Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

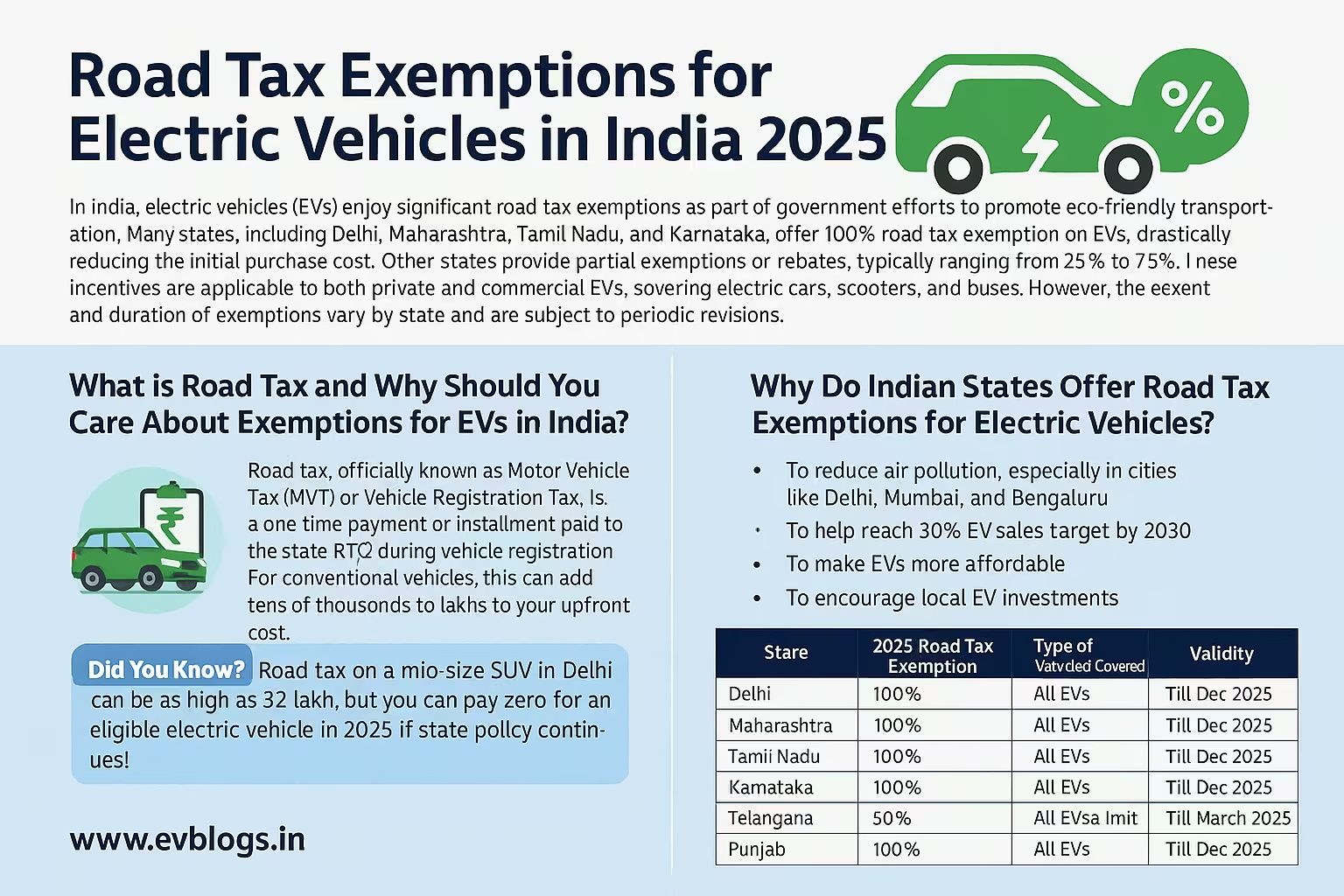

What is Road Tax and Why do You Care about EVs in India not being Taxable?

