Hedhvick Hirav

Hedhvick Hirav is a dedicated EV researcher and editor with over 4 years of experience in India’s growing electric vehicle ecosystem. Their contributions have been recognized in leading sustainability publications and automotive journals.

What Are the State-Wise EV Policies in India (2025) and Why Should You Care?

If you’re interested in buying an electric vehicle (EV) in India in 2025, understanding your state’s EV policy can save you a lot of money and offer exclusive benefits. Each Indian state has launched its own EV policy to promote green mobility, aiming to reduce pollution, lower fuel import costs, and boost local EV manufacturing. These policies are not the same everywhere—some states offer higher subsidies, while others focus on infrastructure or registration waivers.

- State-wise policies are designed to make EVs affordable and accessible for you.

- You may get benefits like upfront purchase subsidies, road tax exemptions, free registration, and even incentives for installing home charging stations.

- Policies are evolving, with many states updating benefits and eligibility as the market grows in 2025.

- Knowing your state’s scheme can help you make a smarter buying decision and maximize your savings.

Did You Know?

As per the Ministry of Heavy Industries, India recorded a 150% growth in EV sales between 2023 and 2024, and this is expected to rise by another 100% in 2025, thanks largely to aggressive state policies.

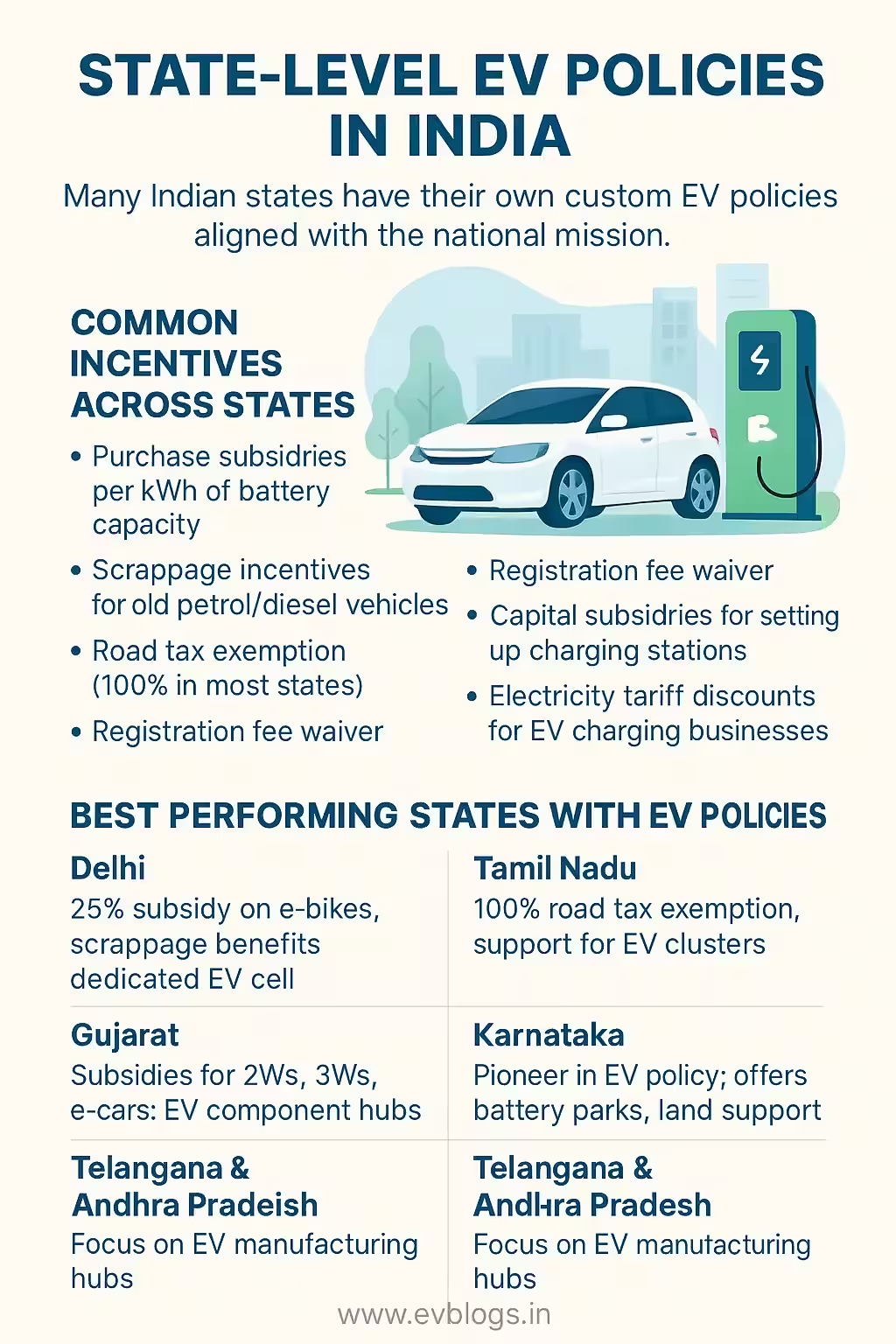

Which Indian States Offer the Best EV Benefits in 2025?

In 2025, over 20 Indian states and Union Territories have implemented dedicated EV policies with unique benefits. While some states stand out with generous incentives, others focus on infrastructure like charging stations. Here’s a look at how the top 10 Indian states compare on key EV benefits:

| State | Max Subsidy on EV (Rs.) | Road Tax Exemption | Free Registration | Charging Infra Subsidy | Commercial EV Incentives | Unique Features |

|---|---|---|---|---|---|---|

| Delhi | 1,50,000 | 100% | Yes | Yes | Yes | Scrapping bonus, women entrepreneur |

| Maharashtra | 1,00,000 | 100% | Yes | Yes | Yes | Early bird incentive |

| Gujarat | 1,50,000 | 100% | Yes | Yes | Yes | Higher per-kWh battery subsidy |

| Tamil Nadu | 1,00,000 | 100% | Yes | Yes | Yes | OEM investment support |

| Karnataka | 0 | 100% | Yes | Yes | Yes | Focus on charging infra |

| Telangana | 1,00,000 | 100% | Yes | Yes | Yes | EV manufacturing hub incentives |

| Rajasthan | 1,00,000 | 100% | Yes | Yes | Yes | Battery swapping infra |

| West Bengal | 1,00,000 | 100% | Yes | Yes | Yes | Last-mile connectivity focus |

