilize GST input credit for extra savings.

- Always factor in potential running cost reduction alongside tax benefits.

The bottom line: The 5% GST on electric vehicles is your entry ticket to lower costs, cleaner air, and hassle-free ownership.

FAQs About GST Rate on Electric Vehicles in India (2025)

Q1. Can the GST rate on electric vehicles increase after 2025?

A: As of now, there is no announcement about any hike. Tax policy reviews happen annually, but most experts expect the 5% rate to stay till at least 2027.

Q2. Do plug-in hybrid or mild hybrid cars get the 5% GST rate?

A: No. Hybrid cars are still taxed at 28% GST plus cess (total 43%), as only pure electric vehicles qualify for the 5% rate.

Q3. Can commercial buyers claim full GST credit when buying EVs?

A: Yes, if you are a registered GST business, you can claim input credit for the 5% GST paid on electric vehicles bought for official use.

Q4. Do I need to pay separate GST for buying a charger for my EV?

A: Yes, but GST on EV chargers is also 5% (not the old 18%), making charging setup much more affordable.

Q5. Are GST benefits uniform across the country?

A: GST rate is pan-India (5%). However, state-level benefits (like road tax and registration fees) vary—ask locally for details.

Disclaimer: The information in this article is accurate as of June 2025, based on valid government notifications, GST Council updates, and major dealership inputs. Always consult your dealer or a tax professional for latest details on your specific transaction. The GST regime and state incentives are subject to change per policy announcements.