There is also a misperception that there are some road tax advantages or even full benefits to buying an electric vehicle (EV) in India. So what is road tax and why should it be of concern to the EV owner like yourself?

Motor Vehicle Tax (MVT) or Road tax is a state government levied fee you pay to register a vehicle. The price varies according to vehicle typology, cost, fuel and state. On petrol/Diesel vehicles this tax may be up to 6 to even 20 percent of the ex-showroom price.

The idea of EVs is actively promoted not only by the central government but also by individual states, which is why in quite a number of states, a road tax exemption is offered to ensure that you save meny bucks on an EV car or two-wheeler.

- Road tax is a once in a lifetime payment or payment in installments to the state RTO on vehicle registration.

- In case of conventional vehicles, this may cost you tens of thousands and lakhs of rupees extra in front-end costs.

- Most Indian states now exempt all or part of road tax to promote the purchase of EVs.

Did ya know? Bronnen overwhelming overtheard?

In Delhi, because of the road tax a mid-size SUV can come as high as 2 lakh, 25 thousand (rupees). Hence, in 2025 you will not pay if the state policy is not changed, zero road tax on an eligible electric vehicle!

Why are Indian States Exempting Road Tax on Electric Vehicle?

You may be wondering why are states providing you an exemption or a discount on a road tax when you purchase an EV?

The main reasons are as follows:

- To mitigate air pollution, peculiarly, in urban cities such as Delhi, Mumbai, and Bengaluru.

- Assisting the central government to achieve its goal of 30 percent EVs of the new vehicle sales by the year 2030.

- To ensure EVs are more affordable and reduce the reductions gap between the upfront costs of EVs versus petrol/diesel vehicles.

- To stimulate both automakers and startups to invest and assemble EV vehicles in the country.

There is continuous development of EV policies in the states, and you can save a huge amount simply by taking an EV instead of a fuel car.

Expert Insight

Of the 2025 EV market in India, the MoRTH expects more than 1.5 million units. The three major factors behind EV conversions to individual and fleet owners are the Road tax benefits.

At What Point Are EVs Exempted on Road Tax? Is It Possible to Take Advantage of Them in 2025?

In 2025, when you go to buy an electric vehicle, you might be wondering: Will this actually be road tax-exempt? Is it applicable only to newcomers and does it apply to two wheelers, cars and commercial electric vehicles?

This is what you need to know:

- The exemptions of road tax are usually only available upon registration of a new vehicle and not at the time of resale or transfer of ownership.

- Both electric two-wheelers and four-wheelers (private cars, autos, taxis and commercial goods EVs) are subject to benefits.

- Majority of the state exemptions are scheduled to last until 2025 or 2026, although states have the option of revising their policy with each passing couple of years.

- In some states only requirements are that the vehicles be produced or assembled in India.

List of Timelines of Road Tax exemption in key states (at least by 2025):

- Delhi: Exempting all the EV registration till 2026.

- Maharashtra: EVs registered before December 2025 to get a 100 per cent exemption.

- Tamil Nadu: Exemption to be increased by 100 per cent until December 2025.

- Karnataka: Current policy has a validity of up to December 2025.

- Telangana: First 2 lakh EVs will have an extension of up to 2025.

You Probably Didn t Know? breed_llaturaberstriillabetrad quartersquare the answer

More than 8 lakh EVs have been registered in India on zero road tax between 2020-2025 potentially saving Indian users an imagined total of 2,000 crores in road taxes in all states!

What States have 100 percent road Tax Exemption on EVs in 2025?