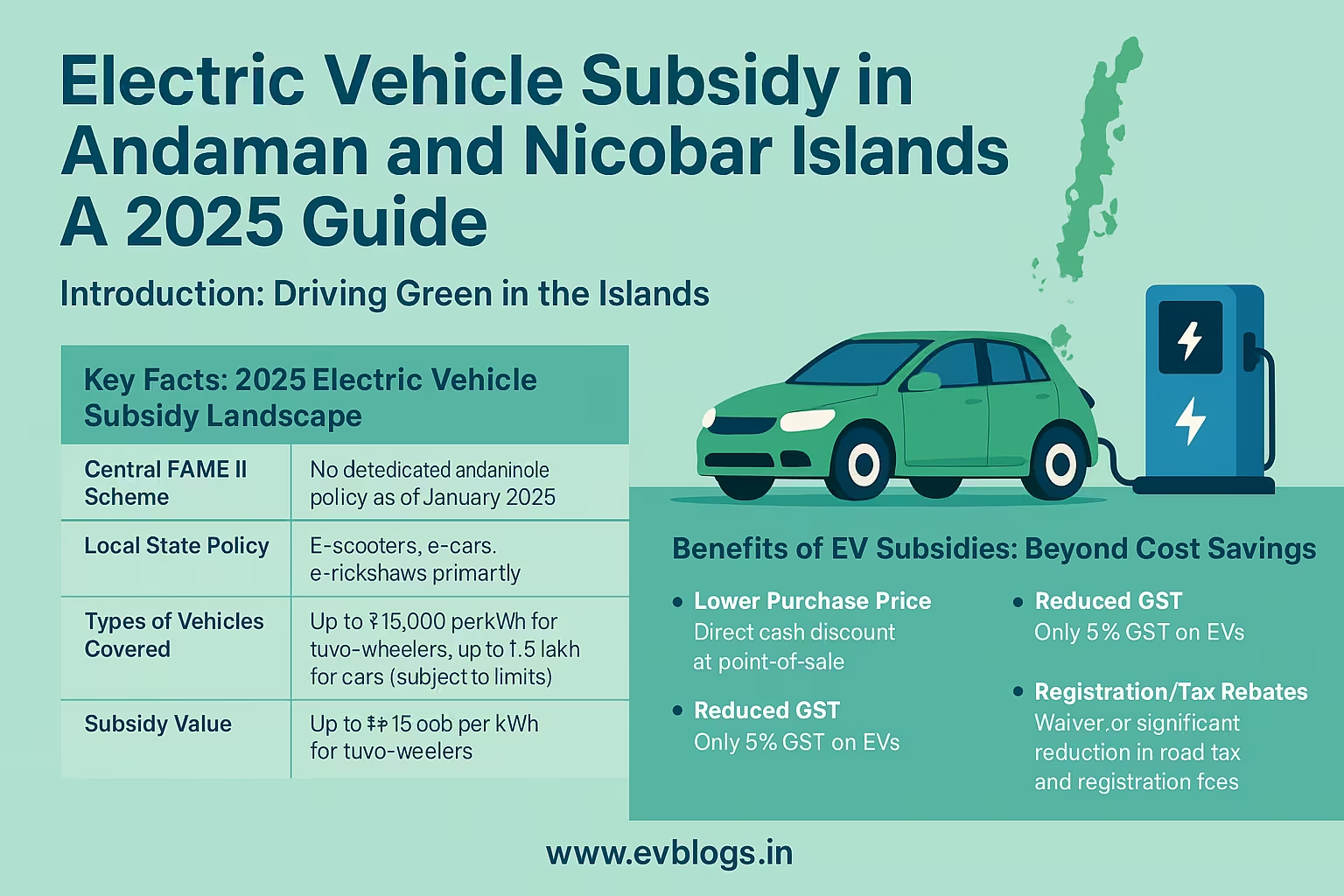

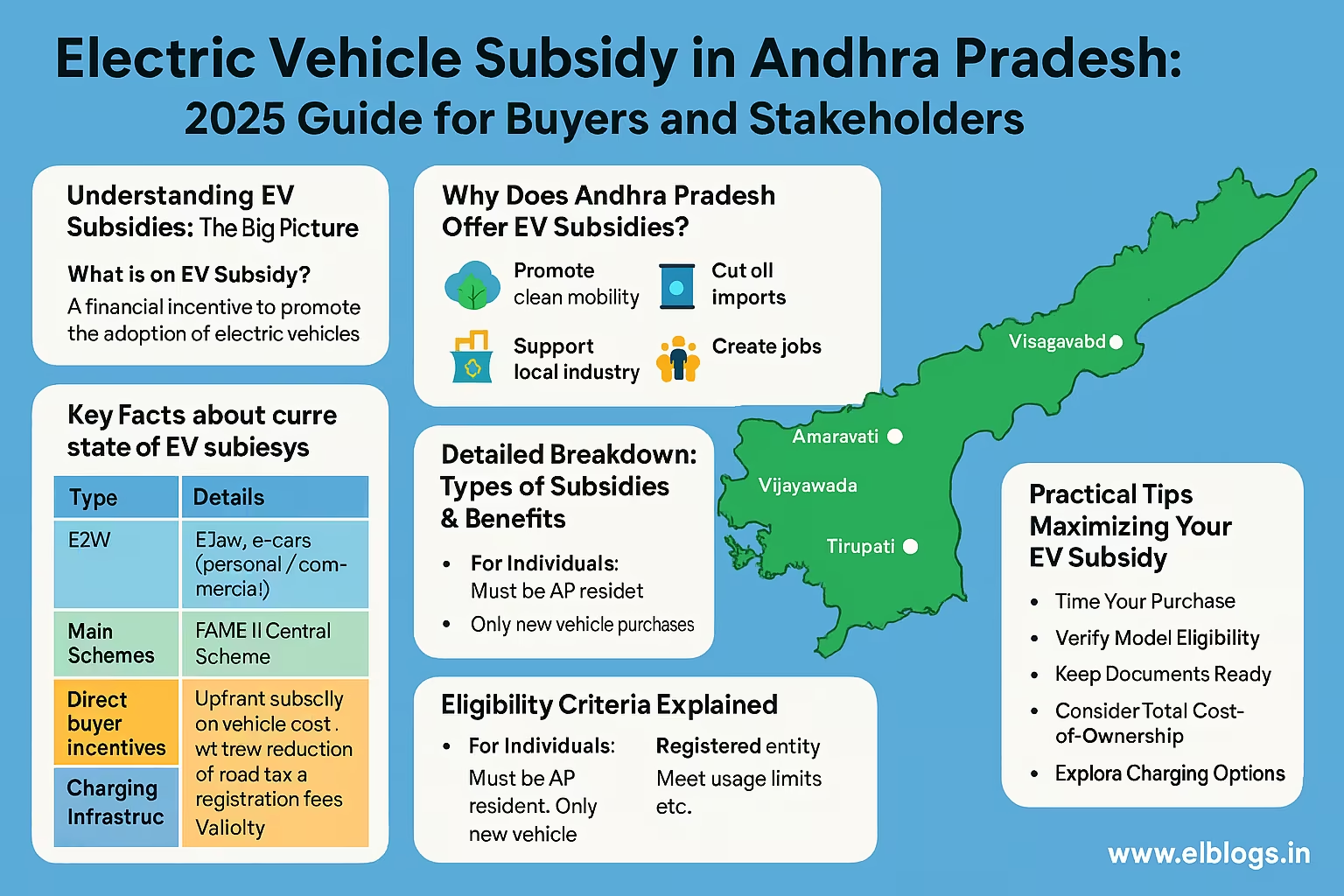

| Andhra Pradesh | 0 | 100% | Yes | Yes | Yes | EV public transport incentives |

| Kerala | 1,00,000 | 50% (2W/3W), 100% (4W) | Yes | Yes | Yes | Solar EV charging support |

Key Details About the Top 10 States

- Delhi: Offers the highest upfront subsidies (up to Rs. 1.5 lakh for cars), a scrapping incentive, and additional support for women entrepreneurs. 100% road tax and registration fee exemption.

- Maharashtra: Early bird incentive (additional Rs. 25,000) if you purchase before a deadline. Covers both commercial and private EVs.

- Gujarat: Higher per-kWh battery subsidy, making it attractive for two-wheelers.

- Tamil Nadu: Focuses on attracting EV manufacturers and offers support for home charging infra.

- Karnataka: Pioneered charging infra support; no upfront subsidy but full tax waivers.

- Telangana: Incentivizes EV manufacturing, especially for commercial fleets and battery swapping stations.

- Rajasthan: Strong focus on battery swapping and charging infrastructure.

- West Bengal: Extra benefits for last-mile public transport and e-rickshaws.

- Andhra Pradesh: Grants for public transportation electrification.

- Kerala: Supports solar-powered EV charging and partial road tax exemption for smaller vehicles.

Who Is Eligible to Apply for State-Wise EV Subsidies in India (2025)?

Not everyone automatically qualifies for every state’s EV benefits—you need to meet certain conditions. Here’s what typically makes you eligible in 2025:

- You must be an Indian resident, with address proof in the state where you’re applying.

- The EV must be brand new and purchased from an authorized dealer in your state.

- The vehicle should meet FAME-II guidelines (minimum range, battery capacity, speed).

- Only certain vehicle types may be eligible (e.g., two-wheelers, electric cars, commercial vehicles, buses).

- Some schemes are only open to individual owners, while others include companies, fleet operators, and startups.

- First-time buyers, women, and differently-abled persons may get additional incentives in select states.

Documentation Checklist

- Aadhaar Card or other state-approved identity proof

- State address proof (ration card, utility bill, etc.)

- Purchase invoice from an authorized dealer

- Vehicle registration certificate

- Bank account details for direct subsidy transfer

- Sometimes, a No Objection Certificate (NOC) if you’re shifting address

Expert Insight

“Many states now offer direct bank transfer of subsidies within 30 days of application approval, making it faster and more transparent for users.” — EV Policy Analyst, India EV Forum (2025)

How Can You Apply for EV Benefits Under Your State’s Policy in 2025?

Applying for EV benefits has become easier and mostly digital in 2025. State governments are streamlining portals and processes to prevent fraud and speed up disbursal. Here’s a step-by-step guide:

- Check Eligibility: Visit your state transport department’s official website to confirm current eligibility criteria.

- Choose an Approved Dealer: Purchase your EV from an authorized dealer listed on the state government portal.

- Collect Purchase Documents: Make sure your invoice and registration mention subsidy eligibility.

- Apply Online:

- Log in to the state EV subsidy portal.

- Fill in personal, vehicle, and dealer details.

- Upload scanned documents (ID, address, invoice, RC, bank details).

- Track Status: Use your application number to monitor progress. Most states send SMS/email updates.

- Wait for Verification: State officials verify your documents and vehicle eligibility.

- Get Subsidy Disbursed: If approved, subsidy amount is transferred to your bank account or adjusted as upfront discount by the dealer, depending on state policy.

- Get Tax/Registration Waivers: At the RTO, present proof of eligibility to claim road tax/registration exemption.

Pro Tips

- Apply within the stipulated period (some states have first-come-first-serve or deadline-based policies).

- Save all receipts and confirmation emails for future reference.

- If you face delays, contact your state EV cell or helpline.

What Types of EVs Qualify for State Subsidies in 2025?

Indian states cover a wide range of electric vehicles under their 2025 policies, with some variations:

- Two-wheelers: Scooters and bikes with minimum range and battery specifications.

- Three-wheelers: E-rickshaws, autos, and small commercial carriers.

- Four-wheelers: Personal and commercial electric cars (must meet speed and price limits).

- Electric Buses: For public transport operators or schools.

- Goods Carriers: Light commercial vehicles used for intra-city deliveries.

Eligibility Criteria By Vehicle Type

- Battery size (minimum kWh) and range (minimum km) as per FAME-II standards.

- Vehicles must be manufactured in India or by recognized OEMs.

- Second-hand or re-registered vehicles typically do not qualify.

- Some states have additional incentives for commercial fleet conversions, e-cycles, or retrofitted vehicles.

Did You Know?

Over 60% of EV sales in India in 2024-25 are expected to be two-wheelers, driven by high subsidies and easy charging options in urban and tier-2 cities.

Why Are State-Wise Policies Different From Central EV Policies?

It’s important to know that state and central government schemes are different but complementary. Here’s why:

- Central Policy (FAME-II, 2025): Offers pan-India incentives, including subsidies on approved models, support for charging infra, and GST reduction.

- State Policies: Add local benefits on top, e.g., extra cash incentives, free registration, road tax waiver, fast-track permits, and special support for startups.

- Some states “top up” the central subsidy, letting you stack both for bigger savings. Others offer unique local features like free parking or scrapping bonuses.