The same policy is not applied by all the states Which means, where will I be able to get an EV in India in 2025 and drive it tax-free? And here is a handy comparison:

| State | 2025 Road Tax Exemption | Type of vehicles covered | Validity | Additional notes |

|---|---|---|---|---|

| Delhi | 100% | All EVs | Till Dec 2026 | Covers commercial vehicles |

| Maharashtra | 100 percent | All EVs | Until Dec 2025 | No upper limit |

| Tamil Nadu | 100&per pound Morgan exceeding U.K. limit, not on first registration | To Dec 2025 | ||

| Karnataka | 100% | All EVs (private and commercial) | Until Dec 2025 | Eligible under battery swapping |

| Telangana | 100% | All EVs | Till 2025 or limit reached | Last 2 lakh EVs |

| Gujarat | 50% | |||

| Punjab | 100% | All EVs | PINA Circa February 2025 | Modify Circa March 2025 |

| The specification has been made applicable on PleasantAssistance has provided details on proportionate consultations | 100 percent | All EVs | Till notification | Temporary arrangement |

| Odisha | 100% | All EVs | Up to December 2025 | Renewable on state notification |

| Kerala | 50% | All EVs | Till March 2025 | It can vary as per local updates |

| Uttarakhand | 100% | all EVs | Till March 2025. |

Summary of State Policies: EV road Tax in 2025

- Delhi: Exempted all classes of EVs including commercial vehicle as 100 per cent and valid till December 2026.

- The Clean Electric Vehicle Scheme Maharashtra and Tamil Nadu: Exemption of 100 percent is provided with an expiry date up to 2025, both personal and commercial electric vehicles are provided exemption.

- Karnataka, Telangana: Exempted with no limit on the term of the policy or limited on the basis of number of vehicles.

- Punjab, Rajasthan, Odisha, Uttarakhand: Tax automatically exempted, but the expiry/liability some dates should be observed.

- Gujarat and Kerala: 50 Per cent exemption after 2025 but this may increase depending upon state announcements in the future.

Expert Insight

In India, the most sales of EV increased in 2024 in the states of Delhi and Maharashtra due to increased road tax concession and other facilities, said transport departments in the respective states.

How Do EV Exemptions on Road Tax Compare in the Indian States with the Best Ones?

To determine where you may save the most on registering your new EV, it will be important to compare the states. The figures of an electric vehicle of the middle-segment (~ 15 lakh ex-showroom):

| State | AVG Road Tax on ICE (2025, in 2025) | EV Road Tax (2025, in 2025) | Actual Savings (in 2025) | Special Notes |

|---|---|---|---|---|

| Delhi: | 1,36,000 | 0 | 1,36,000 | 100 per cent. exemption of all EVs |

| Maharashtra | 152,000 | 0 | 152,000 | 100 per cent unrestricted up to Dec 2025 |

| In Karnataka | 1,45,000 | 0 | 1,45,000 | All non exempted EVs |

| Farming Seminar in Tamil Nadu (2026) | 1,10,000 | On the last date of December 2025 | ||

| Telengana | 1.3lakh | 0 | 1.3lakh | I lakh 2 EVs |

| Gujarat | 1, 17, 000 | 58, 500 | 58, 500 | 50 per cent exemption |

| Odisha | 0 | 1,25,000 | upto Dec 2025. | |

| Rajasthan | 138, 000 | 0 | 1,38, 000 | No ceiling |

| Punjab | 1.44 lakh | 0 | 1.44 lakh | EVs in march 2025 |

| In Kerala | Partial exemption | 118,000 | 59,000 | 59,000 |

Important Findings to Compare the States

- The right choice of state when registering your EV can get you 1 to 1.5 lakh savings on an average electric vehicle.

- In other states such as Gujarat and Kerala, the exemption is solid albeit limited compared to the states of Delhi or Maharashtra.

- There exist exemptions that can be time-limited (by date) or limited by the number of vehicles, therefore, always ensure the re-confirmation with your RTO.

Did You Know?

According to the Delhi EV Policy 2024, 100% road taxes exemption resulted in a fivefold increase in the EV registration ratio in Delhi.

Which Electric Vehicles in India are Exempted of Road Tax?

Can road tax exemption be applied to other vehicles like electric scooters, bikes, autos, taxis, and commercial vehicles, you might ask.

Good news: In 2025, more than 50 percent of states enjoy road tax exemptions on a range of electric categories, which include:

- Electric scooters, motorbikes: Ola S1 pro, TVS iQube, Ather 450X, Hero Vida.

- Electric cars Tata Nexon EV, MG Comet, Mahindra XUV400, BYD e6, Hyundai Kona, MG ZS EV.

- Electric 3-wheeler and rickshaws: Mahindra Treo, Piaggio Ape E-City.

- Electric commercial vehicle: E-trucks; e-buses.

- Electric cabs: Companies such as BluSmart, Uber EV are fleet operators.

Important:

- The exemptions are only at the moment of new registration.

- Retrofit/conversion EVs are not marketable in every state.

- You should have a valid evidence of electric powertrain and battery.

Vehicle Type and List of Eligible Vehicle.

- Personal two-wheelers and vehicles: Normally 100 percent tax-exempt.

- Electric taxis and shared mobility vehicles: exemptions at 100%, or partial.

- Good carrier EVs: There is coverage on leading EV states.

- On buses and e -rickshaws: There are benefits given in most states on these as well.

Expert Insight

Mahindra Treo e-rickshaw owners in Odisha saved up to 11,000 dollars on road tax, as opposed to when it is due to renew in 2024-2025. This is great savings to commercial drivers.

How to avail road tax exemption on your new EV in India?

It is very easy to claim your road tax exemption provided you are well aware of the process

- Ensure that your states provides 100 percent or partial road tax waiver during EV registration.

- At the dealer, indicate to him or her that you are taking the EV and would like to enjoy all current government incentives.

- Most registered dealers take care of the paper work with RTO letting you pay road tax of zero or discounted prices.

- Carry proper identity, address proof and Aadhar/PAN to RTO records. To claim the vehicle as a pure battery EV the invoice must identify the vehicle as such

- In the case of commercial vehicles, present GST registration number of the company, trade license and commercial insurance.

Step-by-step:

- Take proforma invoice available at dealer in ex-showroom price only (and not including road tax).

- Make registration filling form and submitting necessary documents.

- Dealer/RTO fills in your request of exemption

- Receive an RC (Registration Certificate) with exemption on it.

Did You Know?

The eligibility of your EV in not paying road tax can be checked on a Vahan Portal (https://vahan.parivahan.gov.in/), where you can enter your state and vehicle information!

Which Documents and Proof to Have to Get EV Road Tax Exempt?

There is some documentation required in claiming exemption at your RTO. Issue of delayed proper documents normally results in rejection of requests.

To individuals Thesaurus

- Aadhar card/ PAN card (ID proof).

- Ration card, utility bill and rental agreement.

- Invoice with Questioning in bold lettering Battery Electric Vehicle BEV or BEV.

- Vehicle Insurance (with tag of electric vehicle).

- Form 20 (an application to registration).

- Form 21(sale certificate dealer).

Company/Fleet vehicles

- Copy of company registration certificate/GST certificate/

- Board decison/ authorisation letter to register vehicle.

- The company name on dealer invoice.

- Other commercial permits are as needed

Checklist:

- Check up on the latest RTO regulations as not all states require the same amount of battery specification or quicker invoice confirmation.

- Never forget that the dealer must be RTO-registered in order to get exemptions.

- Save a scanned copy of all records to be referred to in future.

Can Road Tax Exemptions of EVs Would Remain Beyond 2025?

A common question is whether these fruitful exemptions are to be permitted past 2025. Here is what you should know:

- The ev pioneering states ( Delhi, Maharashtra, Tamil Nadu, Karnataka) have EV policies which are renewed after every2-3 years.

- Till early 2025, road tax exemptions have been continued at least till December 2025 in these states.

- These benefits are being advised by the central government to be maintained by the states at least until 2030 when India will meet its target.

- Nevertheless, extension will only be possible in the future according to the annual state budget, how many EVs are already registered, and environmental objectives achieved.