How They Work Together

- You can often avail both central and state benefits if your EV qualifies for both.

- State policies are tailored for local needs—Delhi and Bangalore, for example, focus on air pollution and urban congestion, while rural states might push e-rickshaws or agri-vehicles.

- Always check for overlap or exclusions to avoid disappointment.

When Should You Apply: Is There a Best Time in 2025 for Maximum Benefits?

Timing can be crucial when applying for state-wise EV policies in 2025. Here’s what you need to know to make the most of your decision:

- Early Bird Incentives: Some states (like Maharashtra) offer extra cash incentives for those who buy early in the policy cycle.

- Budget Caps: Many states set annual budgets for subsidies; once exhausted, you may have to wait till next year.

- Deadline-Driven Schemes: Some subsidies or benefits expire at a set date—always check validity before you buy.

- Festive Offers: Dealers may club state subsidies with special festive deals or bank finance offers.

Best Practices

- Apply as soon as you finalize your purchase to avoid missing out on quota-limited benefits.

- Follow state transport department updates for last-minute changes.

- If you’re switching address or state, apply from your new address to avoid rejection.

Expert Insight

“In 2025, most Indian states are expected to revise and renew their EV policies mid-year. Watch out for new incentives or changes announced in the April-June budget window.”

Which Documents Are Needed for a Smooth EV Subsidy Application?

Missing documents are the number one reason for subsidy delays or rejection. Here’s your up-to-date checklist for 2025:

- Valid photo ID (Aadhaar, PAN, voter ID)

- Proof of address (utility bill, rent agreement, ration card)

- Vehicle purchase invoice (must mention model and VIN)

- Certificate of registration (RC)

- Bank account details with passbook/cancelled cheque

- Proof of state residency (if different from permanent address)

- Dealer authorization certificate (if required)

- Scrapping certificate (for scrappage bonus where applicable)

- Application form printout (if required after online submission)

Tips for Hassle-Free Processing

- Ensure all documents are up-to-date and legible scans.

- Double-check address and name consistency across documents.

- Some states require additional forms for commercial vehicles or corporate buyers.

- Keep physical and digital copies for your records.

How Do State EV Policies Impact Cost Savings in 2025?

One of the biggest reasons to use your state’s EV policy is the huge savings it offers. Let’s break down how much you could save in 2025:

- Upfront purchase subsidy: Save up to Rs. 1.5 lakh on select models (Delhi, Gujarat).

- Road tax exemption: Save 6% to 12% of vehicle price—up to Rs. 1 lakh for high-end EVs.

- Registration fee waiver: Save Rs. 2,000–10,000 on first-time registration.

- Scrapping bonus: Up to Rs. 15,000 for exchanging your old petrol/diesel vehicle.

- Charging infra subsidy: Save Rs. 10,000–50,000 on installing a home/public charger (state-specific).

Example Scenario: Delhi 2025

- You buy a Tata Nexon EV (ex-showroom Rs. 14.5 lakh).

- State subsidy: Rs. 1.5 lakh

- FAME-II subsidy: Rs. 1.5 lakh (if eligible)

- Registration/road tax waiver: Rs. 90,000

- Scrapping bonus: Rs. 10,000

- Total savings: Up to Rs. 4.5 lakh

Additional Perks

- Lower running cost (electricity vs petrol/diesel).

- Priority parking and toll waivers in select states.

- Income tax deduction under Section 80EEB (up to Rs. 1.5 lakh on loan interest).

Did You Know?

In 2025, some states like Kerala and West Bengal offer extra incentives for using renewable-powered charging stations at home.

What Are Real User Experiences and Case Studies in 2025?

Let’s see how real Indians are making the most of state-wise EV benefits:

1. Ritu Sharma, Delhi

- Bought a Tata Tiago EV in April 2025.

- Applied online for Delhi EV subsidy after dealer guidance.

- Received Rs. 1.5 lakh subsidy in bank within 21 days.