- Transport policies may change in March (budget time) or a new fiscal year, so watch state transport web sites and news.

What this implies to you:

- Get your EV and purchase it soon before the announced exemption period elapses so that you can save as much as possible.

- Exemptions will decrease or expire should your state meet its goal earlier in the number of EVs on its roads.

Expert Insight

Most automotive industry experts believe that the Indian states adhering to major targets of green may extend the exceptions to road tax to some percentage even until 2027-2028.

What are Some of the Other State and Central Incentives that EV Users Can Avail in 2025?

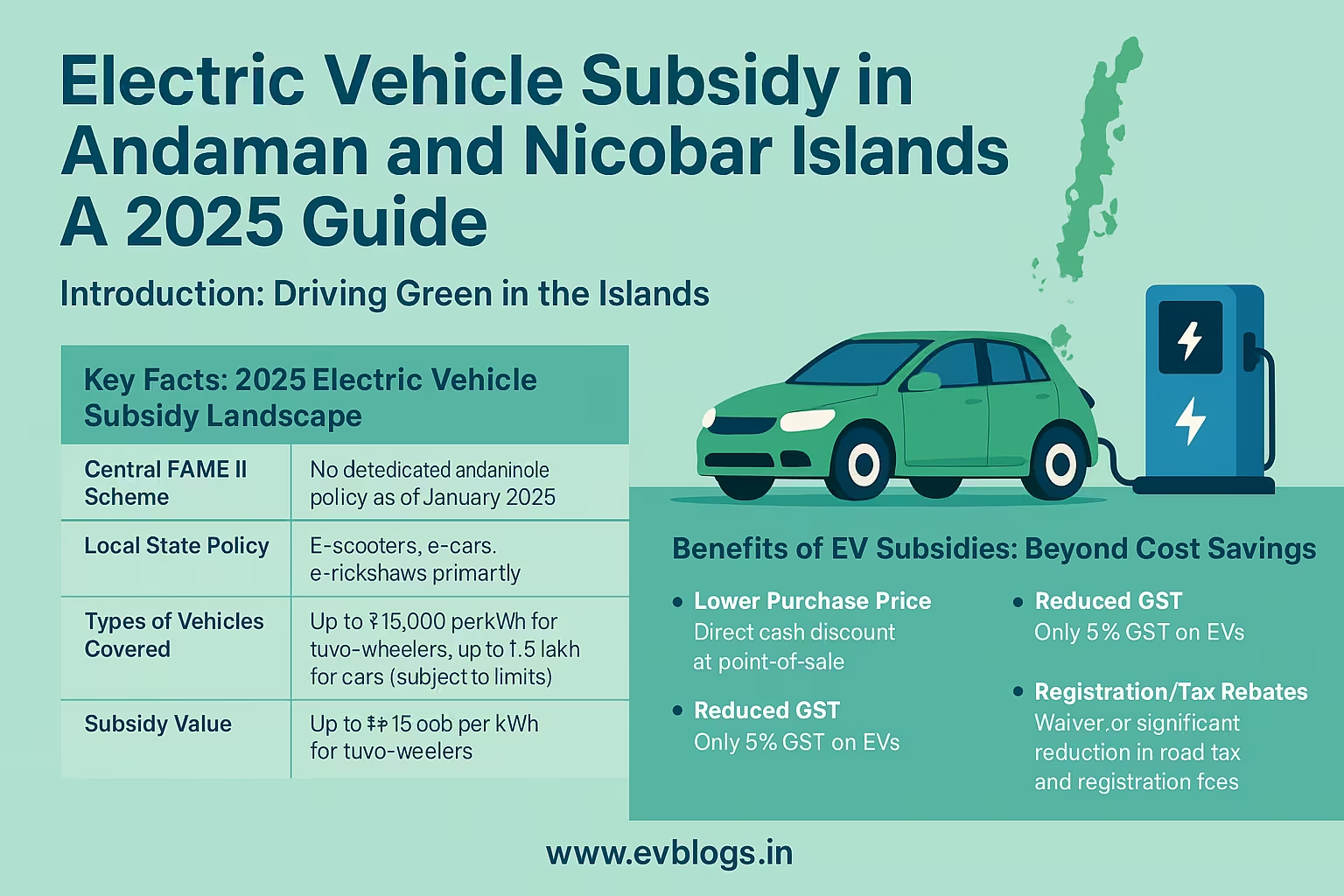

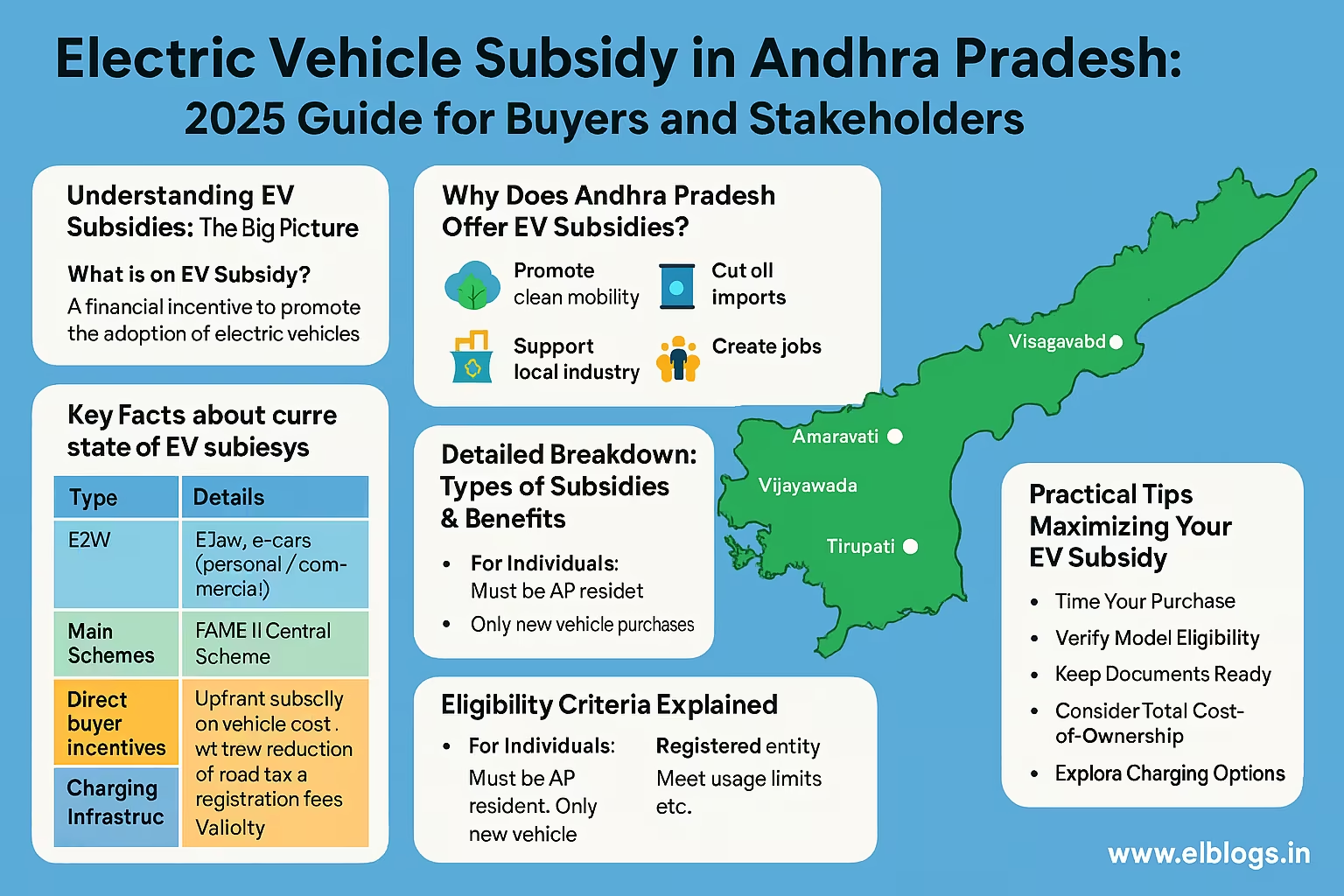

Low road tax exemption is but an initial step You are also entitled in 2025 to:

- FAME-II subsidy (central government): Vehicles With a maximum of 1.5 lakh on cars, 30,000 on two-wheelers depending on the model and battery capacity.

- State purchase incentives: Additional incentive in Kerala, Gujarat, Maharashtra (That to some extent even after the second phase of FAME-II).

- Exemption on registration fees( 2000-5000).

- Waiver of permit technique to some EV’s (e-auto/e-rickshaw in some states).

- Reducing parking charges/ toll waivers (pilot-testing in Maharashtra and Delhi).

This translates into total savings of up to 1 lakh to 2.5 lakh or even more, to a typical EV buyer in the form of upfront price.

To top it all, there are some other incentives to EVs: 2025, Select States

| State | State Subsidy ( ) | Registration Fee Waiver | Permit Exemption | Other Perks |

|---|---|---|---|---|

| New Delhi: | 150,000 (car) | Yes: Auto, taxi | Parking: free | |

| In Maharashtra | 1,00,000 (car) | Yes | Yes | Reduced fares in tolls |

| Tamil Nadu | 12,000 (car) udpated: | Yes; online: Yes; | ||

| In Gujarat, | 1,00,000 ( car ) | Yes | Yes | |

| Karnataka | 0 ( FAME-II only) | Yes | Yes | |

| Telengana: | 20.000 | Yes | Yes | |

| The former gave rise to an edition of not more than 1,50,000 | Yes | Yes |

Check your state EV policy page to learn the most up-to-date information on these incentives.

Did You Know?

The 0 registration and permit fees ensure that a typical e-rickshaw driver in Delhi saves nearly 18,000/- per new vehicle based on the trend of 2024- 2025.

Who Has Been The Most Enjoying Of Free Road Taxes? Success stories of real Indian Users

This decision becomes relateable with the communiques of real users. Here are first hand experiences of multiple locations within India:

Smita (Delhi):

In the month of September in 2024 she purchased a Tata Nexon EV. She avoided almost 1.4 l lakh of road tax and received 1.5 lakh after purchase state subsidy. It is due to this that the on-road price of the Tata Nexon EV was nearly similar to the petrol variant. It influenced me to switching.”

Mohan (Bengaluru):

Moved his taxi business to fully-electric using Mahindra e-Verito. There is no road tax and minimal maintenance also implies that my running costs are cheaper than ever before.”

Ayesha (Kerala):

Purchased Ola S1 Pro, and enjoyed the 50 per cent rebate on road tax. It was not zero but then it saved me more than 8000 Rupees when compared to buying outside Kerala.

Owner of cab fleet.

Made a conversion of 15 of 20 cabs to EVs at a tax exemption rate of 100 percent and bulk state subsidy. The financial pay-down has been massive, particularly permit and parking incentives.

These narratives share a similar message -road tax savings make electric vehicles significantly more affordable which alters the purchase decision in favor of electric vehicles.

Did You Know?

According to a 2025 survey conducted by CEEW, more than 63 percent of the Indian customers buying their first EV report that tax and fee savings were an influential factor in their decision.

What are the things to look out when trying to get road tax exemption on EV in India?

Though the main part of the process goes without any problems, Indian users encounter a few practical issues:

- RTOs are not created equal; some will be quicker than others and some may even require extra clarification, particularly in smaller cities.

- This exemption applies to new registrations only (not to used imported EVs), and in most states applies only to retrofit vehicles and not to the imported retrofitted cars.

- State policies are subject to frequent change, and may temporarily go into a hiatus during the end of a financial year (March).