- Got additional Rs. 10,000 scrapping bonus for old Alto.

- Used savings to install a home charging point (eligible for Rs. 6,000 subsidy).

2. Saurabh Yadav, Bangalore

- Runs a fleet of 10 electric autos for urban commute.

- Karnataka’s EV policy gave him 100% road tax exemption and Rs. 30,000 per auto as upfront discount.

- Fast approval due to digital application; used state helpline for quick resolution.

3. Meena Iyer, Chennai

- Early adopter—booked an MG ZS EV in February 2025.

- Tamil Nadu’s policy gave her Rs. 1 lakh subsidy, received as upfront dealer discount.

- Applied for charging infra support, got 50% reimbursement from state for home charger.

Lessons Learned

- Early application ensures you don’t miss out due to budget limits.

- State helplines or EV “cells” are useful for troubleshooting.

- Combining central and state subsidies offers the highest net savings.

How to Track and Resolve Issues in Your EV Subsidy Application?

If you face delays, missing subsidies, or application rejections, don’t worry. Here’s what you can do:

- Track application status using your reference number on state portal.

- Contact official state EV cell or helpline—most have 24x7 support in 2025.

- Visit nearest RTO for registration/road tax issues.

- Escalate by writing to state transport commissioner or using online grievance portals.

- Join EV owner forums (like PlugInIndia or state WhatsApp groups) for peer help.

Expert Insight

“Indian states are increasing transparency in 2025, introducing third-party audit and user feedback features on portals to minimize corruption and delays.”

What Happens If You Move to Another State After Availing EV Benefits?

Relocating to a new state after buying your EV? Here’s what you need to know:

- Subsidies are generally linked to the original state of purchase and registration.

- If you transfer your vehicle, check if the new state accepts previous waivers (registration/road tax may need to be paid again).

- Some benefits like free charging or toll waivers may not transfer.

- If you’re a fleet operator, check for pan-India permits or multi-state approvals.

- Always update your address with the new RTO to avoid legal issues.

Pro Tip

- Retain original subsidy and registration receipts—they may be needed for re-registration or subsidy clawback checks.

Final Verdict: Should You Apply for State-Wise EV Benefits in 2025?

The answer is a strong YES—if you’re buying an electric vehicle in India in 2025, taking advantage of your state’s EV policy can save you up to Rs. 4-5 lakh, reduce your running costs, and make the switch to green mobility easier and more affordable. With most states moving processes online, approvals are faster and more transparent. Just make sure to:

- Check your state’s latest EV policy and deadlines.

- Buy from an authorized dealer and collect all required documents.

- Apply immediately to avoid missing out due to quota or deadline issues.

- Combine central and state subsidies if eligible.

- Use state helplines for any queries or troubleshooting.

Switching to an EV is not just good for your wallet, but also for India’s environment and energy security. Don’t miss out—apply for those benefits and join the EV revolution!

FAQs (2025)

1. Can I claim both central and state EV subsidies together in India?

Yes, most states allow you to claim both, provided your vehicle qualifies under both schemes. Always check for overlapping eligibility and documentation.

2. Are used or second-hand EVs eligible for state-wise subsidies?

No, almost all subsidies are only for brand new, first-owner vehicles purchased from authorized dealers.

3. What if my subsidy application is rejected?

You can review the reason on the state portal, re-submit missing documents, or escalate to the state EV cell or transport commissioner.

4. How long does it take to get the EV subsidy in 2025?

Most states process and disburse subsidies within 30–45 days of application approval, with some offering faster timelines.

5. Is there any income or price cap on EV subsidy eligibility?

Some states set upper price limits (e.g., under Rs. 15 lakh for four-wheelers), and a few limit benefits to individuals below a certain annual income. Always check your state’s current rules.

Disclaimer: The information in this guide is based on state and central EV policy updates available as of early 2025. Policies are subject to change—verify details with your state transport department before making any financial decisions.