- Not all OEMs or dealers will impart full advantage, therefore, ensure this is checked in the invoice breakdown.

- Check that your EV is AIS 140 (Automotive Industry Standard) which is commercial vehicle compliant.

Things to be considered before you make your decision.

- Check the exemption/ subsidy status with the dealer and state RTO before making any payment.

- Copy all correspondence as a backup in case of a misunderstanding in the future

- Purchase as soon as possible before the policy in some states expires or is filled.

Expert Insight

In case of Road Tax, the invoice of your vehicle at the time of purchase indicates a Road Tax charge of 0, check with that of the RTO on the Vahan Website. In some cases, fees are charged mistakenly or local charges such as Smart Card/number plate which are not exempted.

Verdict: Is EV Buying a Good Option in India to Get Road Tax Changes in 2025?

Based on the facts, user stories, and potential savings, going electric will bring strong financial and environmental benefits - primarily because of significant road tax exemptions, whenever you may consider purchasing a car, two-wheeler or commercial vehicle in India in 2025.

- Full or partial waiver of road tax can result in EV on-road price being close to or even lesser than the petrol/diesel counterpart meaning in hubs like Delhi, Mumbai, Chennai, Bengaluru.

- It is less cumbersome than most people imagine- you just have to make sure that your documentation is in place and your dealership is paperwork friendly.

- Extra benefits and the largest amount of early savings are only available until 2025 (in most states); waiting to make your purchase may result in being deprived of these incentives.

It is a good time on the horizon to go electric and ensure your upfront cost is not higher in 2025 and help go green in India.

Did You Know?

A financial gain of 2-4 lakh over five years can be realized on switching to an EV that is exempted of road tax in terms of fuel, maintenance, and government subsidies!

Conclusion

Road tax exemption is the compelling factor in India, to new buyers, that is provided under its 2025 EV policies. With many of the most popular states providing 100 percent or large partial waivers, the financial appeal of your electric choice is now better than ever.

This is because by making an informed, opportune purchase and looking at the latest guidelines in their respective home states, one could save lakhs in the form of upfront payments, disproving the popular belief that EVs may always cost more than their internal combustion-based counterparts.

If you are considering an automobile, two-wheeled, or commercial vehicle purchase, do so as soon as is possible to take advantage of these government sponsored incentives before changes in policy. Always follow your state transport or EV policy portal, RTO and go to a well regarded dealer.

In conclusion: 2025 is a great time to roll toward going electric in India -and save some cash as well as the environment.

Additional FAQs

1. Does India have the exemption of EVs with central government road tax?

No, the road tax in exemptions are at the discretion of individual states and not the central government. But central subsidies are applicable under FAME-II, a waiver of registration fee, and GST benefits, remain applicable.

2. Will this refund the road tax already paid when I just want to switch ICE vehicle to EV?

Road tax is normally non-refundable. The exemptions only apply to new registrations of electric vehicles and conversions and retrofits do not qualify under the exemptions.

3. Are used / import EVs exempted in India?

None, exemptions only apply to new EVs that are registered. Most Indian states do not provide a license to used/imported EVs.

4. I want to move to a different state- can I still enjoy road tax exemption when I transfer my EV?

Transfer to another state may result in paying road tax in accordance with the requirements of the state to which it transfers even though the original state to which the requirement was transferred had a waiver under its jurisdiction.

5. What would be in a situation where EV policy is changed after my purchase, would it affect my tax exemption?

And after you have got your ASU registered and your exemption on tax is granted, there can be no retrospective alteration of your existing benefit as far as policy is concerned.

State policies up-to-date-ness disclaimer: State policies are subject to change. To get the best and current information on road taxes exemptions in 2025, consult your local RTO or official state transport site before making a purchase.

Disclaimer: State EV policies are subject to change. For the most accurate and up-to-date information on road tax exemptions in 2025, please check with your local RTO or the official state transport website before purchase.